Capital Gains, Estate Tax, Featured Article, Ordinary Income, QSBS

Our Guided Tax Planning Tools: How & Why

“Why can’t tax planning be simpler?” It can. With Valur’s guided planning tool, you can reduce your capital gains and income taxes by 50% or more, and fast

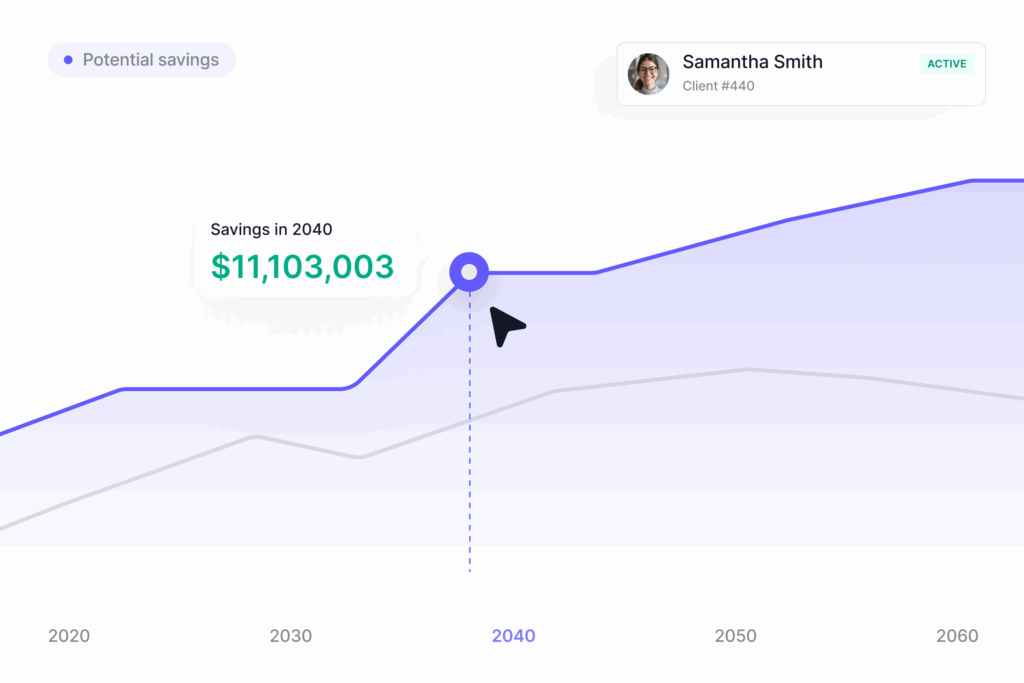

Capital Gains, Featured Article, Ordinary Income

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

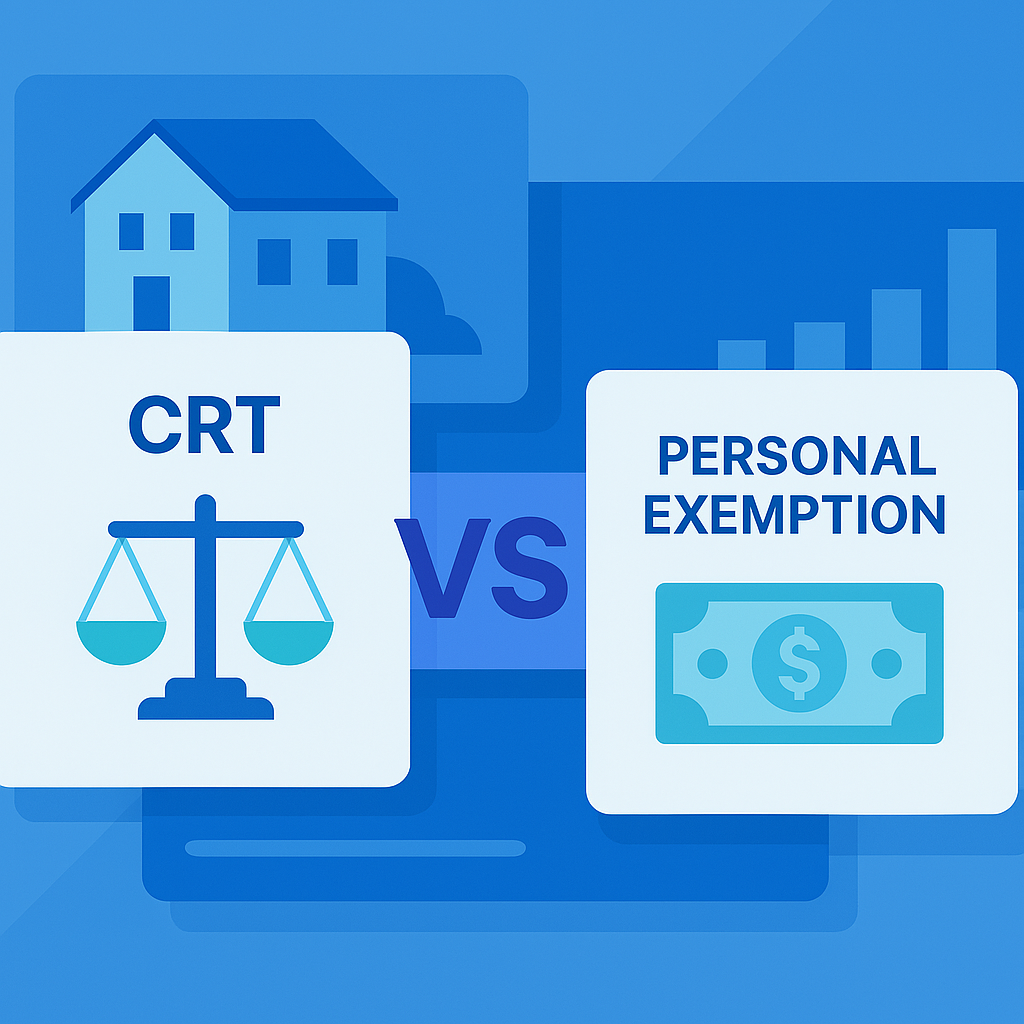

Capital Gains, Featured Article

Charitable Remainder Trust Guide

From the basics of how Charitable Remainder Trusts work, the different CRT options, when they make sense and case studies of people who have benefited

Capital Gains, Featured Article

CRUT: A Charitable Remainder Unitrusts Guide

A Charitable Remainder Unitrust (CRUT) is a tax-exempt trust that provides significant tax benefits and higher returns compared to other charitable trusts. It allows asset owners to defer taxes, receive immediate charitable deductions, and make annual withdrawals. Various CRUT types offer flexibility in distributions and terms, benefiting both individuals and charities.

Featured Article, Ordinary Income

Solar Tax Benefits Guide

Key highlights: Renewable energy is experiencing a surge in popularity — just look around and count how many homes on your street now have rooftop solar panels. This growth isn’t just limited to consumers; builders and purchasers are increasingly getting involved. This is unsurprising; since 2022, the U.S. government has […]

Estate Tax, Featured Article

Intentionally Defective Grantor Trusts: A Guide

An intentionally defective grantor trust (“IDGT”) is a type of irrevocable trust that is optimized for estate tax savings. The key feature of IDGTs is that they are disregarded for income-tax purposes but not for gift and estate tax purposes. This article provides background on what intentionally defective grantor trusts […]

Capital Gains, Estate Tax, Featured Article, QSBS

Estate Tax Planning Trusts: A Comprehensive Guide

The purpose of estate tax planning is to maximize the assets you pass on to future generations by minimizing gift and estate taxes. Estate-tax strategies revolve around the use of irrevocable trusts. This article discusses the most common types of irrevocable trusts that are used to minimize gift and estate […]