FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A CRUT, or Charitable Remainder Unitrust, is a type of Charitable Remainder Trust that typically offers greater returns and distributions than its cousin, the Charitable Remainder Annuity Trust. This guide will explain the basics of Charitable Remainder Unitrusts, dive into the various types of CRUTs and explore an example.

A CRUT is a tax-exempt structure with many tax benefits and, according to Charles Schwab, is well suited for appreciated assets you have not yet sold. In exchange for donating some of the money in the trust to a charity, you can defer the taxes you would otherwise pay when selling an asset and grow your asset tax-free inside the trust. Plus, CRUTs give you an immediate charitable income tax deduction when you put the assets in.

So, how does a CRUT work? It is a form of a tax-deferred account, similar to an IRA, designed to incentivize charitable giving in exchange for 3 significant tax benefits:

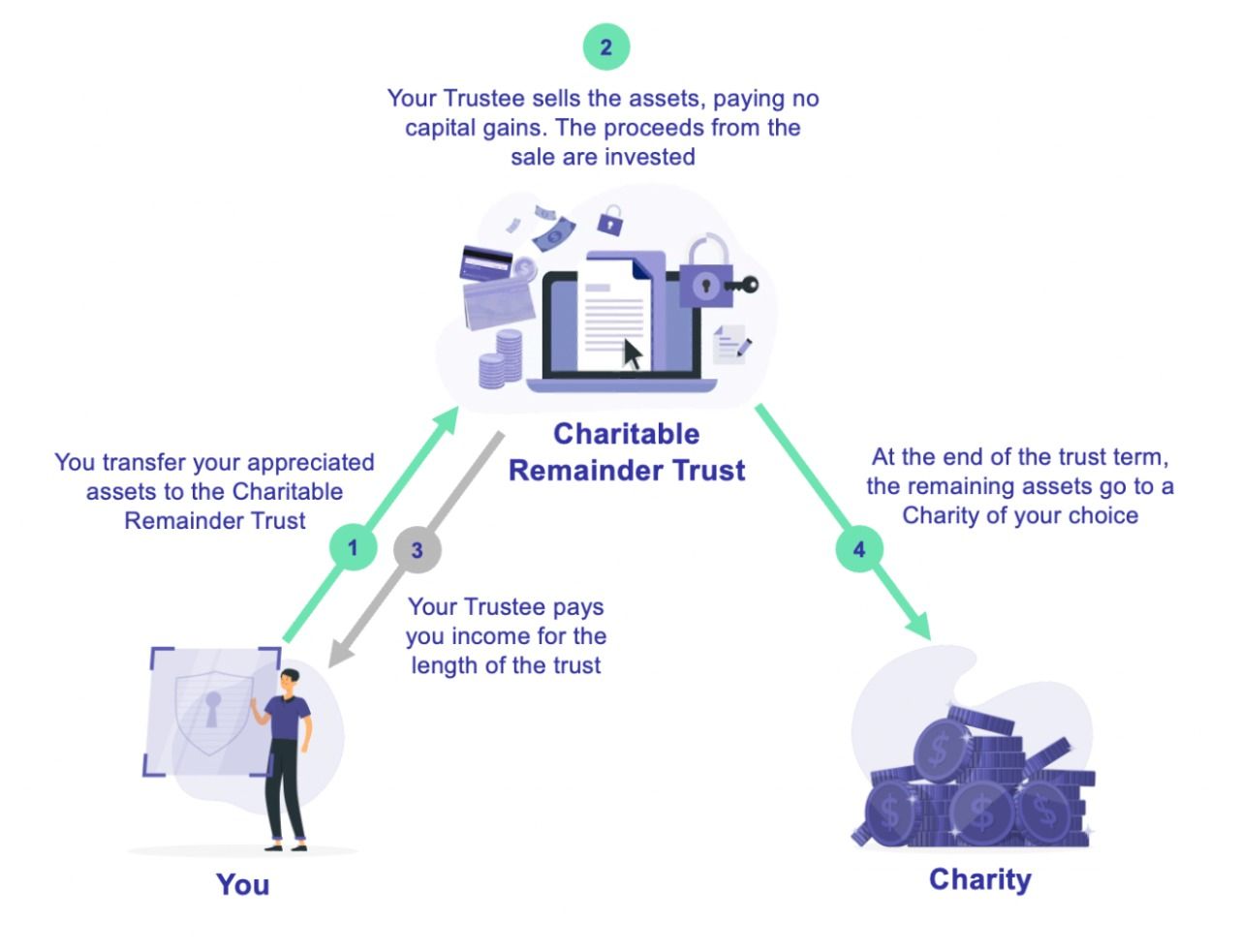

Like all Charitable Remainder Trusts, setting up and reaping the benefits from a Charitable Remainder Unitrust is easy:

A Charitable Remainder Unitrust carries three significant tax benefits.

