FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

The most significant wealth transfer in history will happen over the next two decades: about $30 trillion will pass from Baby Boomers to Millennials. Taxes will pose a significant obstacle to that transfer of wealth. Even after accounting for deductions, a high-net-worth individual’s estate can easily be cut in half by taxes before it reaches the individual’s heirs.

It doesn’t have to be that way. Well-defined wealth transfer planning can help high-net-worth individuals minimize estate taxes and maximize their families’ returns. This article will explore what a Grantor Retained Annuity Trust (or “GRAT”) is, how it works, and why it has become such a popular strategy.

The federal government imposes a 40% estate tax upon individuals’ estates to the extent they exceed the estate tax exemption amount. In 2025, that amount was $13.99 million per person (or $27.98 million for a married couple). Under the OBBBA, the exemption will be $15 million per person starting January 1, 2026, indexed for inflation.

The federal government also taxes lifetime gifts above that same exemption amount at a rate of 40%, but there’s no double-dipping: When someone uses a portion of his or her gift tax exemption amount, the donor’s future estate tax exemption is amount is reduced proportionately. So, for example, someone who gifts $5 million to her children during her lifetime will only have $8.99 million ($13.99m-$5m) of her estate tax exemption remaining upon death.

Transfers to grandchildren are subject to a second 40% tax – the generation-skipping transfer tax – in addition to gift tax or estate tax.

Then there are state estate taxes. Not all states have them, but where they exist they are often pretty steep. Some are as high as 20%. In general, the state estate tax exemptions are lower than the federal exemptions – sometimes, much lower. Oregon, for example, only exempts $1 million of wealth per person from its estate tax.

There are many estate planning solutions available, each offering unique benefits depending on your goals. If you’re unsure which solution is best for you, try out our Estate Tax Planner.

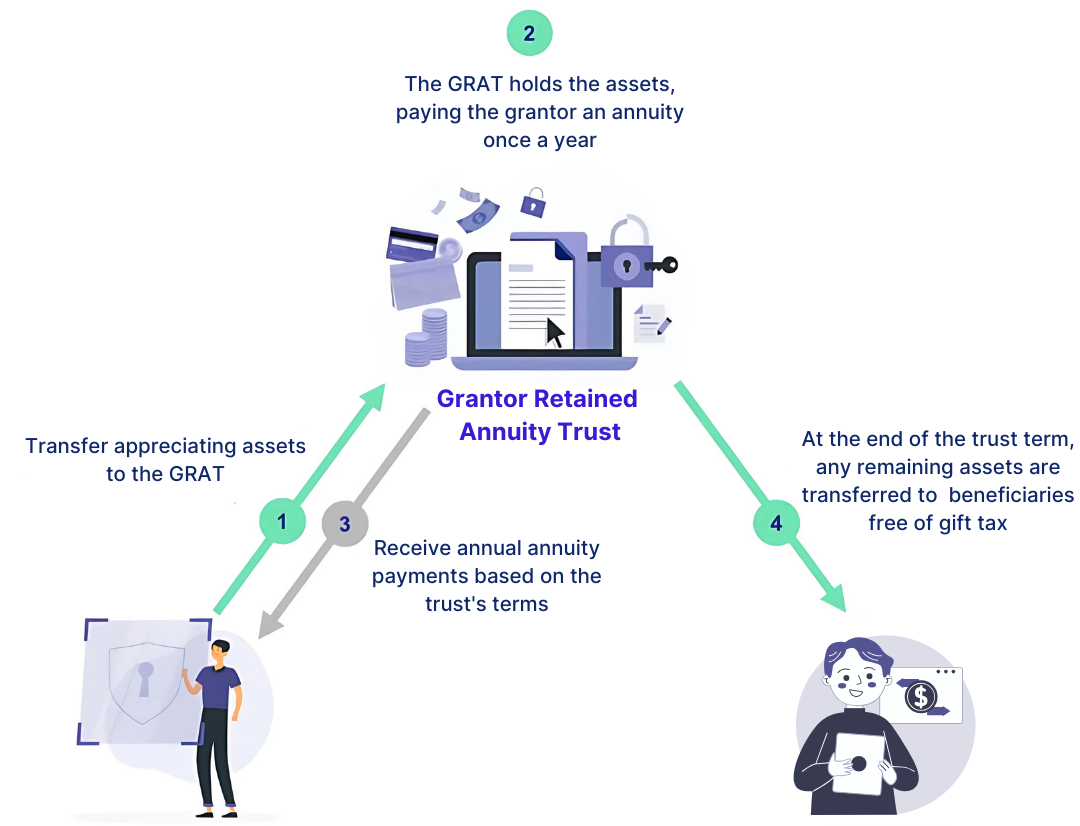

A Grantor Retained Annuity Trust or a GRAT is a common type of trust, or financial tool, that allows an individual to pass assets to others, usually their children, free of the wealth-transfer taxes described above.

