FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A Charitable Lead Annuity Trust is an irrevocable trust that pays a specified amount (an “annuity”) to a designated charity for a set term of years, the actual amount can increase by up to 20% from year to year but cannot decrease. At the end of that term, any remaining assets in the trust pass to non-charitable beneficiaries (often children or a family trust) free or largely free of additional gift or estate taxes.

Because the charitable gifts reduce the taxable value of the initial contribution, if the assets in the CLAT appreciate faster than the IRS’s assumed rate of return (the Section 7520 rate), all excess growth above the 7520 rate passes to the heirs tax-free. In simpler terms, the IRS’s 7520 rate is the hurdle rate for CLATs. If your assets grow faster than this hurdle rate in addition to receiving a charitable deduction you (or your family) will receive assets from the CLAT after it’s paid out the required payments to charity.

A critical piece why CLATs are used in estate planning is due to the fact that based on the IRS calculation when the trust is setup, the value of the assets (based on the 7520 rate) expected to go to the heirs is $0. As a result, the heirs interest in the trust (called the remainder interest), counts as a $0 gift to the heirs and no matter how much is actually passed on to the heirs will be gift/estate tax free. In other words, this structure can “freeze” estate values for tax purposes and shift asset appreciation to the next generation at little or no gift and estate tax cost.

How It Works

At a basic level, a CLAT is simple:

We know this is complicated, so let’s dive into a real-life example!

Mark and Sarah, a successful couple in their early 60s, have spent decades building a family business and accumulating significant wealth. With a combined estate of approximately $50 million, they are well above the federal estate tax exemption. As they consider their legacy, their priorities are twofold:

Their advisors recommend a Charitable Lead Annuity Trust (CLAT) to help them achieve both of these goals simultaneously. The CLAT allows them to fulfill their charitable giving objectives while greatly reducing — and potentially eliminating — gift and estate taxes on transfers to their children’s trust.

Mark and Sarah transfer $10 million worth of marketable securities from their taxable estate into a 20-year CLAT. At the time of contribution, the IRS’s Section 7520 rate (the “hurdle rate”) is assumed to be 4%. Their CLAT is structured to pay out a fixed annual annuity to a designated charity over its 20-year term. The remainder beneficiary of the CLAT is a trust for their children and future descendants, ensuring multi-generational stewardship of the family fortune.

Mark and Sarah’s CLAT is designed to pay out approximately $600,000 per year to various charities (the exact amount can be structured to meet specific philanthropic goals while generating the maximum tax benefit). Over 20 years, this will direct a total of about $12 million to charities, fulfilling Mark and Sarah’s philanthropic vision. The exact annual payout amount is set so that the “gift value” to the non-charitable beneficiaries, the remainder interest, is worth $0 at inception. This strategy makes the initial gift to the children’s trust carry no upfront gift tax.

The assets inside the CLAT are invested in a diversified portfolio aiming for returns above the hurdle rate. If their investments grow at an average of 7% annually — above the IRS’s 4% assumed growth rate — the difference accrues to the benefit of the remainder beneficiaries. Even after paying out $600,000 annually to charity, if the portfolio meets or exceeds the target growth, the principal can remain stable or grow.

After 20 years, when the final charitable payment has been made, any remaining assets will be transferred to the family trust for Mark and Sarah’s children and future generations. Because the initial valuation for gift tax purposes assumed the entire benefit was essentially “used up” by the charitable payments, the growth above the hurdle rate flows to the family trust free from additional gift or estate taxes.

Initial Contribution: $10,000,000

At first glance, it looks like the entire trust will be spent down through charitable distributions. However, the growth of the trust’s assets can offset these payouts.

Assumed Growth Rate: 7% annually

IRS Hurdle Rate: 4% annually

Here’s a simplified projection:

For instance, if after careful investment and asset management, the trust averages a 1% net growth over the entire 20-year term (after charitable payments), the remainder might still be close to the original principal or slightly higher. Even if the remainder ends up around $10 million (just holding steady in real terms), that $10 million passes to the family trust free of gift and estate taxes.

Bottom Line: Instead of paying large estate taxes on passing a portion of their wealth to their children, Mark and Sarah have directed $12 million to charity, provided for their children through the CLAT remainder, and effectively minimized the tax cost of transferring a substantial sum to future generations.

A Charitable Lead Annuity Trust offers a powerful strategy for individuals and families who have both philanthropic and legacy goals. In Mark and Sarah’s case, a properly structured CLAT allows them to simultaneously fulfill charitable missions, reduce or eliminate large transfer taxes, and secure a meaningful inheritance for their descendants.

