FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

So far we’ve covered the basics of Grantor Retained Annuity Trusts (GRATs) and how to maximize the use of these powerful estate planning tools with Zeroed-Out GRATs. We’ve really only scratched the surface, though; there are several ways to optimize GRATs to pass on even more assets free of gift tax or estate tax. Probably the most common enhancement is a strategy commonly referred to as rolling GRATs.

But why does this strategy work, and why is it valuable? The key feature is that the trust’s term is much shorter than a traditional GRAT’s term.

A GRAT is a Grantor Retained Annuity Trust. It is a type of trust that allows you to transfer assets to beneficiaries without incurring gift or estate taxes. With a rolling GRAT strategy, you set up a series of short-term GRATs as a way to minimize the risk of the GRAT strategy (more on this below) and maximize the assets you pass on to your heirs estate tax free. Rolling GRATS are one of the most popular ways to avoid paying taxes on large transfers of wealth alongside Private Placement Life Insurance (PPLI), Non-Grantor Trusts and Intentionally Defective Grantor Trusts (IDGTs).

Rolling GRATs are also called short-term GRATs because they present various benefits in comparison to basic GRATs. Some benefits are:

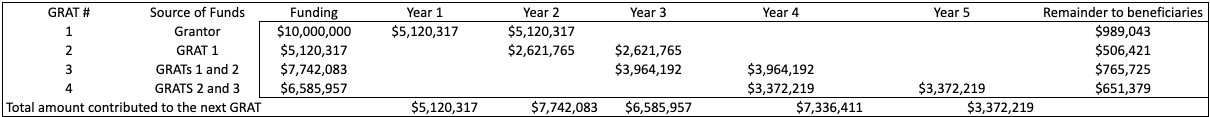

Rolling GRATs are relatively straightforward. We’ve explained the theory, and now we’ll take a spin through an example to demonstrate how this strategy works in practice. Put simply, you’d set up at least one new GRAT per year, each with the same duration — two years is standard. You’d fund the initial GRAT with a portion of your estate, and then you’d take the annual distributions from that trust and fund two additional trusts. Then you’d take the distributions from those trusts to fund additional ones, and so forth. That’ll give you two GRATs operating with the same strategy at the same time, at all times. This process continues on and on until the individual determines they’d like to stop.

Ava is a successful blockchain entrepreneur and published author. She’s married with two children.

Assumptions

Funding the initial GRAT

Ava contributes $10 million to the first trust. A the end of the first year, the trust has grown by 10% to $11 million, with a distribution to Ava of $5.22 million. (This is 50% of the amount contributed, plus the IRS’s 3% growth rate.)

This leaves $5.78 million in GRAT #1 after the first year of operation.

Using the first GRAT to fund the second

The moment Ava receives the $5.22 million distribution from the first GRAT at the end of year 1, she funds the second GRAT with those proceeds. This second GRAT will likewise run for two years, with annual payments of $2.73 million. (50% of the initial amount + the 3% growth over two years).

Using the first and second GRAT to fund the third

At the end of year 2: GRAT #1 passes $1.1 million to her beneficiaries and ceases operation, while GRAT #2 holds $3 million.

This is the first year that any money will be transferred to her beneficiaries — $1.1 million, which is what was left in GRAT #1 after the annual payments, because the assets grew faster than the government’s expected 3% growth rate.

In year 2, Ava had two trusts that were operating independently of each other. At the end of the second year, the first trust will pay her another $5.22 million, and the second trust will pay her $2.73 million, for a total of $7.95 million. Ava will use those cumulative payments to create a newly funded GRAT #3 that holds $7.95 million.

Ava can pursue the same strategy in an ongoing fashion for as long as she wants. At the end of the third year, she’ll pass an additional amount to her beneficiaries — namely, the remainder from the second GRAT — and she’ll fund a fourth trust. Same for the end of the fifth year, and so on. For reference, that could be $3.3 million to her beneficiaries, tax free, over five years, and much, much more over the long term.

Based on the assumptions above, over a 39-year period Ava would have distributed $49 million to her children completely free of gift tax or estate tax. If, instead, she had kept the funds in her regular investment account and pursued the same investment strategy, she would have paid at least 40% in federal taxes before transferring those funds to her children, leaving them only $29.4 million. The rolling GRAT strategy, in other words, produced an additional $19.6 million, or 66.67% more, for her family! And that’s not even including any potential state-related estate tax she could avoid!

It’s simple to do so, and even easier with rolling GRATs. To stop using this strategy, all you have to do is stop forming additional GRATs each year. The remaining trusts will complete their terms, and you’ll keep the distributions instead of using them to set up additional GRATs. (Compare this to the traditional 10-year GRAT strategy. In that case, you would have to see the full 10-year term through before changing course, meaning your assets would be locked up for much longer.)

With a rolling GRAT strategy, you’re getting the best of both worlds: You’re maximizing your use of GRATs while drastically reducing the risks associated with traditional long-term GRATs. Put simply, by recycling these funds through multiple GRATs over your lifetime, you can maximize the efficiency of this powerful estate planning structure.

Check out more details with our GRAT calculator, or schedule a time to chat with our team of experts!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!