Given the power of this approach, it is unsurprisingly popular amongst America’s wealthiest. Famous GRAT users include Facebook’s Mark Zuckerberg and Nike’s Phil Knight. As of 2022, Phil Knight reportedly managed to pass on $6.1 billion of Nike shares to his heirs via GRATs. Had he waited until he passed away, his heirs would have lost nearly half of that amount to taxes!

After you put assets into the GRAT, you will receive the original asset plus interest back over two year but most importantly it allows you to pass on the growth of the assets above a minimum rate to your beneficiaries without using your gift exemption. The trust’s creator — the “grantor” — puts their assets into the Grantor Retained Annuity Trust for a fixed term (usually two years). A portion of that principal is returned to the grantor each year until the end of the term. The exact size of each annuity payment is based on a standardized formula, but basically the grantor is entitled to receive the full amount of the original principal amount plus interest that is based on the government’s interest rate, known as the “7520 rate.” By the end of the term, assuming you survive, the original principal (plus some interest) has been returned to the grantor. Any remaining amount in the trust passes to the grantor’s named beneficiaries free of estate tax or gift tax.

The GRAT’s magic comes from the ability to transfer wealth to beneficiaries free of tax by simply funding the trust with assets that outperform the 7520 rate. The 7520 rate is equal to roughly 120% of the yield on a 7 Year Treasury Note, so it typically comes out to somewhere in the 3%-5% range. Even the S&P 500 (not an ideal asset for a GRAT) historically earns ~10%/year and easily outperforms the 7520 rate by ~6%/year.

There are really only two ways for GRATs to fail to pass wealth to the grantor’s beneficiaries:

Need some help to understand if a GRAT is the right fit for you?

Let’s use Sam, 40 years old and a successful entrepreneur and investor who has accumulated $25 million of assets at this point in her life. Her investments comprise $20 million of stock in her own company plus $5 million of liquid assets and a home. Although she is young, Sam already has enough assets to exceed the lifetime gift tax exemption and wants to start planning to maximize how much wealth she can transfer to her children. So Sam has decided to use a GRAT.

Sam has decided to set up a 10-year GRAT. She is contributing a significant portion of her net worth: $15 million of her company’s stock.

Because Sam set up a 10-year trust, she will receive an allotment each year equal to $1.75 million (in cash or shares), or 10% of the original amount contributed to the trust, plus 3% 7520 rate. (That 3% is set by government regulation).

If Sam sold some of her shares, she would have the opportunity to reinvest those proceeds as she sees fit. But let’s assume for this example that she holds on to her start-up shares in the trust and decides to let them appreciate as she continues to grow her business.

The government expects the assets to grow to $17.5 million over ten years (at 3% annual growth), but with a successful exit of her business and savvy re-investing, the assets grow to $217.5 million! That extra $200 million remaining in the GRAT at the end of the term would transfer to Sam’s heirs free of gift tax. Given the applicable gift tax rate of 40%, the family would save $80 million in estate taxes.

Are there ways to further optimize a GRAT? Sam’s approach has the virtue of simplicity, but you can do better.

There are five key ways to improve on the basic GRAT to increase your final returns substantially:

With a zeroed-out GRAT, you can achieve 100% tax-free gifting by ensuring that the current (or present) value of the trust’s annual distributions over the trust’s term equals the total value of the property used to fund the trust. Since you (the grantor) receive distributions equal to what you contribute to the trust, the IRS expects the amount left for your beneficiaries to equal $0. Since the discounted value of the remainder of the GRAT assets is zero, according to the IRS’s formula, by funding the GRAT you won’t be deemed to use any portion of your lifetime gift tax exemption. Instead, any assets remaining in the GRAT after the final annuity payment will pass to your beneficiaries tax-free.

If this sounds complicated, don’t worry: We take care of all these calculations.

