FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

What started as a way to leave the 9 to 5 world behind has become so much more. It may have taken a decade or two, but you’ve achieved what many small-business owners see as the dream: an offer to purchase your business, and with it, financial freedom.

You’re not alone: By some accounts, more than 100,000 small- and medium-sized businesses (SMBs) change hands every year. That’s nice, but it may be cold comfort when you realize that you’re going to owe significant taxes on your sale.

Or are you? In this article, we’ll explain how you can use a Charitable Remainder Trust (CRUT) to shield some or all of your capital gains from federal and state taxes.

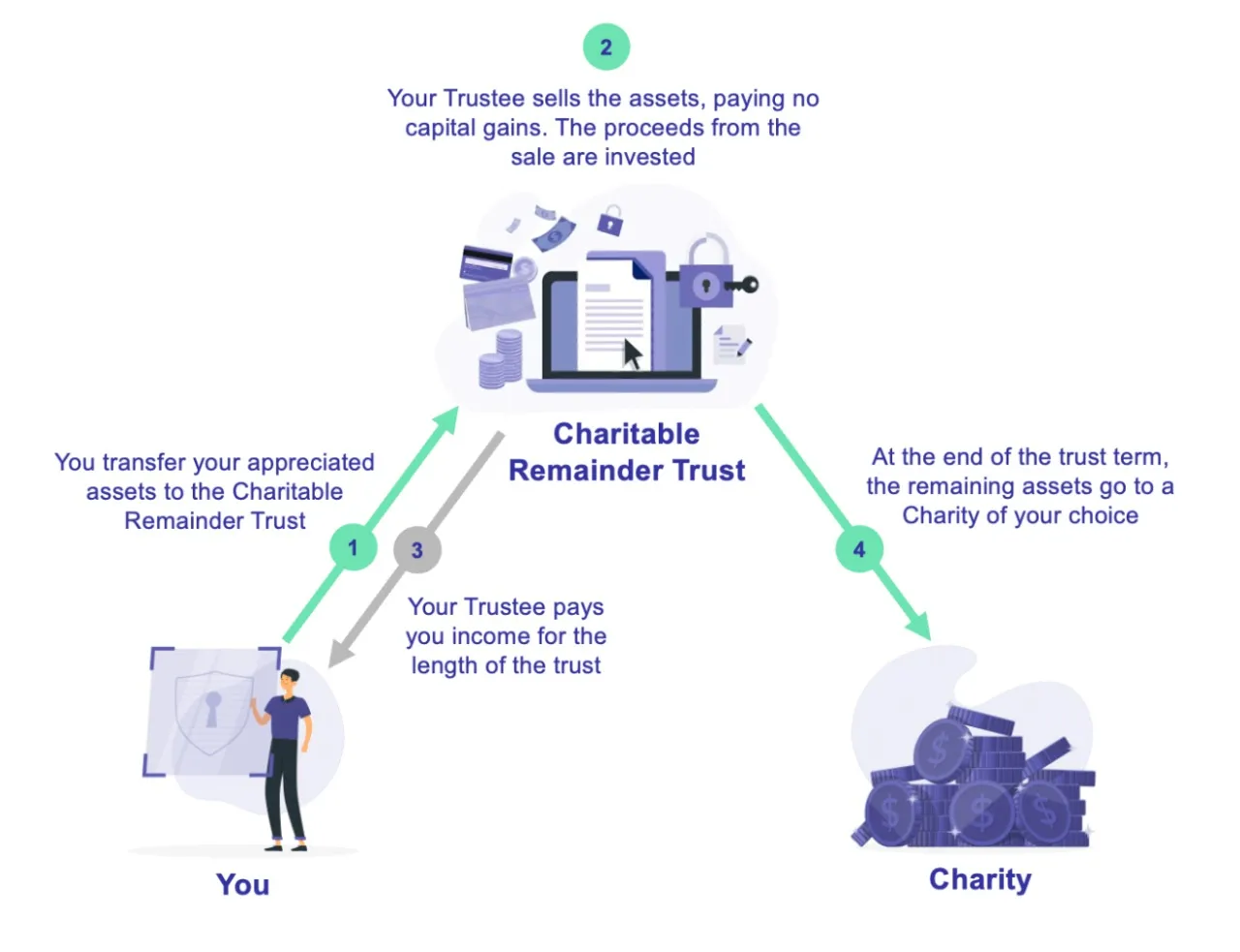

At a basic level, a CRUT is simple:

How can a simple tax-advantaged account increase your financial position so dramatically? The power of compounding. A CRUT protects your earnings from taxes when you sell your business, and the money you save on taxes is reinvested and continues to grow. For example, if you are a New York City resident and you have capital gains of $1 million when you sell, you would typically pay about $360,000, or 36%, in taxes, and you would be left with about $640,000 to invest (or spend!) going forward. If your shares were in a Charitable Remainder Trust, by contrast, the trust would keep the whole $1 million to reinvest.

You will have to pay taxes on that money when you receive distributions—similar to an IRA. But you get to invest those savings in the meantime. It’s almost like receiving a 0% interest loan from the government on your taxes.

And think about what happens when you reinvest those savings: your tax savings continue to grow. Of course you would rather have $1 million in the market working for you than $640,000, but it may not be intuitive just how big of a difference that will make over time. Assuming just an 8% annual return—a tick below the average historical return from relatively conservative index investing—that extra $340,000 will turn into more than $3.4 million in additional gains over 30 years after taxes. Even after you leave a gift for the charity of your choice (more on that in a minute), you could come out more than $2.7 million ahead on an $1 million exit over that same period. That’s the magic of the one-two punch of a tax-advantaged Charitable Remainder Trust and compounding.

Take Nisha, who owns a successful dental practice in New York with her partner. They do good business and have for years, and they’ve received a compelling offer to sell: $3 million cash. All of those earnings, of course, would be taxed at the highest federal and state capital gains tax rates, and, as a result, Nisha expects to pay a 36.7% effective tax rate, for a total bill of $1,100,000. No doubt that puts a damper on the family’s celebration.

That’s a tough pill to swallow, and Nisha would like to do what she can to reduce her bill so she can keep investing and growing her assets, instead of sending about a third of her hard-won gains out the door.

Fortunately, Nisha can use a CRUT to defer those taxes for years, or even decades. Let’s take a look at how. Let’s take a look at how.

Nisha’s age: 50

Partner’s age: 49

Cost basis in the business: $0

Expected sale price: $3,000,000

Chosen trust: Lifetime Standard CRUT

Payout rate: 6.60%

Expected market return: 8%

At age 50, Nisha’s kids are out of the house, and she’s ready to have the freedom to decide how she spends her days, so she wants the proceeds from the sale of her practice to fund her day-to-day expenses. Accordingly, she’d like a steady annual distribution, so she chooses a Standard CRUT that will run for her and her partner’s lifetimes, which comes with a 6.60% annual distribution. (Read more about how we design our lifetime trusts, and about the choice between a Standard CRUT and a NIMCRUT.)

Like everyone who chooses a Charitable Remainder Trust, Nisha will get an immediate tax deduction. Consistent with the IRS’s rules, she’ll get to deduct about 10% of the current value of her business, or about $300,000, off of this year’s ordinary income. Since she lives in New York City, which is a high-tax city in a high-tax state, the tax savings are substantial: That $300,000 deduction translates into cash savings of about $140,000 in taxes.

That’s $140,000 extra in Nisha’s pocket before things even really get going. Next, of course, Nisha gets to defer the state and federal taxes she would otherwise have owed on the business she’s selling. That’s about $1,100,000 in taxes deferred to a later date.

Because she chose a Standard CRUT with a 6.60% payout rate, Nisha will receive that amount every year, like clockwork. That’ll be around $200,000 in the first year, and growing from there as the value of the trust’s assets grows. If her trust lasts 35 years — about right based on her life expectancy — Nisha can expect to receive around $8.6 million in distributions, before taxes. (She’ll owe income taxes — likely at the long-term capital gains rate — when she receives those distributions.)

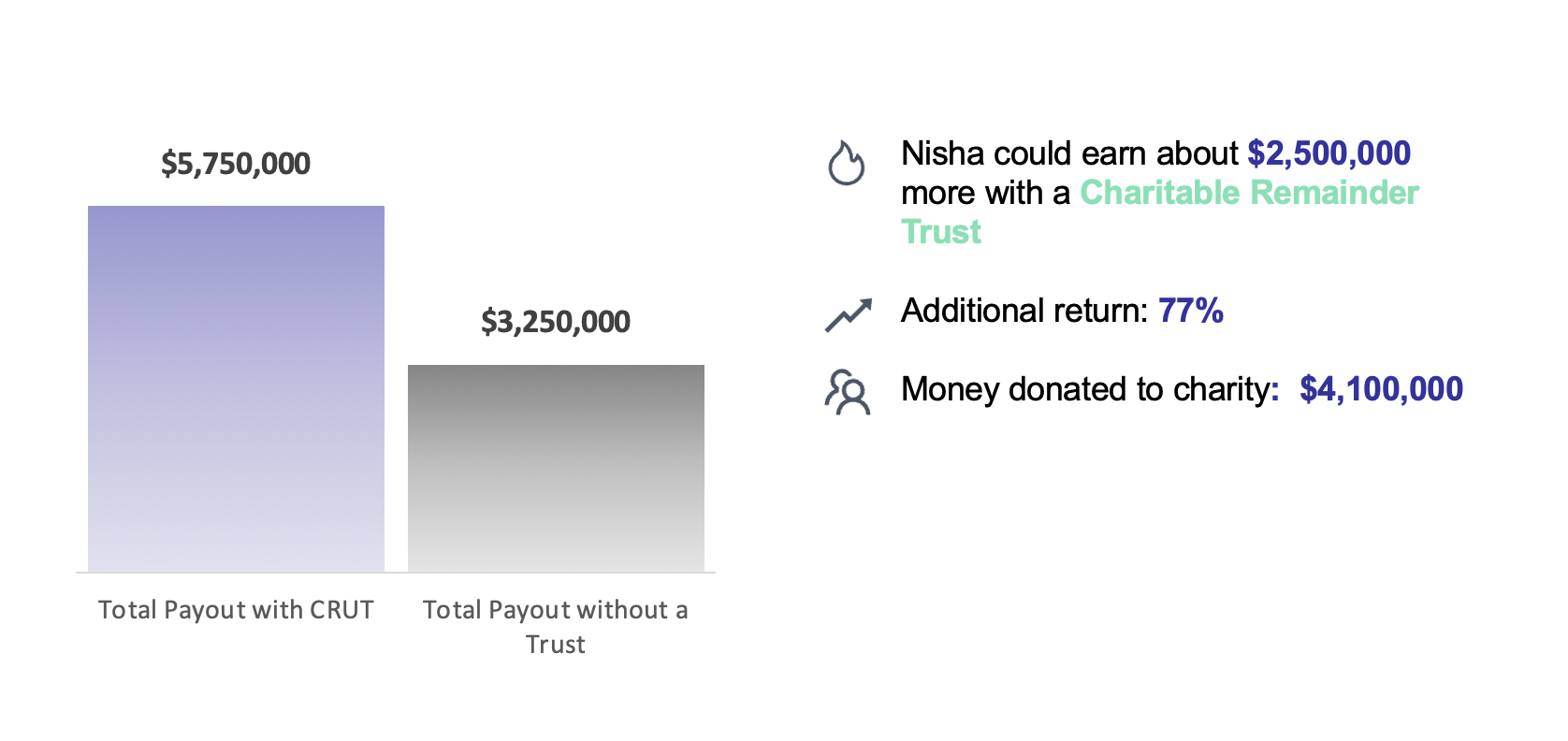

What would all of these tax savings, investment gains, and distributions mean for Nisha’s bottom line?

After 35 years, Nisha expects to end up with about $5.75 million in total distributions, after taxes. Another $4.1 million or so will go to Nisha’s chosen charity (or her family’s Donor Advised Fund).

If, instead, Nisha had paid her taxes up front and reinvested the remainder — about $1.9 million instead of $3 million — in a regular, taxable investment account, she would have ended up with about $3.25 million after taxes.

In other words, even after making that very generous charitable donation, Nisha will still pocket an extra $2.5 million, or 77% greater returns, because she used a Charitable Remainder Trust.

See our previous article on the basics of CRTs. Evaluate your potential returns with our CRUT Calculator, or schedule a time to chat with our team or get started setting up your trust.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!