FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

The federal and state governments have committed over $1 trillion toward the country’s largest-ever investment in renewable energy, with a strong focus on solar infrastructure. Since 2022, the U.S. government has ramped up incentives for green energy through the Inflation Reduction Act, making solar projects more appealing than ever. Most recently, the administration passed a new tax bill on July 4th, 2025, extending the Investment Tax Credit incentives through 2027, building on the tax credits and depreciation deductions established by the 2022 Inflation Reduction Act.

The potential financial returns are significant for a typical high earner, purchasing a solar energy project can increase take-home income by 50% or more. And these benefits apply broadly; they can reduce all forms of personal and business taxable income, including income from salary, RSUs, a bonus, business profits, capital gains, and other sources.

Key takeaways

The solar project offers following benefits:

The Solar projects offer the following benefits:

A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe. It is similar to a gift card or store credit you can use to reduce your tax bill.

For example: if you owe $1,000 in taxes and you have a $600 tax credit, your tax liability will be reduced to $400.

The government typically offers tax credits to incentivize certain behaviors or purchases. Over the last few years, tax credits have become an increasingly popular tax-mitigation tool due to incentives tied to renewable energy.

Depreciation is the amount of value that a physical asset loses over time. From a tax standpoint, it’s important because you may be able to take a deduction for this amount, reducing your taxable income and saving money on your taxes.

Example: Suppose you earn $2 million in income and, at the highest federal marginal tax rate of 37% (ignoring state taxes for this example), would owe about $740,000 in federal taxes. If you had $800,000 in depreciation, you could use it to reduce your taxable income by that amount—bringing it down to $1.2 million. At a 37% tax rate, that would save you roughly $296,000 ($800,000 × 37%) in federal taxes.

Solar projects typically include 20-30 year income streams tied to the energy produced by the project. These returns depend on the location of the project and local energy rates among other factors but typically will generate between 1-5% annually of your purchase amount.

While solar projects offer significant benefits, it’s just as important to be aware of the qualifications and limitations that apply.

Depreciation for solar purchasers who want to apply it against W‑2 income (i.e., salaried income) is capped at $313,000 per individual or $626,000 per couple per tax year (adjusted annually for inflation) due to the excess business loss limitation. Any unused depreciation in a given calendar year can be carried forward to future tax years.

Importantly, if you are a business owner — with either active or passive business income — there is no limit on the amount of depreciation you can apply.

Tax credits work differently. The amount you can use in a given year is limited to 75% of your remaining federal tax liability after applying depreciation. Any unused credits can be carried forward and applied against your taxes for the next 15–18 years.

The IRS categorizes income into two buckets: active income (e.g., W-2 earnings, income from a business you actively run) and passive income (e.g., rental income from property you don’t actively manage). Importantly, tax benefits must match the character of income — passive losses can offset passive income, and active losses can offset active income, but the two can’t cross.

Solar follows the same rule. If you want to use the tax benefits from solar to offset active income, you must be active in the solar space. So, you will need to set up an LLC through which you will make your purchase, and you will also need to materially participate in the solar business. In this context, “material participation” means participating in the solar space for more than 100 hours during the tax year in activities that are considered regular, continuous, and substantial, and participating at least as much as any other individual involved in the business.

(Note that this is not true for investments in oil and gas wells due to a unique law benefiting the space, so that can be a viable alternative if you are unable to qualify as an active participant in solar. Note also that those with passive income can use the benefits of solar without qualifying as an active or material participant in the solar space.)

Why is this a gray area? Due to the lack of clarity from regulators: The IRS and tax court have so far chosen not to define what activities constitute material participation in the solar space. As a result, there isn’t complete certainty as to what specific activities will satisfy the 100-hour requirement. That being said, we work closely with a national accounting firm that’s overseen over a billion dollars in solar transactions and whose clients have been audited. Their advice: treat your solar project like a business – spend time on regular, continuous, and substantial activities that will benefit your solar business.

(This is a very simplified explanation. For more details on material participation and common questions we hear from CPAs, check out this article.)

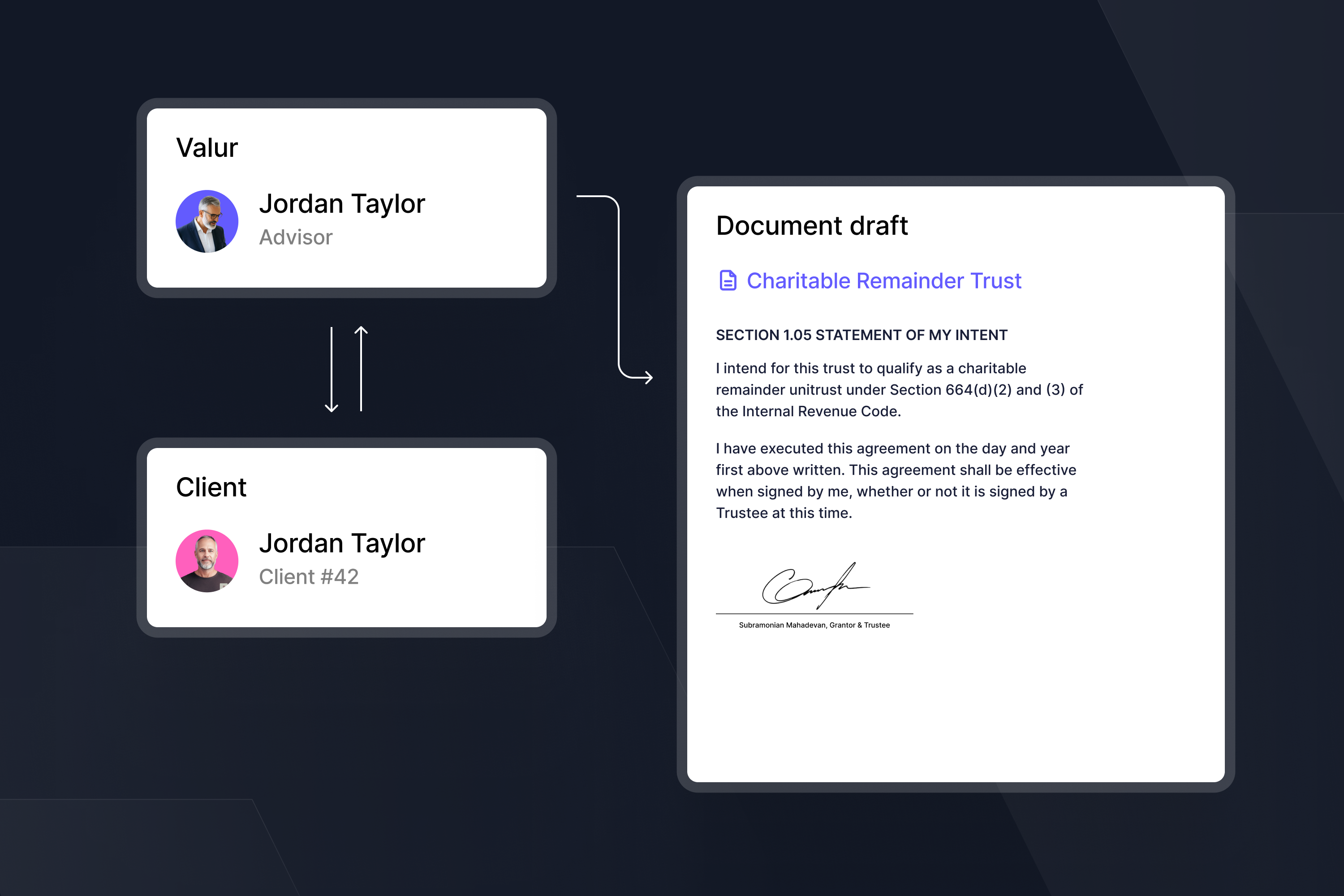

A quick note on tracking: Tracking these hours and activities can be a headache, but Valur streamlines your documentation process, enabling you to save relevant documents and log your participation hours directly on our platform. Read more about those tools here.

Purchasing solar projects can be an effective strategy for high-income earners with significant ordinary income to reduce their tax liability.

How can you go about buying qualified projects? It’s relatively simple: Valur has partnered with reputable developers to make solar projects accessible to high-income earners. We help you identify and evaluate available opportunities, compare different project options, and visualize the potential benefits—using a calculator tailored to your specific income situation.

From there, we’ll help you seamlessly finalize your purchase—with no fees charged to you by Valur.

To learn more you can schedule a call with us here.

Need some help to understand which if this is the right fit for you?

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!