Estate planners call any GRAT where the annuity payments are perfectly calibrated to avoid this gift-tax issue a “zeroed-out GRAT.” In practice, virtually all GRATs these days are zeroed out. After all, many GRATs fail to pass on assets (often because the assets inside of them lose value during the GRAT term). If you fund a GRAT in a way that triggers a taxable gift, and then the GRAT fails to pass on assets, you will have wasted a portion of your valuable lifetime gift tax exemption amount!

As discussed above, GRATs are required to make annual distributions to the grantor. But rather than making equal annuity payments to yourself, you should backload the payments so that the annuity payments increase over time. By starting with a smaller payout in the first year and then growing the size of the annuity payments each year until the GRAT ends, you reach the same discounted payout, but you keep more assets in the trust for longer. The longer you can defer distributions to yourself, the more value you leave behind in the trust tax free to your heirs. The only rule is that the annuity payments can’t increase by more than 20% per year. So if the annuity payment in Year 1 is $500,000, the annuity payment in Year 2 can be no larger than $600,000.

Interested in setting up a GRAT?

Long-term GRATs, or GRATs set up for a long time, come with some risks, including the chance that one bad investment year may mean the GRAT’s returns may not keep up with the 7520 rate, or that you could pass away before the trust’s term ends.

The best practice to reduce those risks is to set up a series of zeroed-out, short-duration trusts every year and for the annual distributions from each trust to “roll” into one of those GRATs. In this “rolling GRAT” strategy, the grantor designates an initial GRAT for two years. The grantor receives two payments from that GRAT, one each year of the trust’s term. At the end of Year 1, the grantor uses that year’s distribution to fund a second, identical GRAT. The grantor now has two trusts operating with the same strategy.

In this way, you can replicate the dollar value of a long-term GRAT but with much less of the risk and more upside. If your trust investments have a bad year, you can just set up a new GRAT in less than two years and start the process over with a lower starting valuation and as a result a lower hurdle to pass on assets to your heirs tax free!

Some people own tons of individual stocks, like Nvidia, which make for excellent GRAT assets. But other people own index funds. While index funds can be GRAT assets, they are not ideal because they various holdings can generate different returns that cancel each other out. For example, some years the S&P 500 is flat even though hundreds of individual stocks outperformed the 7520 rate. Imagine if, instead of funding a single GRAT with shares in an S&P 500 index fund, you set up 500 individual GRATs, each with the fund’s component stocks. If you do the math, the second “indexed” approach generates much better returns. Historically, GRAT set-up was a manual process, so setting up 500 GRATs was not feasible. But with Valur’s automated platform, setting up 500 GRATs is as simple as setting up one.

In general, the shorter the GRAT term, the better, because shorter terms can isolate upside volatility from downside volatility. In the past, the IRS has approved two-year GRAT terms, but it has not approved shorter terms. So, for now, one-year GRATs are a no-go.

Fortunately, there’s a way to simulate a shorter term: swapping. The idea is that once the asset inside the GRAT has appreciated significantly, the grantor enters into a trade with the GRAT for an asset with equal fair market value owned by the grantor themselves.

To use a simple example, let’s say that you put $500,000 of Alphabet stock into a GRAT. At the end of Year 1, the stock has appreciated to such an extent that there’s still $500,000 left in the GRAT even after you’ve made the first annuity payment. But you’re worried that the stock might fall significantly in Year 2. So, rather than risking that happening, you swap the Alphabet stock out of the GRAT in return for $500,000 of a stable asset, like short-term Treasuries, that you own. Going forward, the $500,000 of Alphabet stock will be owned by you and the $500,000 of short-term Treasuries will be owned by the GRAT. This way, you will lock in the GRAT’s returns a year before the GRAT has terminated. While it’s possible that the Alphabet stock will appreciate further in Year 2, you can hedge against that risk by simply putting the swapped stock back into a new GRAT.

It’s incredible how quickly your focus can shift from providing for yourself and your family now to ensuring that you leave a legacy behind. GRATs are a powerful tool for transferring wealth to your beneficiaries free of transfer taxes—try out our calculator to see how these strategies can work for you. If you have more specific questions about GRATs, check out this article with all the answers you need! There are many estate planning tools available, each offering unique benefits depending on your goals. If you’re unsure which solution is best for you, try out our new Estate Tax Solution Comparison Calculator to find the ideal strategy tailored to your specific needs.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax