FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Green energy is having its moment. Almost half of all new homes in the United States have solar panels. And the previous government and Congress decided to go all in to incentivize the purchase of renewable energy projects through generous tax benefits.

In particular, the Inflation Reduction Act (IRA) increased and extended previously available tax benefits, tax credits and depreciation, for specific renewable energy projects, including solar. The current administration has passed a new tax bill on July 4th, 2025 and decided to keep these tax benefit incentives till 2027.

In case you haven’t read about tax credits and depreciation from our previous articles, you can do so here. In summary, tax credits are a dollar-for-dollar reduction in the amount of taxes you owe. The government lets you deduct a certain percentage of solar purchase costs from your taxes. Depreciation, instead, refers to the amount of value that a physical asset loses over time. You can take a tax deduction for some or all of the amount of the value an asset loses over time, reducing your taxable income and saving money on your taxes.

The basic tax benefits of buying qualified solar infrastructure projects are massive, you can receive up to 145% of your purchase amount in tax savings in year 1, as we explain in detail in our solar project purchase tax benefits guide.

A flip partnership is a partnership between a solar purchaser (who funds the project) and a solar developer (who develops, operates, and matches the purchaser’s contribution with debt to double the project value), where both form a legal partnership to jointly own a solar project. The name comes from the way ownership “flips” over time between the two partners.

The flip partnership structure uses leverage to enhance tax benefits. The solar purchaser puts $1 into the project, and the developer brings in another $1 of recourse debt—bringing the total project value to $2. The partnership structure allows the solar purchaser to claim tax credits and depreciation on the full $2 project value, not just the $1 they contributed.

You can read more about the details in our guide to solar flip partnerships.

In a flip partnership structure, the solar purchaser typically holds 99% ownership for the first 5–6 years. During this period, they’re entitled to 99% of the tax benefits, including credits and depreciation, which are fully vested over those initial years.

After 5–6 years, the partnership typically “flips,” with the solar developer becoming the majority owner—usually holding 80–95% of the project. The tax equity investor’s ownership decreases to 20–5%. By this stage, all tax incentives have been fully realized, so the project primarily generates cash flow moving forward. That cash flow is distributed based on the updated ownership percentages, with the majority going to the developer.

This is considered a fair trade-off since the purchaser receives nearly all the tax benefits up front, while the developer receives the majority of the cash flow after the flip.

Aaron is a married California resident with $1,000,000 in income in 2025, and, as a result, he’s looking at $503,000 in federal and California taxes at the end of the year, Assuming he falls into the highest federal marginal tax bracket of 37% and California’s highest marginal tax rate of 13.3%.

As we explained in earlier articles, however, buying a qualifying solar project could earn Aaron and his wife significant tax credits, depreciation deductions, and ongoing income to mitigate their high tax burden.

Specifically, imagine that the family chooses to put $200,000 in a flip partnership solar project this year. As a result of this purchase, Aaron is positioned to reduce his 2025 tax bill by $286,150 and save an additional $42,154 of taxes in the following five years. Here are the numbers:

Situation Overview:

Solar Impact:

Total Tax Savings:

As a result, Aaron’s total tax bill will drop from $503,000 to as low as $216,850. That’s a total reduction in federal and state taxes of up to $286,150 (143.1% of the $200,000 purchase amount) in Year 1. From Years 2-6, there’s an additional $42,154 in state tax savings — a 21.1% return on the $200,000 purchase amount.

In other words, Aaron could receive more in immediate tax savings than he contributed, making this one of the most efficient ways to reduce his tax burden.

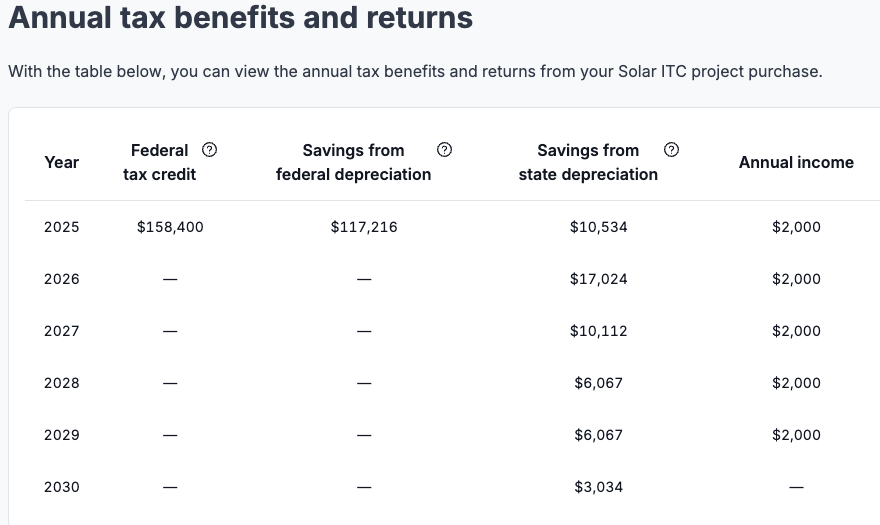

Year-by-Year Tax Savings:

Below, you can see the year-by-year tax savings from tax credits and Federal and State depreciation for Aaron taking into account their particular situation.

See your potential savings with your own numbers using our online calculator here.

Tax credits and depreciation are subject to limitations based on the type and amount of income you’re applying them against in a given calendar year. However, any unused credits or depreciation can be carried forward to future years—they don’t expire or get lost. You can read more about these limitations here.

In addition to tax benefits, this strategy includes a cash flow component. Estimated distributions are around 1% of the purchase amount. On a $200,000 purchase amount, that’s roughly $2,000 yearly and $12,000 total over six years. While projections are subject to variation, these estimates are based on typical performance and current tax law.

What if Aaron chose not to purchase a solar project?

This is a common question: How would Aaron do if he simply paid his taxes and invested the remaining money?

If Aaron doesn’t put $200,000 into the solar project, he would owe more than that in taxes. Given that Aaron’s income is $1,000,000.

Situation Overview:

If Aaron chose to pay his taxes instead of purchasing solar projects, he would owe that full tax bill of $503,000. Compare that to the additional $140,304 he would gain in tax savings and cashflow from the flip partnership ($340,304 in tax savings & cashflow minus the $200,000 cost of the solar purchase).

Compare the Alternatives:

Solar projects provide clear tax benefits, though some qualifications and limitations apply. Read more about the mechanics (including “active investor” and other regulatory requirements) here.

Since Aaron is using the tax incentives to offset active income, he’s required to materially participate in the solar business for it to be considered an active business. This allows him to apply the tax benefits against his W-2 income (active income). You can learn more about material participation on our blog post or watch our explainer video below:

watch our explainer video.

Purchasing solar projects can be an effective strategy for high-income earners with significant ordinary income to reduce their tax liability.

How can you go about buying qualified projects? It’s relatively simple: Valur has partnered with reputable developers to make solar projects accessible to high-income earners. We help you identify and evaluate available opportunities, compare different project options, and visualize the potential benefits—using a calculator tailored to your specific income situation.

From there, we’ll help you seamlessly finalize your purchase—with no fees charged to you by Valur.

To learn more you can schedule a call with us here.

Need some help to understand which if this is the right fit for you?

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Ordinary Income