First, the sale of appreciated assets in a CRUT trust is tax-deferred; you pay no taxes when you sell, and the money you save can be reinvested and continue to grow on a tax-free basis inside the trust. That additional reinvestment can more than double your returns.

Second, selling assets via a Charitable Remainder Unitrust will allow you to achieve “tax smoothing” by spreading your income out over many years to lower your annual income and the effective tax rate you pay on your income.

Third, when you place assets into a unitrust, you will receive an up-front tax deduction worth about 10% of the assets’ value. That’s yours to use in the year you fund your trust (or over the next 5 years)—no matter when you sell the assets.

A Charitable Remainder Unitrust (or CRUT) is a type of Charitable Remainder Trust alongside a Charitable Remainder Annuity Trust. So, how does it compare to a CRAT?

A unitrust is a trust that pays out a fixed percentage of trust assets yearly rather than paying out a fixed amount yearly. The annual distribution of a unitrust is measured as a share of the fair market value of the CRUT assets every year. The amount you receive from the trust will change every year — and, in most cases, it will go up as the trust’s assets grow over time.

If you put $1 million into your Unitrust and choose a 10% payout rate, you’d receive $100,000 in the first year. If your trust investments do well and the trust value grows to $2 million, you would receive 10% of that new value or $200,000. In most cases, a CRUT trust allows you to withdraw more money from your trust for your use compared to CRATs for a couple of reasons:

Need some help to understand if a Charitable Remainder Unitrust is the right fit for you?

Let’s assume you’ve decided on a Charitable Remainder Unitrust for its larger annual payouts and greater overall returns. However, there are still two critical decisions to make:

Withdrawals work differently depending on whether you choose a Standard CRUT, a NIMCRUT, or a Flip CRUT. So, what are their key differences?

With a Standard CRUT, you’ll receive a set percentage of the trust’s assets each year. Because this is a unitrust, you’ll know the rate at the start of the trust, but each years distributions will depend on the value of your trusts assets each year.

Standard CRUTs can be a good fit for customers willing to give up some returns in exchange for relatively predictable, consistent payouts.

With a NIMCRUT, you are owed the same percentage of trust assets yearly as you would from Standard CRUT and you have some ability to defer those distributions to future years. These trusts distribute the lower of the trusts realized income and the percentage of trust assets it owes you. If the realized income is lower than the distribution percentage the trust owes you, any underpayments are rolled over to future years, giving you control over your annual distributions by controlling how much income your trust realizes each.

Although NIMCRUTs carry the highest expected returns, they can only distribute realized gains, so down markets can be a problem. For that reason, a NIMCRUT can be a good fit for those who are set on maximizing total returns, setup their CRUT for a long period and can weather down years.

Flip CRUTs ‘flip’ from a NIMCRUT structure to a Standard CRUT structure after a predetermined event, such as the sale of a non-marketable asset or a certain number of years.

They are commonly used if you want consistent distributions but have illiquid assets that won’t be liquid for a while. With a Standard CRUT the trust may be forced to liquidate or distribute illiquid assets due to its forced distributions. Flip CRUTs also work for those who want to defer distributions for some time and then switch to the consistent, predictable distributions of a Standard Charitable Remainder Unitrust — for example, if you are planning for a period of growth and then will need retirement income.

A Charitable Remainder Unitrust can last for a fixed period (between 1 and 20 years), for one life, or for even longer – say, your lifetime and your partner’s, or your lifetime plus a set period of years after that for your family to draw other distributions.

Term trusts may be easier for some people to commit to due to their shorter and predictable length compared to lifetime trusts that last a lifetime. While lifetime trusts have several advantages:

CRUTs are valuable structures for people who haven’t sold their assets yet. Take Annie, age 30, who joined a successful Bay Area startup at a relatively early stage. The company recently completed its IPO. Annie exercised her shares for a total cost of around $50,000, and she’ll be able to sell at a significant markup: $5 million.

By setting up a CRUT trust, Annie will receive a charitable income tax deduction of approximately 10% of the current value of her shares, or $500,000. Also, she’ll save about $1.6 million in taxes when she sells her shares, allowing her to reinvest those savings and create more wealth for herself. And Annie will be able to withdraw as much as 11% of her assets from the trust yearly, depending on whether she chooses a term trust or one that lasts for her lifetime or longer.

What would all of this mean for Annie’s bottom line? If she has her money in a Lifetime Charitable Remainder Trust, she’ll end up with about $19.6 million in total payouts. It would have been about $8.7 million had she not used a CRUT and sold her equity in a regular taxable account. From using the CRUT, Annie is able to take home an extra $10.9 million, even after making a large donation to charity. Not a bad outcome for what amounts to a simple tax planning exercise!

If you want to read this example in more depth you can do so here.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!