FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

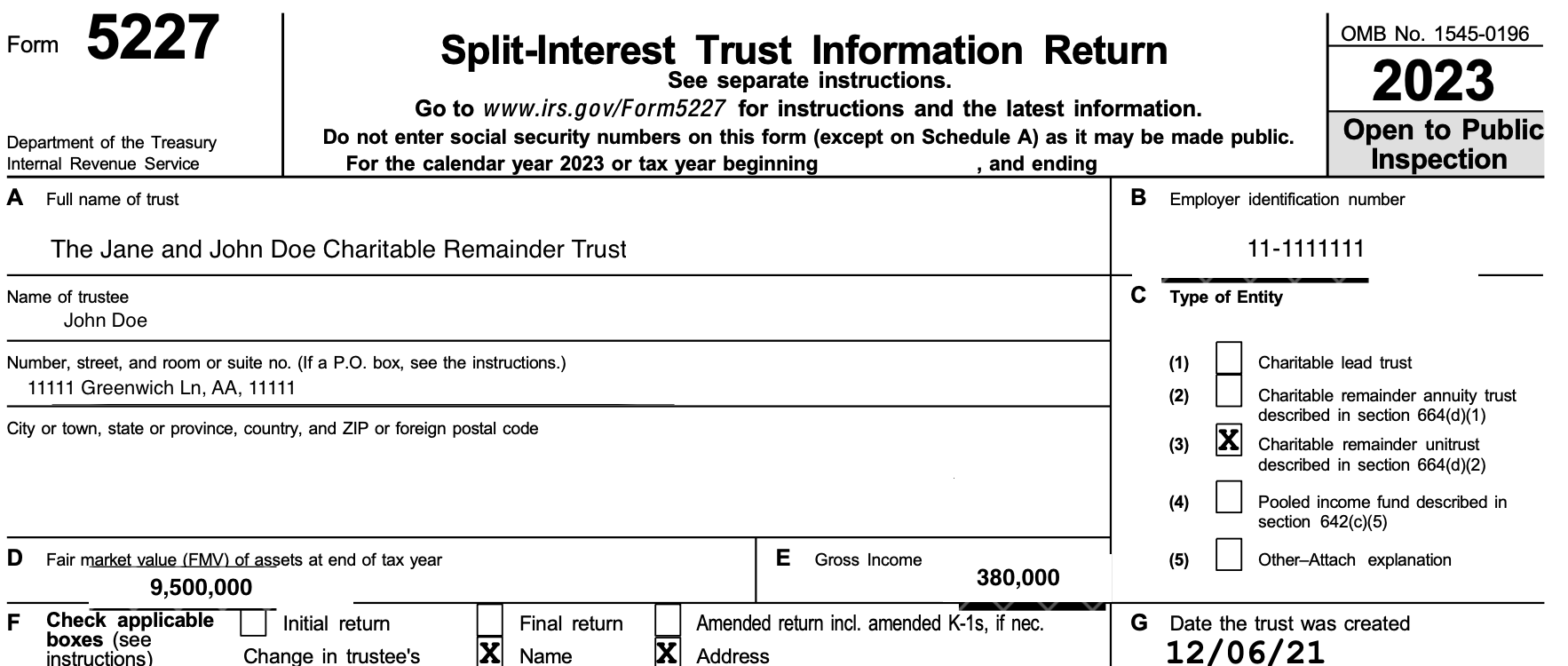

In this article we’ll review IRS Form 5227 instructions, the Split-Interest Trust Information Return. This crucial document is part of the annual tax filing requirement for Charitable Remainder Trusts, serving as a detailed report of the trust income, deductions, balance sheet, and required distributions, among other elements that helps the IRS track the trust and ensure it’s following IRS rules. While this form isn’t the easiest to digest, we aim to make it as digestible as possible, dissecting each part to ensure that you feel confident in your ability to understand and review it accurately and efficiently.

We’ll start with the first thing you’ll see when you review the form.

