FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

If you’ve gotten to this point, you’re probably familiar with grantor retained annuity trusts (GRATs) and the estate tax more broadly. This article drills down into the concept of a “zeroed-out GRAT,” a type of GRAT that is optimized for gift and estate tax purposes.

But first, let’s recap! A GRAT is a powerful estate tax planning vehicle. The mechanics are simple: A grantor transfers assets to the trust for a term of years (often two years). The trust makes annual annuity payments to the grantor on the anniversary of the trust’s funding. At the end of the term, whatever is left over after the final annuity payment has been made passes to the grantor’s remainder beneficiaries free of gift tax. Most often, those remainder beneficiaries are the grantor’s children. But if the grantor isn’t careful, the initial funding of the GRAT will be considered a gift for gift tax purposes. Fortunately, there’s a solution to this problem: the zeroed-out GRAT.

When a grantor funds a GRAT, he or she is considered to have made a taxable gift to the remainder beneficiaries unless the annuity payments that the grantor receives are at least equal to (a) the amount that the grantor contributed to the GRAT plus (b) interest. The amount of that interest is based on the IRS’s 7520 rate. The grantor wants to avoid making taxable gifts, because doing so will use a portion (or maybe all!) of the grantor’s lifetime gift and estate tax exemption amount. So it’s important that the annuity payments equal this minimum amount.

For example, if a grantor funds a two-year GRAT with $150 when the 7520 rate is 4%, the annuity payments will have to total about $159 ($150 of principal plus $9 of interest) in order for the grantor to avoid making a taxable gift. If the annuity payments do total $159 or more, the grantor will not have made a taxable gift.

Estate planners call any GRAT where the annuity payments are perfectly calibrated to avoid this gift-tax issue a “zeroed-out GRAT.” In practice, virtually all GRATs these days are zeroed out. After all, many GRATs fail to pass on assets (often because the assets inside of them lose value during the GRAT term). If you fund a GRAT in a way that triggers a taxable gift, and then the GRAT fails to pass on assets, you will have wasted a portion of your valuable lifetime gift tax exemption amount!

That’s fairly abstract, so let’s walk through a more in-depth example. Garrett, a successful serial entrepreneur, has accumulated well over $20 million of assets, so he expects to use his full lifetime gift tax exemption and pay at least some estate tax. He hasn’t done any estate tax planning in the past, but he decides to set up a single zeroed-out GRAT to test the waters. He plans to fund it with $1 million.

Setting up the trust. Garrett has decided that he wants to set up a four-year trust for the benefit of his children. Because Garrett does not want to use any of his lifetime gift tax exemption amount, he makes sure to structure it as a zeroed-out GRAT. That means that the annuity payments must total $1.1 million, which is the $1 million contribution amount plus interest (based on a 7520 rate of 4%). Assuming level annuity payments, that means the annual annuity payments will equal $275,000.

Funding the trust. Garrett has a number of assets that he could theoretically put into the GRAT. He decides to put $1 million of Apple stock into it. He figures that Apple stock is a fairly volatile, concentrated stock position, so there’s a decent chance that it will appreciate a lot during the four-year term. If that happens, Garrett will be able to pass on that appreciation to his children tax-free. If that doesn’t happen, it won’t be the end of the world. Garrett will get the Apple stock back with no negative tax consequences.

The outcome. The GRAT distributes $275,000 per year to Garrett. By the end of Year 4, Garrett has received $1.1 million of distributions. But, wait, there’s still over $373,000 in the trust! That’s because the Apple stock appreciated by 15% per year during the term, much higher than the 4% interest that was applied to Garrett’s annuity payments. That excess return passes to Garrett’s children free of gift tax.

At Valur, our goal is to make the GRAT planning process simple and easy. We’ll do the math, draft your trust, and handle the annual distributions and other administrative tasks, so that you can focus on what matters.

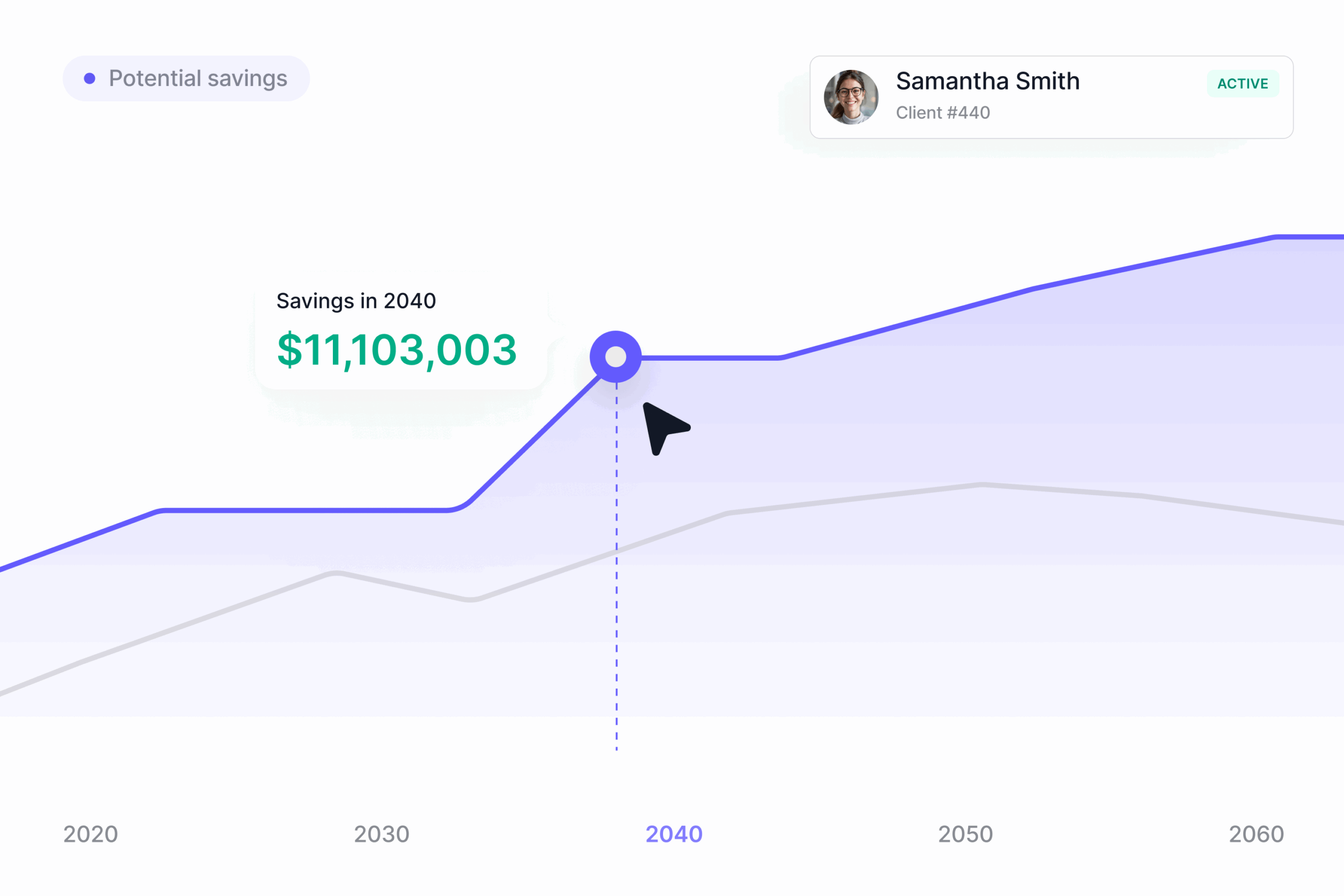

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!