FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

If you work at Apple, your equity has been a big part of your compensation and probably your net worth. After spending time in the company, you’re probably looking to monetize it tax efficiently, and the good news is there are a number of ways to do so.

In this article, we’ll dig into 2 key tactical approaches you can take to maximize the hard-earned gains coming your way:

But first of all, let’s start with the basics of what tax planning is and how RSUs work.

Tax planning is a strategic approach designed to reduce a person’s or a company’s tax liability by leveraging various tax benefits and allowances. It’s about understanding the tax implications of your financial decisions, so you can minimize your taxes. Unfortunately, most people are unaware of how impactful it can be and that it can help you keep more of your hard-earned gains coming from your Apple equity.

RSUs are a type of equity compensation that public and late-stage private companies use to incentivize and reward employees. An RSU represents the right to receive a share of the company’s stock at a certain price. RSUs typically vest over a period of time and once they vest, the employee receives the company shares.

RSUs can be an attractive form of compensation for employees but the resulting tax can significantly reduce the value. If you receive RSUs, you will be subject to paying ordinary income taxes on the value of the RSUs when they vest and capital gains taxes when on any appreciation above the vesting value and the value you sell the shares.

So now that you understand the basics, what are your possible strategies to monetize your Meta equity in a tax efficient manner?

Need some help to understand the most convenient tax planning structure to monetize your equity in a tax-efficient way? Our team of tax-planning experts can help!

There are multiple ways to monetize your Apple equity and, even better, alternatives to do so tax free. If you are seeking to maximize the value of your Apple exit strategy, here are some smart options that can help create a plan that saves you money:

Below, we’ll discuss the benefits and risks of each strategy, as well as who might be best suited to use them.

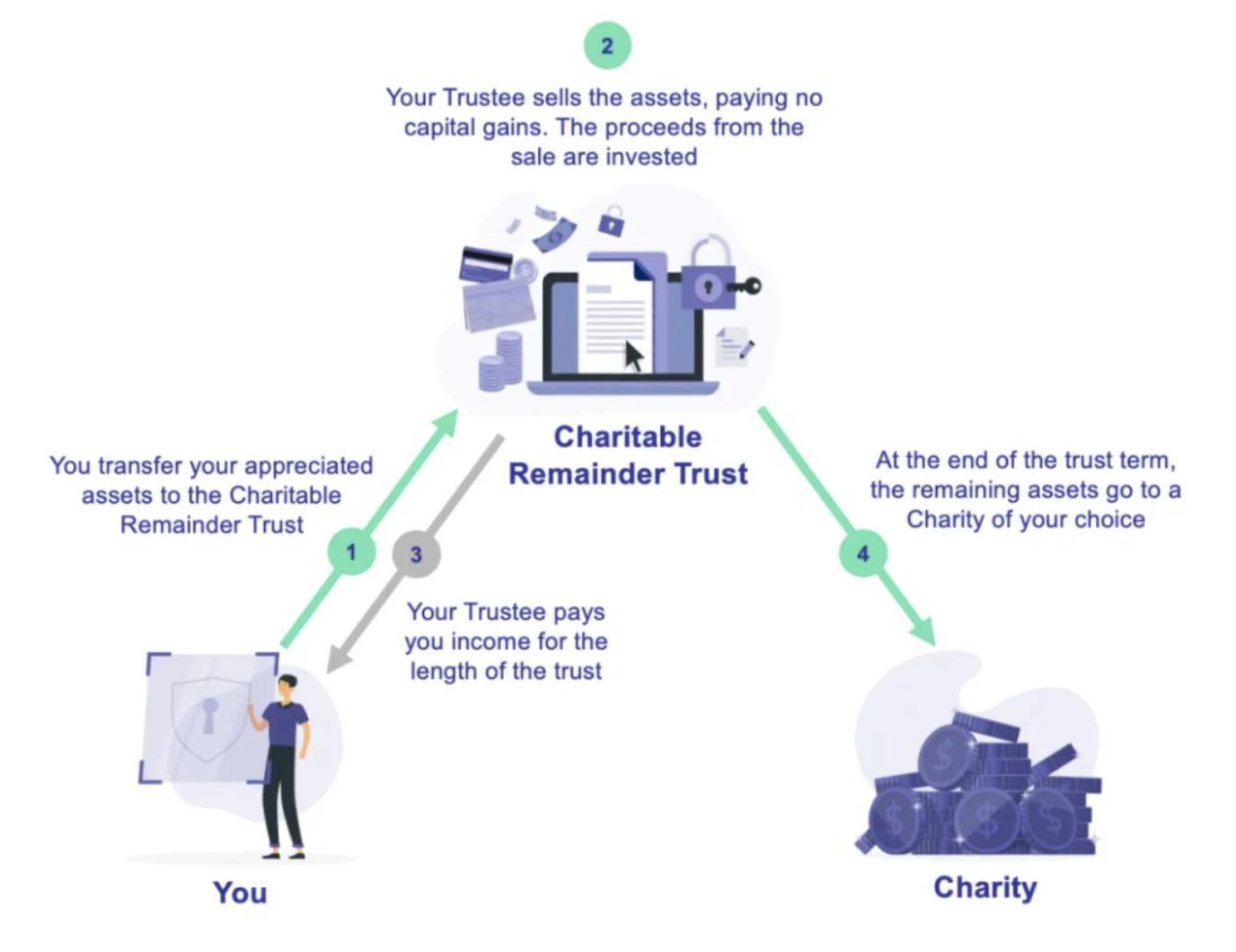

If you haven’t sold your shares you can use a Charitable Remainder Trust (or CRT) to sell your equity tax free. These structures are tax-exempt irrevocable trusts that work best for appreciated assets with unrealized gains, meaning that you have the opportunity to sell your shares tax free as long as you place them in the trust “prior” to selling.

With a CRT, you may gift equity to the trust, sell it and reinvest it tax free, and then receive a stream of income from the trust for a specified period of time. After the trust’s term ends, the remaining assets are donated to a charity of your choice.

By doing so, it’s common to be able to take home 100% or more compared to not using a CRT and just selling your assets in a regular taxable account, even after making a large donation to charity.

You can learn more and read a real-life example here and you can estimate your ROI here.

The benefits of using a CRT to monetize Apple equity include:

The risks of using a CRT to monetize Apple equity include:

If you’ve already sold your shares, a Charitable Lead Annuity Trust (or CLAT) is another strategy that can help you reduce your tax bill and you can read more about it here. Among other options, you can also reduce your taxable income with other tax strategies such as renewable energy projects or Conservation Easements that can help you lower your capital gains tax bill after your sale.

A possible alternative could be to exchange your Apple equity through an exchange fund. An exchange fund is similar to a mutual fund but, instead of contributing cash, you contribute stock. In return for trading in shares, you receive shares in a pooled exchange fund, which invests in other assets, such as valuable late-stage private companies, and real estate.

By aggregating the concentrated stock positions of many investors, an exchange fund allows you to replace your own concentrated stock position with a diversified basket of stocks of the same value and reduce portfolio risk, without triggering capital gains taxes.

Because the transaction is not immediately taxed, you can diversify without paying taxes upfront, putting off tax consequences until later.

You can learn more about exchange funds and a case study here.

The benefits of using an exchange fund to monetize Apple equity include:

The risks of using an exchange fund include:

While all these strategies may be a good option for people who are looking to access cash from their company equity without triggering taxes, the best way to monetize equity tax free will vary depending on your priorities and the options available.

There are two key decision points for these solutions: (1) Does the strategy apply to you? and (2) does the strategy serve your purpose, whether it is diversifying your portfolio, short-term liquidity, or otherwise?

All of the alternatives we’ll discuss are available only to shareholders — that is, individuals who have already exercised their options, converted their restricted units, or otherwise taken possession of actual shares. While Charitable Remainder Trusts are available to anyone who owns their shares, exchange funds and loans are available only to shareholders in a limited list of unicorn companies available here.

Understanding the available options and evaluating their applicability and alignment with goals will empower Apple equity holders to make informed decisions on monetization, potentially maximizing the value of their equity in a tax-efficient manner.

We’ve built a platform to give everyone access to the tax and wealth building tools typically reserved for wealthy individuals with a team of accountants and lawyers. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make things simple. The results are real: We have helped create more than $3 billion in additional wealth for our customers.

If you would like to learn more, please feel free to explore our Learning Center, check out your potential tax savings with our online calculators, or schedule a time to chat with us!