The header is the first section of the form 5227 and it contains the basic information of the trust, as well as some key details corresponding to the tax year’s results. Here you’ll find:

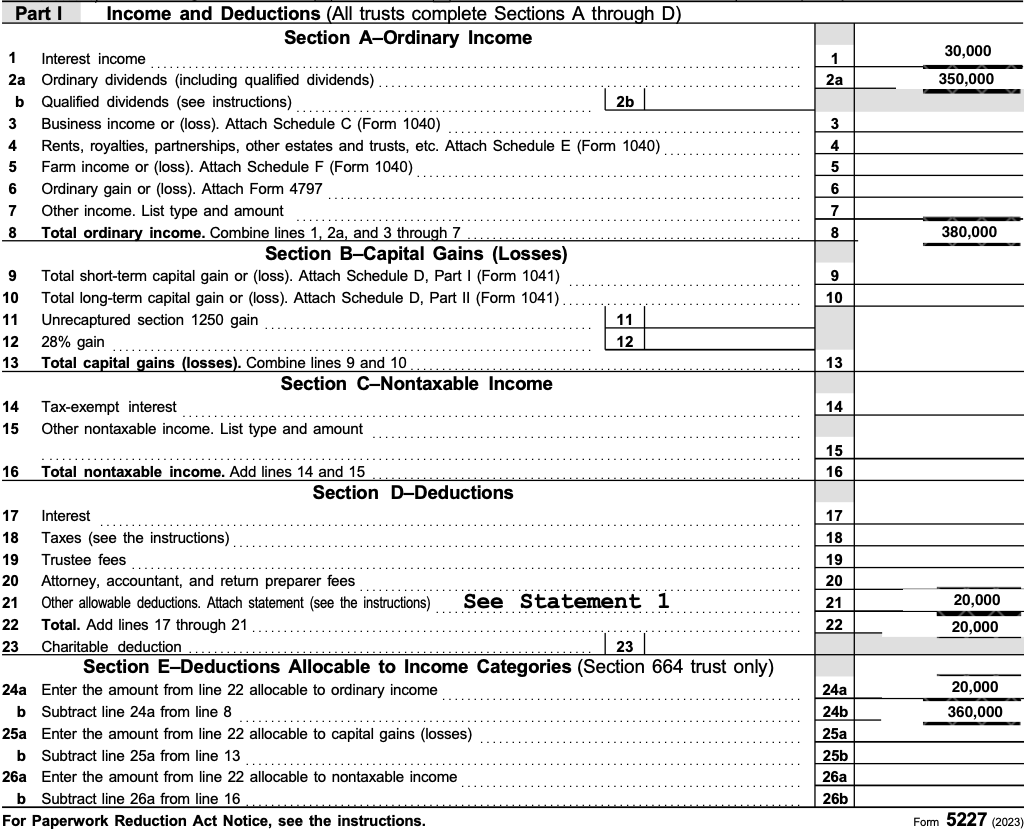

Moving into the next section, we start reviewing Part I of the form, here you’ll see the trust’s income and deductions, divided into five different sections:

All of the information found here is obtained in the 1099s and K-1s of the trust’s investments.

If a trust has multiple assets invested in different places (banks, brokers, etc), each of these investments will generate a 1099 or a K1 form. All of these forms are consolidated to create the relevant trust document. This is important for all trusts, since it will help determine the K-1 for the trust’s distributions.

In the case of NIMCRUTs, Section E is important because, since a NIMCRUT can only distribute income, one way to control the amount of distributions is to allocate fees to income. Since the trust will only be able to distribute net income, subtracting fees from gross income will result in a lower amount available to be distributed. For example, if the trust realized $20,000 in gross income, the fees for that year were $7,000, by allocating fees to income you could reduce the trust’s required distributions to $13,000 and increase the future distributions from the trust and your makeup provision by that $7,000. Effectively allowing you to keep that $7,000 growing tax free inside the trust. Instead, if you allocated the fees to principal, you would have to distribute the full $20,000. One advantage of this method is that it can be adjusted year-by-year based on your necessities. In any given year, the impact of this will be marginal but over many years the numbers can have a large impact.

This section is similar to Part 1 with the key difference that this passes the information through the filter of distributable income. This is an important distinction (specially for NIMCRUTs) because, even though the trust may have realized income, not all of it may be distributable. Since a NIMCRUT will only distribute net income, there may be deductions that need to be taken from the income. This deductions can range from realized losses, to administration fees and other expenses.

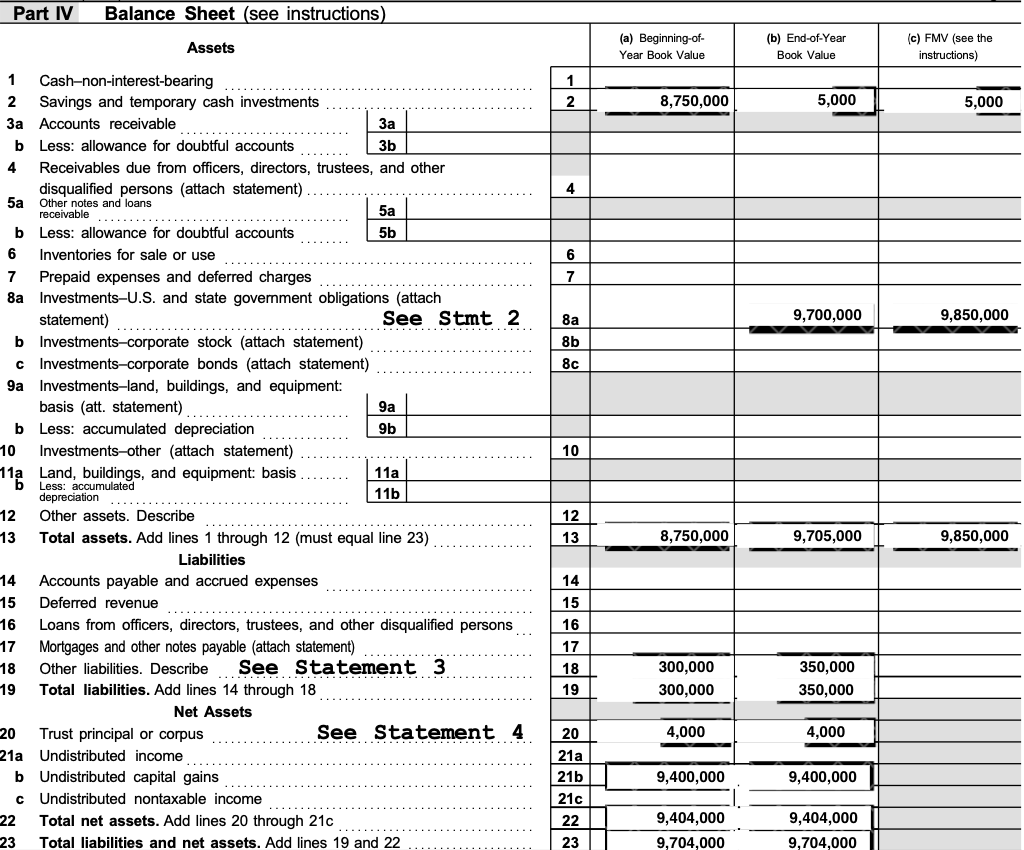

Part 4 tracks the changes in the trust’s balance sheet, or the changes in it’s assets and liabilities.

One key thing you might notice when you look at your form is that the End-of-Year Book Value and the FMV may not match. This is because of how the assets in the trust are measured in accounting terms. On the balance sheet, the assets are valued for their cost basis, which will usually be different from the FMV for many different reasons.

One common difference is that included in the liabilities are the owed distributions. This is because in accounting terms, the trust owes you this distributions for that year (even if they are tactically paid the following year).

One important thing is that, included in the liabilities section, you’ll find the required distributions for this year. This is because in accounting terms, the trust owes you this distributions for that year (even if they are paid the following year).

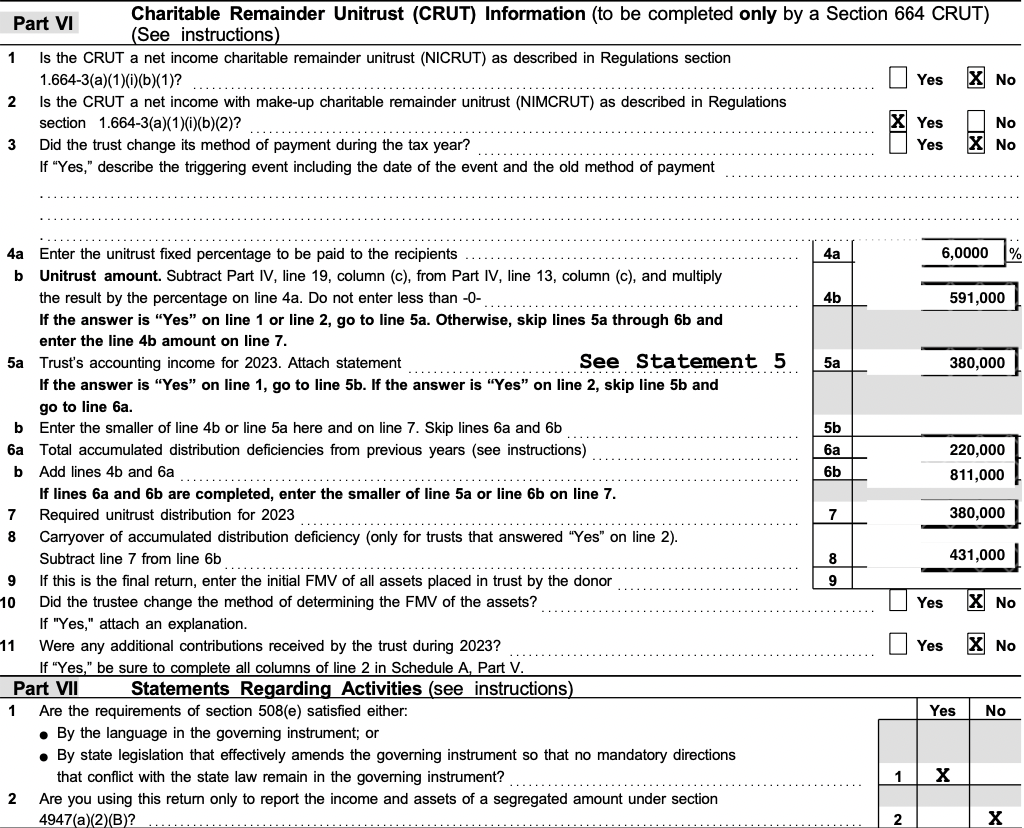

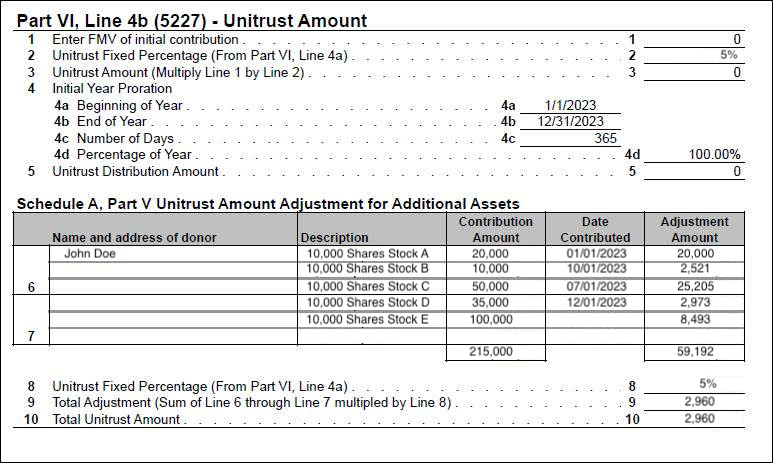

This section will determine how much the trust owes you (line 7), and the make-up account value if the trust is a NIMCRUT (line 8). The unitrust amount is also found here (line 4b). For a quick refresher on a few of the concepts mentioned here:

The unitrust amount is usually just the FMV of the trust’s assets times the payout rate, however, this may need to be adjusted, the most common case is for a partial year, that adjustment is shown in a federal statement attached (one example of this can be found below the Part VI image)

The last important section of the form, you’ll see that towards the end of this page there’s a “sign here” line. That’s where you’ll need to sign and date the trust’s form with a wet signature after you’ve reviewed it and mail it to the corresponding address. The IRS is starting to enable e-filing, so hopefully in the future, this section will not be relevant.

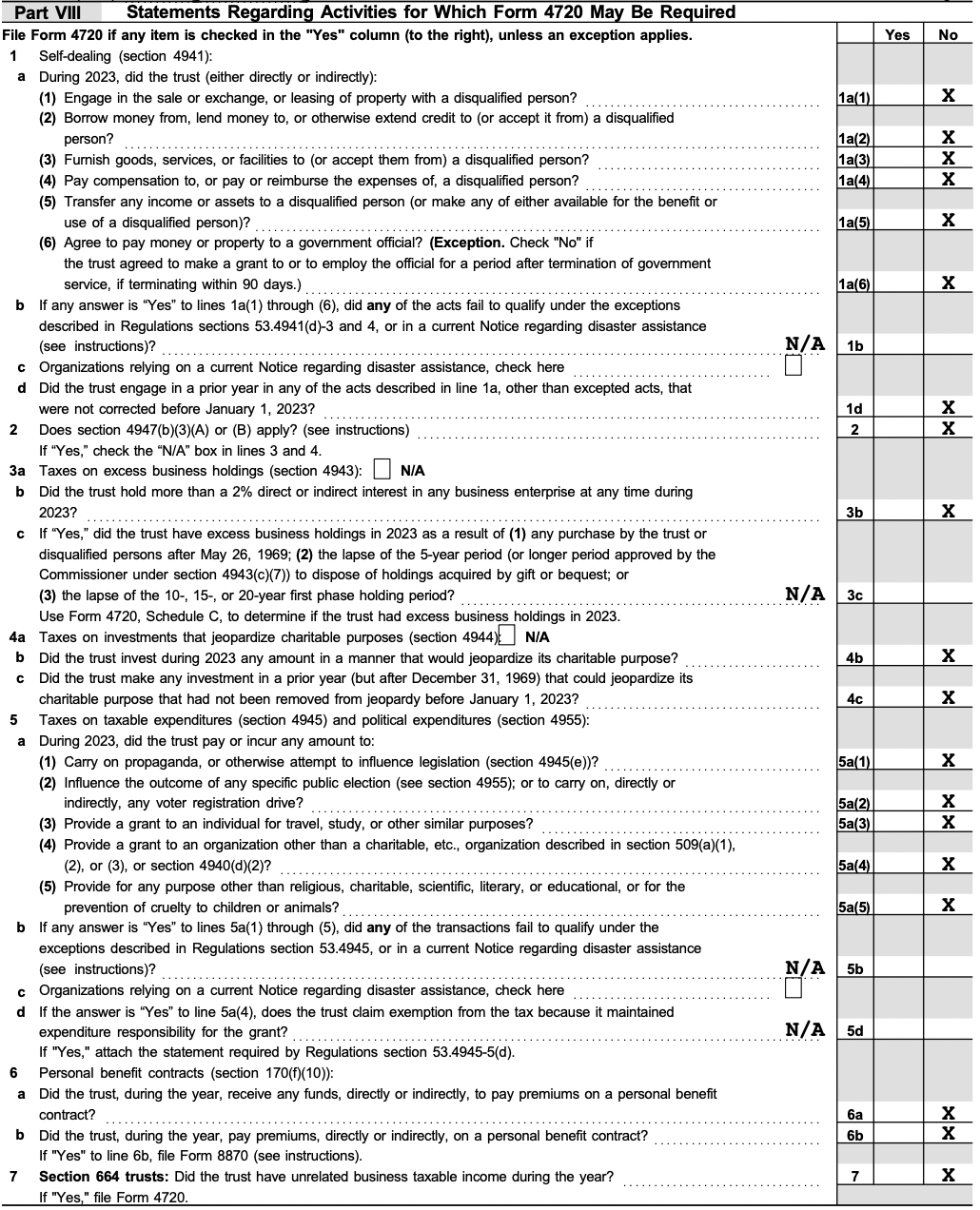

You’ll notice there are three answers checked in the example shown below. The most relevant to understand is the third one, question 14. A trust may be amended for several reasons, the most important one is the 10% test. For a trust to qualify as a Charitable Remainder Unitrust, the actuarial net present value of the remainder, which is calculated using the IRS’s mortality tables, needs to be at least 10% of the fair market value of the assets it holds when they were first contributed. One way to control this remainder is the payout rate selected for the trust. In our calculations, we calculate the payout rate to meet the 10% requirement as closely as possible to maximize your distributions. One issue that may rise is that between the moment of drafting, and the moment of notarizing, the required payout rate to pass the 10% test may have changed. If this were to happen, the trust would have to be amended changing the payout rate to the correct one (but we do not have to create another trust).

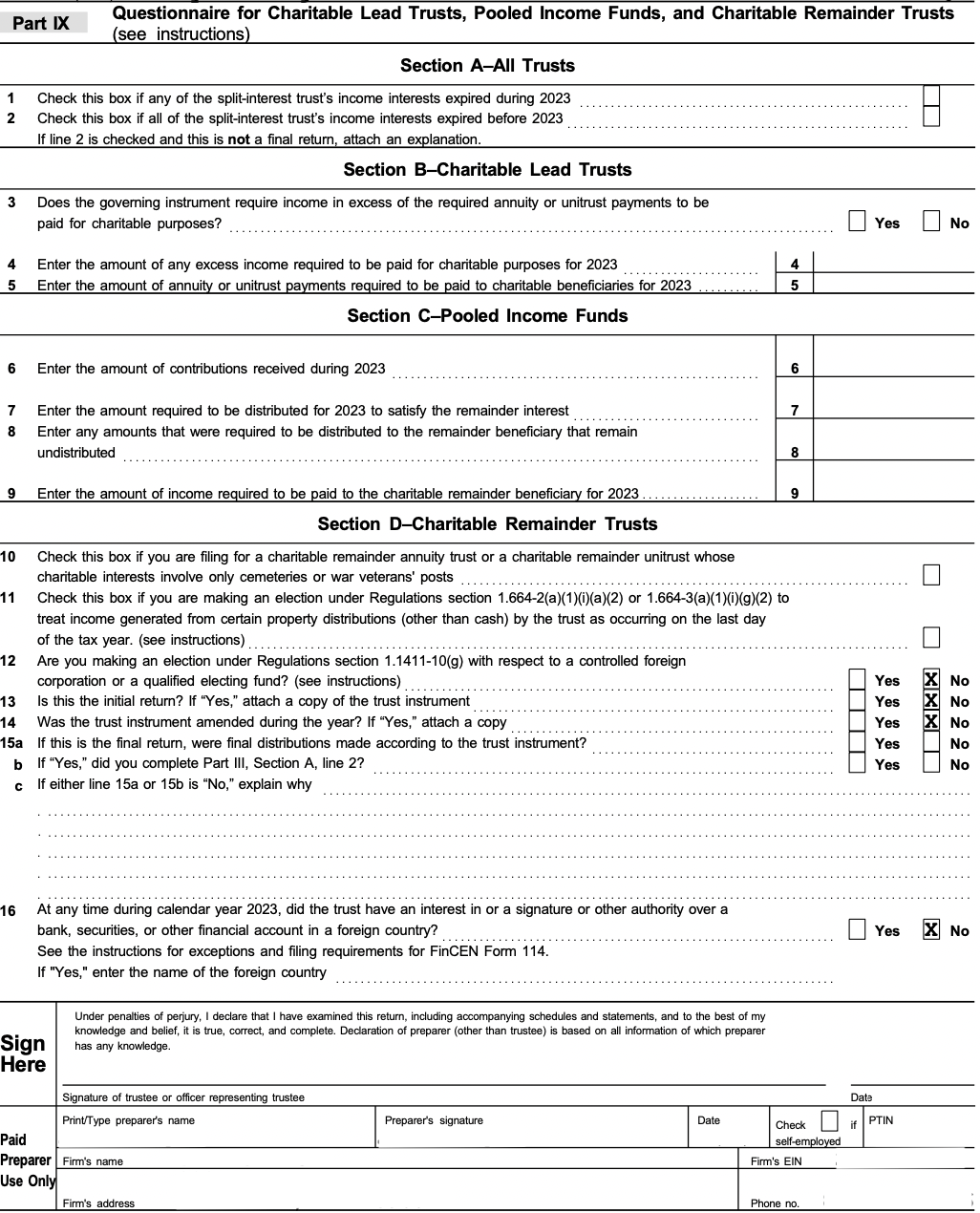

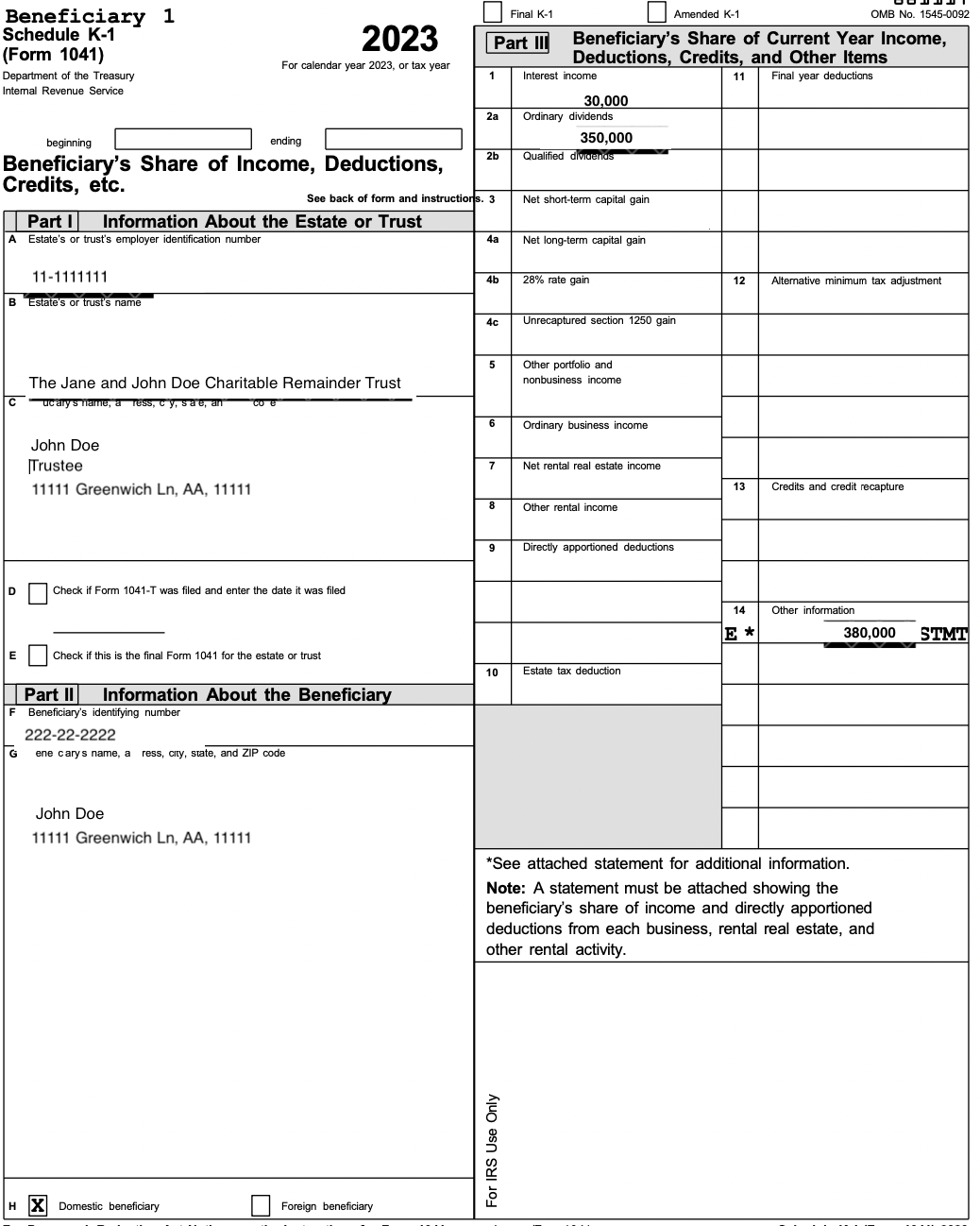

This page is important for both the trust’s tax filing as well as your personal one.

It’s important for the trust’s because it needs to be filed alongside the trust’s return, even if it’s empty.

It’s important for your personal tax filing because it details the tax treatment for your distributions, which will always follow the 4-tier accounting system. You’ll notice that the way these numbers are allocated within each category is tightly related to the section we mentioned before, Part I, Income and Deductions. In simpler language, your distributions keep the same tax category they were realized as, i.e. if assets were realized as long term capital gains inside the trust you will pay long term capital gains taxes when that income is distributed to you. Again the core benefit of a Charitable Remainder Trust is deferring when you pay taxes so you can reinvest the money, it doesn’t avoid you ever paying taxes or change the tax category of the income.

When you see the full 5227 form, all the information shown in Schedule D comes from detailed statements and segments. In them you’ll find details such as the long and short-term capital gains realized in the current year. However, the consolidated information can be found in the Schedule K-1, which is why it’s what we are showing here.

We strive to get the form as completed and correct as possible, but still is always good to check on some key information such as :

Personal information

We fill the trust’s basic and personal information with the information stored in our records, which may be outdated or slightly wrong (a new address, a misspelled name, etc). When you receive the form, always check if that information is correct.

Income and deductions

We retrieve the income and deduction information from 1099s and K1s. Some softwares, particularly those that produce these kind of reports for crypto investments, seldom fail to accurately register the income and capital gains obtained in the year, so it’s always good to reivew the forms before sending them to us, and checking the form, to see if there is some income or deduction overlooked in the form.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!