FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

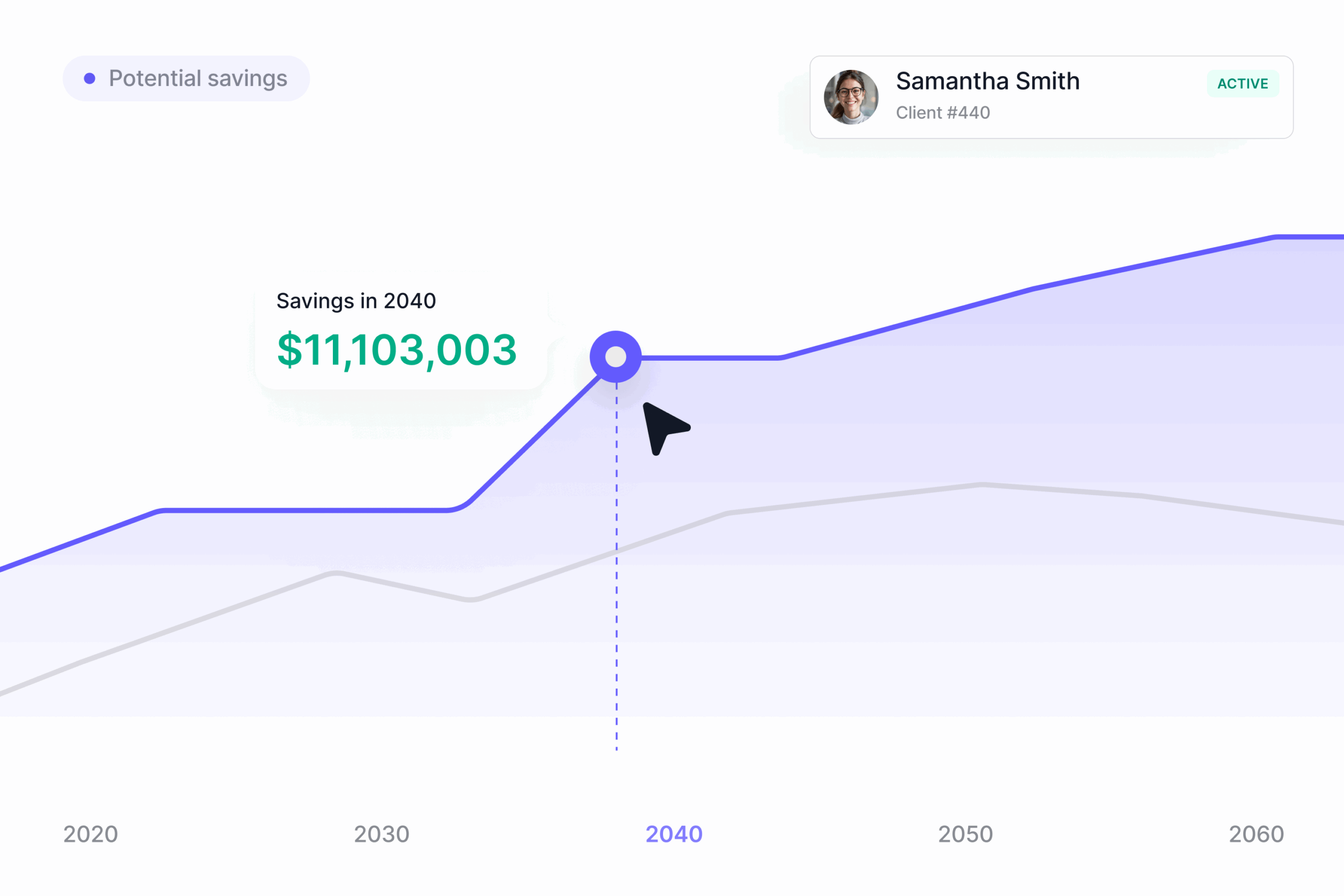

✅ A founder planning for a $3 million secondary sale could earn an extra $1.5 million over a 20-year trust term if they put their shares into a Charitable Remainder Trust.

In our last article, we told you about Sheryl, the co-founder of a bay area architectural startup, who set up a charitable remainder trust to minimize her tax hit when she sells her shares either in an acquisition or an IPO. Today, we’ll continue with the Sheryl example and assume instead she wants to sell a portion of her stock on the secondary market, ahead of a fund raising round or a larger exit in the future. (Before you read about how a Charitable Remainder Trust can help Sheryl with his tax bill, feel free to take a moment to review the foundational posts in our series on CRTs: Our comprehensive guide on the basics, why CRTs are more flexible than you think, and our first example, which focused on an employee planning for a massive IPO.)

Planning for Secondary Sale

Our next example, and one we see frequently, is Sheryl, (as a recap) who lives in the bay-area and co-founded her company in 2018. The company has done very well, and expects to raise its series B in the next 2 or 3 years. Sheryl, however, has some upcoming financial needs including home renovations, college tuition, another investment in her best friends company, etc. She can’t really wait 3 years for liquidity, so she’s interested in selling a portion of her stock ahead of the next fund raise—but she doesn’t want to take the massive tax hit that will accompany the $3,000,000 sale.

Recapping the numbers

Cost basis: $0

Current value: $300,000

Sale value: $3 million

Chosen trust: 20-Year Term NIMCRUT

Immediate Charitable Deduction

Like all of our users who choose a Charitable Remainder Trust, Sheryl will get an immediate tax deduction. Consistent with the IRS’s rules, she’ll get to deduct about 10% of the current value of the shares she puts into the trust, or about $300,000. Since Sheryl lives in San Francisco, which is a high-tax city in a high-tax state, the tax savings are substantial: That $300,000 deduction translates into cash savings of about $108,000 in taxes.

No Taxes On Sale

That’s $108,000 extra in Sheryl’s pocket before things even really get going. Next, of course, Sheryl gets to defer the state and federal taxes she would otherwise have owed on the shares she’s selling. That’s about $1,080,000 in taxes deferred to a later date.

Available Withdrawals + Creative Solutions

Like all of our customers, Sheryl is a little bit concerned about her money being stuck in a trust for the long term. After all, this is the first liquidity she’s pulled out of her company, and she doesn’t yet have a big nest egg for retirement (whenever that is).

Fortunately for Sheryl, she has several options for creating liquidity. First, there’s the easy liquidity she can get out of a NIMCRUT: 11% per year if she chooses a Term trust, or $330,000 year 1 and an additional $500,000—after just 2 more years. What’s more, Sheryl has other tools at her disposal. One that our users have found especially easy to utilize is a simple line of credit: Although Sheryl can’t borrow against the value of her CRT, since that value belongs to both her and her chosen charity, she can open a line of credit using the future income from his CRT as collateral. What this means in practice is that Sheryl can access as much as the full value of her expected payouts from the trust at a reasonable interest rate, should she need more than the liquidity she would normally be able to take out of her trust.

Total Returns

Despite her immediate needs for liquidity, Sheryl is young, so she’s happy to leave most of her money in the trust to grow for the full 20-year term. Let’s suppose her only withdrawals are $330,000 in year 1 (renovations and college tuition), $250,000 in year 2 (more tuition and investment in friend company), and $250,000 in year 3 (final tuition payment and fun money).

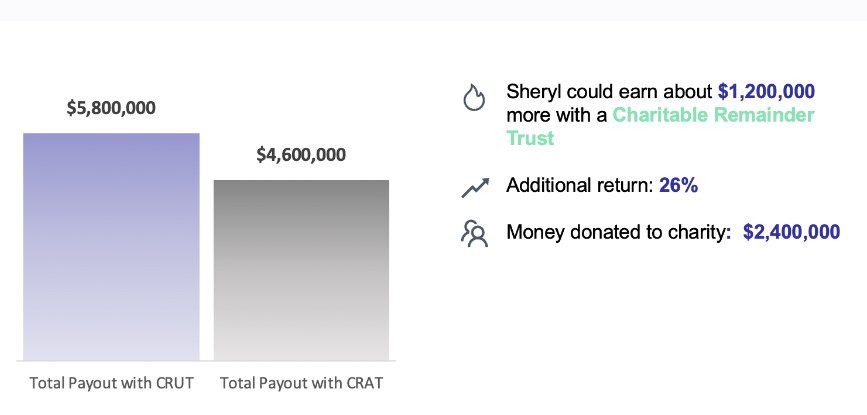

How much would Sheryl have at the end of the trust term? After those 20 years, if Sheryl has her money in a Charitable Remainder Trust, she’ll end up with about $5,800,000 in total payouts (after tax). Additionally, $2.4 million will go to the charity of her choice.

If, instead, Sheryl had kept her money in a regular, taxable investment account, she would have instead ended up with about $4.6 million.

In other words, even after her charitable donation, Sheryl still pockets an extra $1.2 million on her initial $3 million secondary sale.

See our next post on Cryptocurrency Taxes With A Charitable Remainder Trust. Try our Charitable Remainder Trust Calculator to evaluate the potential return on investment given your situation. And if you have any questions, contact us through our chat button below, or schedule a call with us.

We have built a platform to give everyone access to the tax planning tools of the ultra-rich like Mark Zuckerberg (Facebook founder), Phil Knight (Nike founder) and others. Valur makes it simple and seamless for our customers to utilize the tax advantaged structures that are otherwise expensive and inaccessible to build their wealth more efficiently. From picking the best strategy to taking care of all the setup and ongoing overhead, we make take care of it and make it easy.