FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

RSUs are great. If you work for a late stage startup that is still private, you typically get shares but they don’t vest (and cause you to owe taxes) until the company gets acquired or goes public. And if your company is already public, RSUs are really just liquid compensation in the form of stock.

The downside is RSUs are taxed as ordinary income which means you may lose more than 50% of their value when they vest! Fortunately, we have a solution to mitigate these taxes: you can offset nearly upto 90% of the tax you would otherwise owe when you vest or sell your RSUs with solar asset purchases.

In this article, we’ll dig into a case study to explain how that would work and how you can reduce RSU taxes by starting a solar business. But first, a bit about general information about RSUs and solar tax benefits.

Key takeaways:

Restricted Stock Units, or RSUs, are a type of equity compensation that public and late-stage private companies use to incentivize and reward employees. An RSU represents the right to a share of the company’s stock. RSUs typically vest over a period of time and once they vest, the employee receives the company shares.

Most RSUs in private companies today are subject to “double-trigger” vesting. Double-trigger RSUs vest only on two conditions: after the vesting date has passed and after a liquidity event, like an acquisition or initial public offering. By delaying vesting until the shares become liquid, employees are able to delay their often substantial tax bill until they actually receive real compensation.

RSUs can be an attractive form of compensation for employees but the resulting tax can significantly reduce the value. Solar project purchases help so this doesn’t have to be this way.

Buying qualified solar projects can substantially reduce taxes from vested RSUs. The basic benefits of qualified solar infrastructure purchases are massive, and we explain them in detail in this article.

In summary, the financial benefits you receive are:

You can read more about depreciation here and the benefits of solar tax credits here. In the meantime, let’s jump into a case study to illustrate the potential financial benefits from a sale leaseback solar project.

Priya is an engineering manager at Snowflake, a data storage and analytics company and she is married, therefore filing jointly. She joined the company in 2020, shortly before it went public, and her compensation has been a mix of her salary and double-trigger RSUs. In 2025, Priya will earn $600,000 in cash and vest $400,000 in RSUs. Because Snowflake is a public company, her RSUs vest on a set schedule, and she owes taxes on them in the year that they vest whether or not she sells them.

As a result, she has a substantial tax bill: around $503,000 in federal and California taxes in 2025. (assuming she fall into the highest federal marginal tax bracket of 37% and California’s highest marginal tax rate of 13.3%).

Purchasing a qualifying solar project, however, could help her earn significant tax credits, depreciation deductions, and ongoing income to mitigate her high tax burden. Below, we’ll walk through how she can use a solar project to reduce her taxes in 2025.

Imagine that she chooses to contribute $200,000 in a flip partnership (you can read more about that structure here) solar project this year. As a result of this purchase, she could reduce her tax bill in 2025 by $286,150 and save an additional $42,154 of taxes in the following five years.

Let’s now see the numbers:

Situation Overview:

Solar Impact:

Total Tax Savings:

As a result, Priya’s total tax bill will drop from $503,000 to as low as $216,850. That’s a total reduction in federal and state taxes of up to $286,150 in year 1 — equivalent to 143.1% of the $200,000 purchase amount. From Years 2-6, there’s an additional $42,154 in state tax savings, representing a 21.1% return on the $200,000 purchase amount.

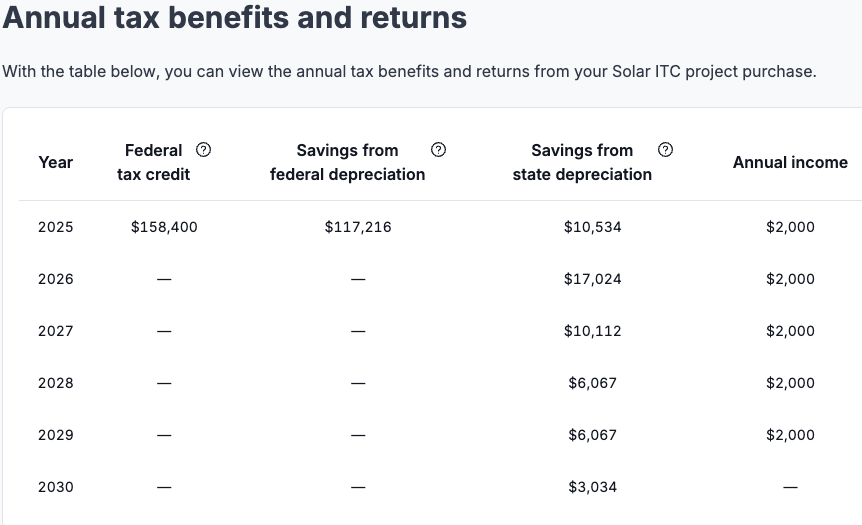

Year-by-Year Tax Savings:

Below, you can see the year-by-year tax savings from tax credits and Federal and State depreciation for Priya, taking into account her particular situation.

See your potential savings with your own numbers using our online calculator here.

Tax credits and depreciation are subject to limitations based on the type and amount of income you’re applying them against in a given calendar year. However, any unused credits or depreciation can be carried forward to future years—they don’t expire or get lost. You can read more about these limitations here.

What if Priya chose not to purchase a solar project?

This is a common question: How would Priya do if she simply paid her taxes and invested the remaining money? This is a pretty simple comparison. If she doesn’t put $200,000 into the solar project, she would owe more than that in taxes.

Situation Overview:

Results:

If Priya simply paid her taxes, she’d owe the full $503,000. By contrast, participating in the flip partnership would generate about $340,304 in tax savings and cash flow. Subtracting the $200,000 cost of the solar purchase, that’s a net gain of $140,304 compared to doing nothing.

The key point: the $200,000 she put in solar is money she’d otherwise send to the IRS and never get back. Instead, solar allows her to redirect those “lost dollars” into something that generates additional tax savings, produces cash flow, and contributes to a cleaner environment.

Some people try to compare this to investing the same amount in the stock market—but that’s not an apples-to-apples comparison. You invest after-tax dollars in the stock market. With solar, you’re putting pre-tax dollars—money you’d otherwise send to the IRS—to work for you.

Since Priya is using the tax incentives to offset active income, she’s required to materially participate in the solar business for it to be considered an active business. This allows her to apply the tax benefits against her W-2 income (active income). You can learn more about material participation on our blog post or watch our explainer video.

Purchasing solar projects can be an effective strategy for high-income earners with significant ordinary income to reduce their tax liability.

How can you go about buying qualified projects? It’s relatively simple: Valur has partnered with reputable developers to make solar projects accessible to high-income earners. We help you identify and evaluate available opportunities, compare different project options, and visualize the potential benefits—using a calculator tailored to your specific income situation.

From there, we’ll help you seamlessly finalize your purchase—with no fees charged to you by Valur.

To learn more you can schedule a call with us here.

Need some help to understand which if this is the right fit for you?

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Ordinary Income