If you are considering a similar structure, it’s critical to work with experienced advisors who can tailor the trust terms — the payment amounts, the trust duration, and the investment approach — to your goals and financial situation. With the right guidance, a CLAT can be a transformative vehicle, amplifying your charitable impact and preserving family wealth for generations to come.

Follow up with our comparative article, try our innovative calculator to evaluate your potential return on investment, or schedule a call to meet our team and share your experience!

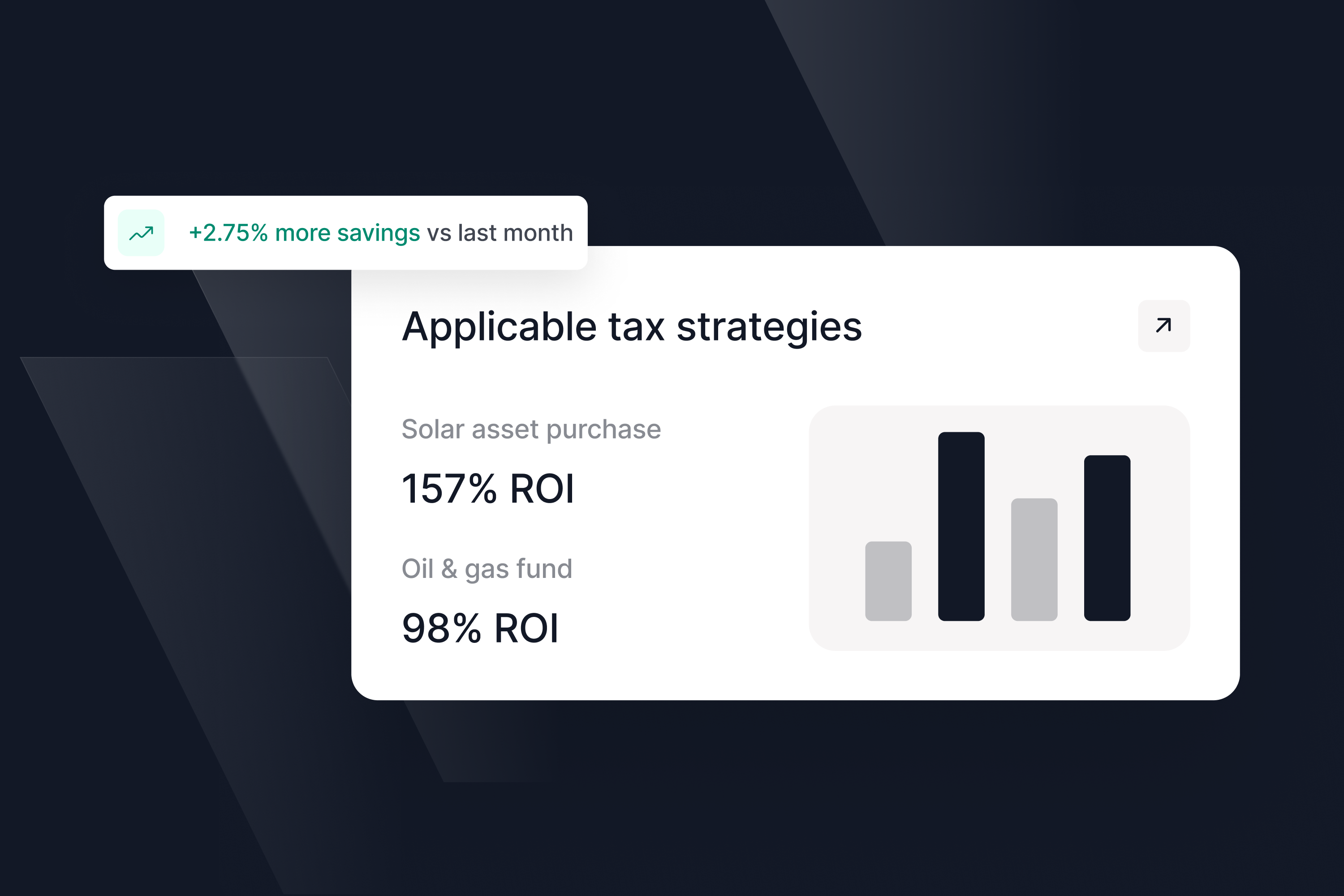

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax