FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Are you looking to invest in solar energy for the tax benefits but overwhelmed by the jargon and complexity? In this guide, we will break down two popular solar project structures: sale-leasebacks and flip partnerships.

Before we move on to explain each structure, it is useful to understand the two key tax benefits we get from buying solar project: tax credits and depreciation. In summary, tax credits are a dollar-for-dollar reduction in the amount of taxes you owe. The Government lets you deduct a certain percentage of solar project purchase costs from your taxes. Depreciation, instead, refers to the amount of value that a physical asset loses over time. From a tax standpoint, depreciation is relevant because you can take a deduction for some or all of the amount of the value an asset loses over time, reducing your taxable income and saving money on your taxes. You can read more about both tax benefits here.

We will now explain how each structure works and their financial benefits, risks, and comparisons to help you make an informed decision.

So let’s get started!

A sale-leaseback is a financial arrangement in which a solar project developer sells a solar system to an individual and then leases it back from the individual. This way, the individual benefits from tax incentives and a steady income stream from the project with minimal overhead, and the developer operates, maintains the system and is able to take the risk and make a profit based on the spread between the price they sell the electricity and what they pay you.

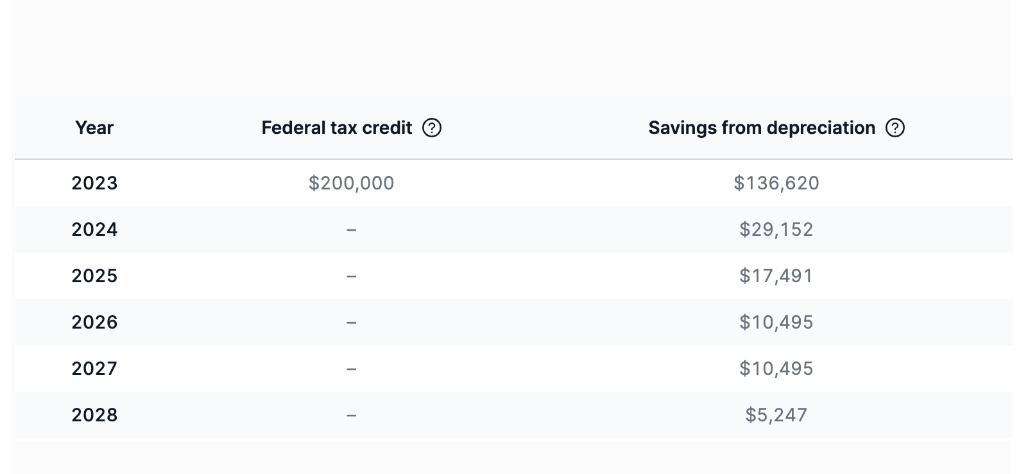

A solar developer sells a $500,000 solar system to an individual and leases it back for 20 years at a rate of $25,000/year (5% of the total amount). The individual can claim a up to 40% federal investment tax credit ($200,000) in the first year and accelerated depreciation that will reduce their tax liability by another $209,500, primarily in their first year. The lease payments generate an additional $500,000 over 20 years. As a result, after putting in just $90,500 (because $409,500 of the $500,000 purchase amount comes back in the form of up-front tax savings), he/she can make up to $500,000 over 20 years! That’s a 550% return!

Check out our in depth case study and calculate the potential returns with our solar calculator.

Year-by-Year Tax Savings

In a flip partnership, a solar project developer and an individual form a partnership to finance and develop a solar project. The individual provides initial capital and a 3rd party banking partner adds additional capital via debt. Critically, the individual receives almost all of the tax benefits, plus cash distributions in the initial years, calculated on the total put in (including the bank’s contribution). After a predetermined period (usually 5 years), the partnership “flips,” and the developer takes the majority stake (typically 95% of the project) — capturing future revenue — while the individual takes a minority stake or gets completely bought out. It’s important to note that even if the individual bows out after the predetermined period, they will keep all of the tax benefits and revenue already earned.

A developer and an individual form a flip partnership for a $1 million solar project. The individual contributes 40% of the capital or $400,000, the developer contributes 10% and the bank loan is 50%.The partnership allocates up to 99% of the tax benefits and cash distributions to the individual in the first six years.

After that, the partnership flips, and the developer receives 95% of the cash distributions. In total, the individual receives tax benefits worth up to $700,000 on a $400,000 purchase amount and cash distributions totaling $50,000 in the first six years. After the flip, the individual receives a smaller share of the cash distributions but has already recouped their initial purchase amount and profited from the tax benefits. Check out our in depth case study, and you can calculate the returns with our solar calculator.

Each of these solar financing structures has its unique advantages and risks. Sale-leasebacks allow individuals to claim significant tax benefits and receive a stable income (higher cash flow). Flip partnerships, meanwhile, typically have the highest financial returns, almost entirely due to the leveraged tax benefits, but offer minimal cash flow.

Choosing the right solar financing structure depends on your individual financial goals, risk tolerance, and available capital. By understanding the mechanics, benefits, and risks of sale-leasebacks and flip partnerships, you can make an informed decision and purchase projects in the rapidly growing solar industry. If you have any accounting questions, we have put together an overview of the most common technical doubts accountants have for us and you can read them here.

So, how can you go about purchasing qualified projects? It’s relatively simple: Valur has partnered with nationally recognized accounting and firms to facilitate buting solar projects. We will help you identify the opportunity and choose between different solar projects, visualize the potential benefits, and calculate how much you need to put in to capture the right sized tax credits. From there, we and our partners will help you seamlessly finalize your purchase and keep track of the relevant data for ongoing tax purposes.

To learn more you can schedule a call with us here.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!