FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

An exchange fund helps investors diversify their concentrated public and private stocks while avoiding . triggering capital gains taxes. But, what are exchange funds, and why are they so helpful?

An exchange fund, or swap fund, is similar to a mutual fund but, instead of contributing cash, investors contribute stock. By aggregating the concentrated stock positions of many investors, an exchange fund allows you to substitute or replace your own concentrated stock position with a diversified basket of stocks of the same value, reducing portfolio risk and putting off tax consequences until later. Importantly after you have exchanged your concentrated position for a diversified basket of stocks you will still have to pay capital gains taxes when you sell the diversified stocks (unless you use a Charitable Remainder Trust) but because you now have a diversified basket of stocks it is less pressing for you to sell your shares and face the capital gains taxes.

Because the transaction is not immediately taxed, you can diversify without paying taxes upfront. Because of exchange funds’ limited partnership structure, U.S. tax law allows investors to swap highly appreciated stock, both public and private, for shares of ownership in these entities without triggering capital-gains tax.

To qualify as an exchange fund, at least 20% of the portfolio must be in “illiquid” investments like real estate. Additionally, to qualify for favorable tax treatment, the investor must hold fund shares for at least seven years. At the end of seven years, the investor has the option to receive a basket of stocks, none of which is their original stock. The number of stocks received varies by fund but is usually at least 20 or 25 different securities.

By contributing to an exchange fund, the investor can achieve instant diversification without immediate tax consequences. If the investor makes a withdrawal after seven years, he or she will receive a proportionate share of the basket of stocks, with a basis equal to what was originally contributed. None of these transactions is subject to taxation until and unless the shares received are actually sold.

What happens to your original cost basis? The original basis is assigned to the basket of stocks you received. In other words, you keep your cost basis even after you’ve received your diversified bucket of shares. This task is performed by the client’s CPA, not the fund, which can add some cost and complexity to managing the process.

Let’s say you are looking to diversify out of a low-basis, concentrated stock position worth $5M — shares in a public company, for example. If you chose to diversify by selling, you would incur federal and state taxes totaling approximately $1.5M (depending, of course, on which state you live in). This is the scenario with the highest tax exposure.

If you decided to use an exchange fund, it might be able to absorb the $5M of stock. In order to participate, you would have to certify that you were a “qualified investor.” The ongoing expenses are 150 basis points per year — around $75,000 at the outset, and growing with the value of the fund portfolio.

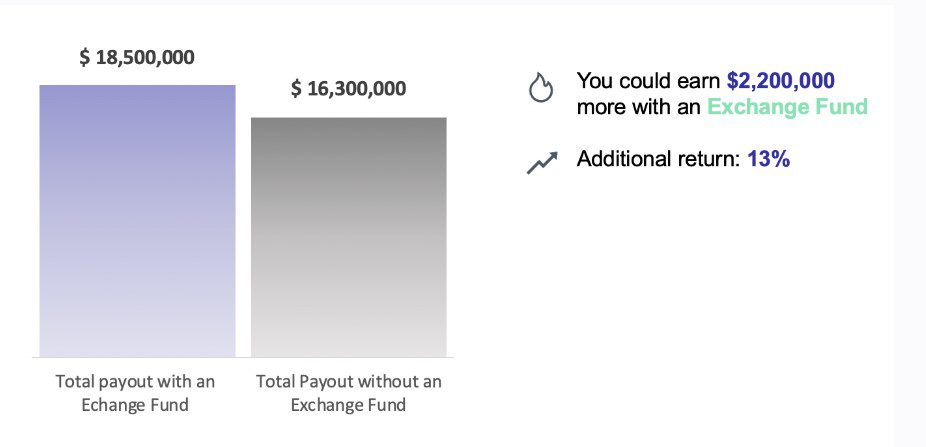

After 20 years with an exchange fund (and assuming a typical growth rate), you could have around $18.5m on a pre-tax basis; if you sold the assets without this structure in place (assuming the same growth rate, minus fees), you might have around $16.3M. That’s an additional $2.2M, or 13%, with an exchange fund.

Exchange funds can help diversify large, concentrated positions, assuming that you don’t need access to the capital for at least 7 years. In other words, they’re better than doing no tax optimization. But these funds might not make sense for periods longer than 7 years, as the ongoing management fees could drag down returns compared to alternative tax planning strategies. If you are wondering what alternatives to exchange funds, here are a few:

Keep up with next steps by reading our primer on Opportunity Zones and how to take advantage of them for realized gains. Check out our CRT calculator to know your potential return on investment, or set up a meeting with our team at Valur.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to reduce your capital gains tax?

Free 15-min consult · No obligation · Capital Gains