FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A CRAT is a Charitable Remainder Annuity Trust. This is a type of Charitable Remainder Trust that typically offers greater certainty but lower returns and distributions than its cousin, the Charitable Remainder Unitrust. In this guide, we’ll explain the basics of a CRAT and explore an example.

But before diving into the definitions, here are a few essentials on CRTs:

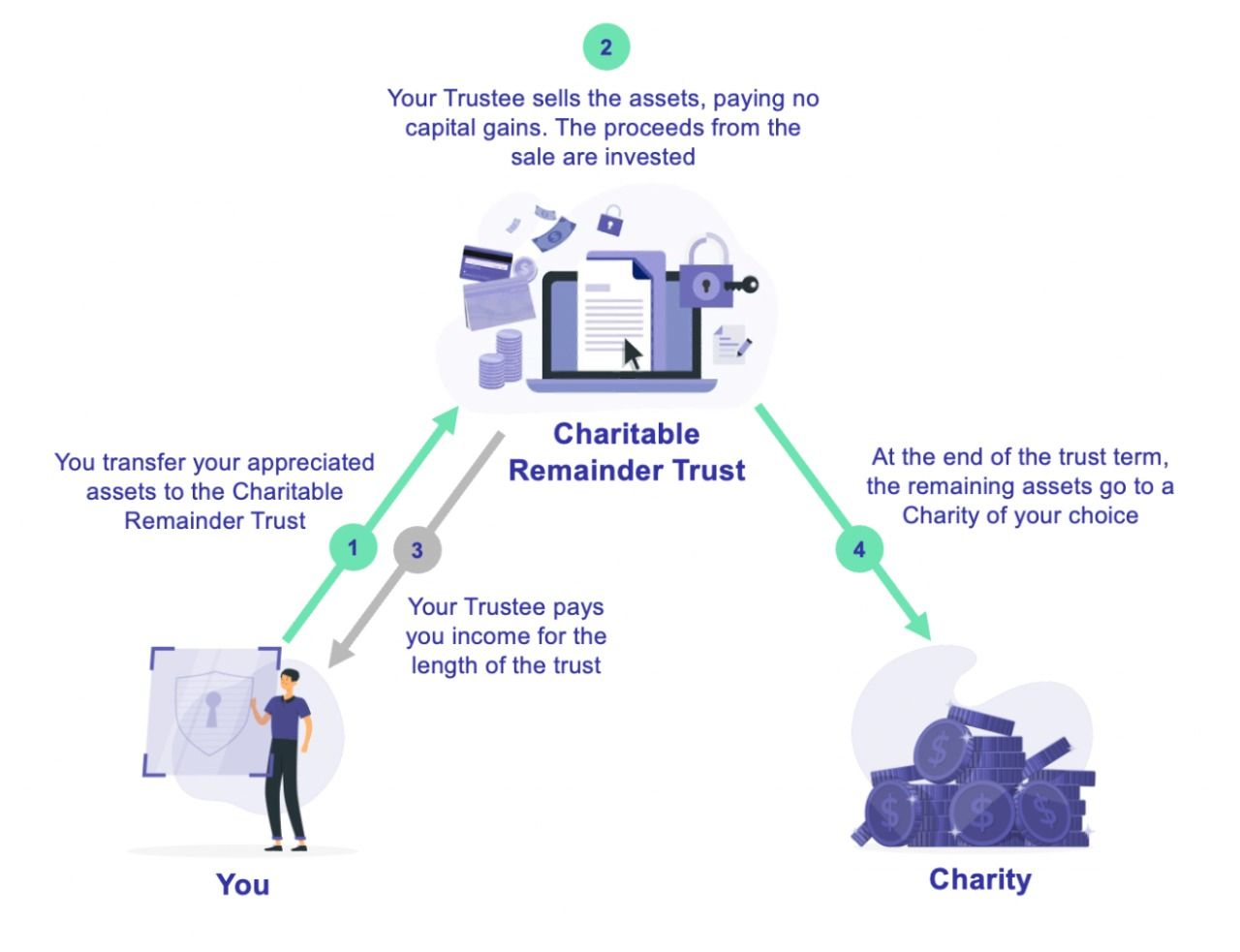

Let’s recap on what is the meaning of a CRAT. A CRT Annuity Trust (or CRAT) is a tax-exempt structure. In exchange for donating some of the money in the trust to a charity at the end, you are allowed to defer the associated taxes when selling assets inside the CRAT trust, you receive an immediate charitable income tax deduction to reduce your taxes and you receive set identical annuity payments for the length of the trust.

CRATs are a form of tax-deferred account, like an IRA, that are designed to incentivize charitable giving in exchange for significant tax benefits: tax deferral, the ability to lower your tax rate via income smoothing and an upfront charitable deduction.

First, choose an asset. You, the individual setting up the trust, choose an appreciated asset that you’d like to contribute to a trust. This could be any asset that has appreciated or is likely to appreciate significantly. Next you’ll designate an income beneficiary — the person who will receive annuity payments from the trust every year.

Second, you’ll transfer the assets intro the CRAT and receive a deduction. You transfer your chosen assets to the trust, and you get an immediate charitable remainder tax deduction, usually equal to about 10% of the value of the asset you put in. Afterwards, you’ll be able to sell your asset tax-free inside the trust, allowing you to reinvest those tax savings to create more wealth.

Annually you’ll receive your annual distribution. Every year you get a set distribution no matter how the investments in the trust performed. After the trust ends, you’ll leave the remainder of what’s left in the trust to a charity of your choice.

An annuity is a fixed amount of money that a person receives for a specified period, usually in exchange for a lump-sum payment upfront. Similarly, an Annuity Trust is a trust that provides a fixed income stream for the trust’s term — either a person’s lifetime or a specified period. That limited income amount is based on the initial value of the assets placed into the trust when it is set up.

So, if you put $1 million in startup equity into your CRAT with a 5% payout rate, you’d receive $50,000 per year, no matter how the trust performs — whether the trust remaining assets grow to $10 million or not at all, you are receiving $50,000 per year. Some unique aspects of CRATs are:

So, now that you have a good idea of why most people choose to set up a CRAT, let’s dive into the key decision you will have to make: Should you use a “lifetime” or “term” trust?

The length of a CRAT trust plays a large role in determining how they will make distributions to the beneficiaries. They can be set up for the length of people’s lives or a specified period of years (Between 1 and 20 years).

In lifetime trusts, you have your whole life if they are 58 or older (or the length of the lives of all the beneficiaries) to withdraw the trust’s remaining assets. In a term trust, instead, withdrawals from the trust’s assets are for a pre established number of years.

Erica is a 36-year-old New Yorker with $1m assets that have no cost basis (that is, she paid $0 for it). She wants to set up a 20-year term trust.

CRAT (Charitable Remainder Annuity Trust):

Standard CRUT: (More on the different CRUT structures)

No doubt you noticed the bottom line: The total payouts from Erica’s CRUT are significantly higher than the payouts from a CRAT trust. Why is that so? It’s simple: Because a CRUT’s annual distributions are defined as a percentage of the trust’s assets, as measured that year, whereas a CRAT’s annual distributions are a fixed percentage of the trust’s starting value. Assuming that the trust grows in value over time — a fair assumption for our users, most of whom will be aiming to at least match historical market returns — the distributions will be much larger if they are keyed to the trust’s growing value, rather than to how much the assets were worth on day 1. However, you can have more confidence in the size of your distributions as with a CRAT your distributions are not at risk based on the trusts investment performance.

Distributions from the Charitable Remainder Annuity Trust are taxable. When you receive distributions from the CRAT they are taxed according to the type of income they were realized as inside the trust, or in other words the taxes on a fixed income realized in the trust are being deferred until you receive the income as distributions. If there are multiple types of income inside the trust such as long and short term capital gains, the income is distributed according to the four tier accounting system. It is important to note, you aren’t taxed on the income realized inside the CRAT, so the investments can grow tax free.

A Charitable Annuity Trust is powerful tax planning structure. While CRATs and CRUTs are very similar, their key difference around how distributions are calculated has massive implications. If you are willing to give up larger distributions and are focused on financial consistency you may prefer a CRAT. Why? Because you want certainty with your annual payments from the trust.

On the other hand, you may prefer a CRUT if you want the CRT to run for a longer time period, value more flexibility with the timing and amount of distributions, and/or want a higher ROI from the structure — that is, more total distributions. So, check out why are CRATs different from CRUTs, access our calculator for tax savings to evaluate the potential return on investment given your situation. And if you have any questions, schedule a meeting with our experienced team.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!