FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

❗ Key Takeaway: In our experience, one of the main concerns our clients have with CRTs — and especially the lifetime version—is that their money could be locked up for longer than they’d like, or that they’ll be stuck with the terms of the trust for longer than makes sense. In reality, though, Charitable Remainder Trust’s flexibility is more tolerant than you might think, because you can access significant liquidity–as much as 100% of the trust’s value 5 to 7 years–and you can always borrow against or sell your future trust income if you need even more.

In our experience, one of the main concerns our clients have with Charitable Remainder Trusts—and especially the lifetime version—is that their money could be locked up for longer than they’d like, or that they’ll be stuck with the terms of . In reality, though, CRUTs are more flexible than one might think.

It’s true, of course, that some amount of money is going to go to charity at the end of the trust term. And it’s true that there are some liquidity constraints, especially early in the term. That’s the point of a CRUT—you trade liquidity now for greater (and potentially significantly greater) returns in the future, which you’re happy to do if you’re planning for the future.

But also, critically, a CRUT is not truly a lifetime commitment.

This is because, while your trust is in operation, you will have several tools at your disposal to pull money out of the trust when you need it—and even to end the trust entirely.

Withdraw money according to the rules of the trust

First, you can do what most people do with a CRUT: Withdraw money according to the terms of the trust.

Borrow against or sell your future trust income

In the past, one of the biggest barriers to setting up a CRUT was that CRUTs are irrevocable. This is still true. But over the past few years, a market has developed for the income streams of CRUTs. The possibility of selling or borrowing against the income stream of a CRUT means that even though the trust is irrevocable, you are not necessarily stuck with a limited income stream for the rest of your life; you may be able to turn that income back into a lump sum.

A Charitable Remainder Trust’s flexibility is one of its main benefits. They allow your money to grow tax free for a long time. Ideally, then, you wouldn’t need to pull more out of your trust than necessary to meet your major cash needs—buying a house, building a college fund, and the like. After all, you want to take advantage of what one commentator has called “the most obvious secret in investing”: That even average returns for a very long time results in “extreme” performance.

Still, it’s always nice to know that you have liquidity options when you need them.

Want to know more about CRTs? Here’s an article on one type of Charitable Remainder Trust, CRATs. Evaluate the potential return on investment using our tax saving tool. And if you have any questions, contact us through our calendar.

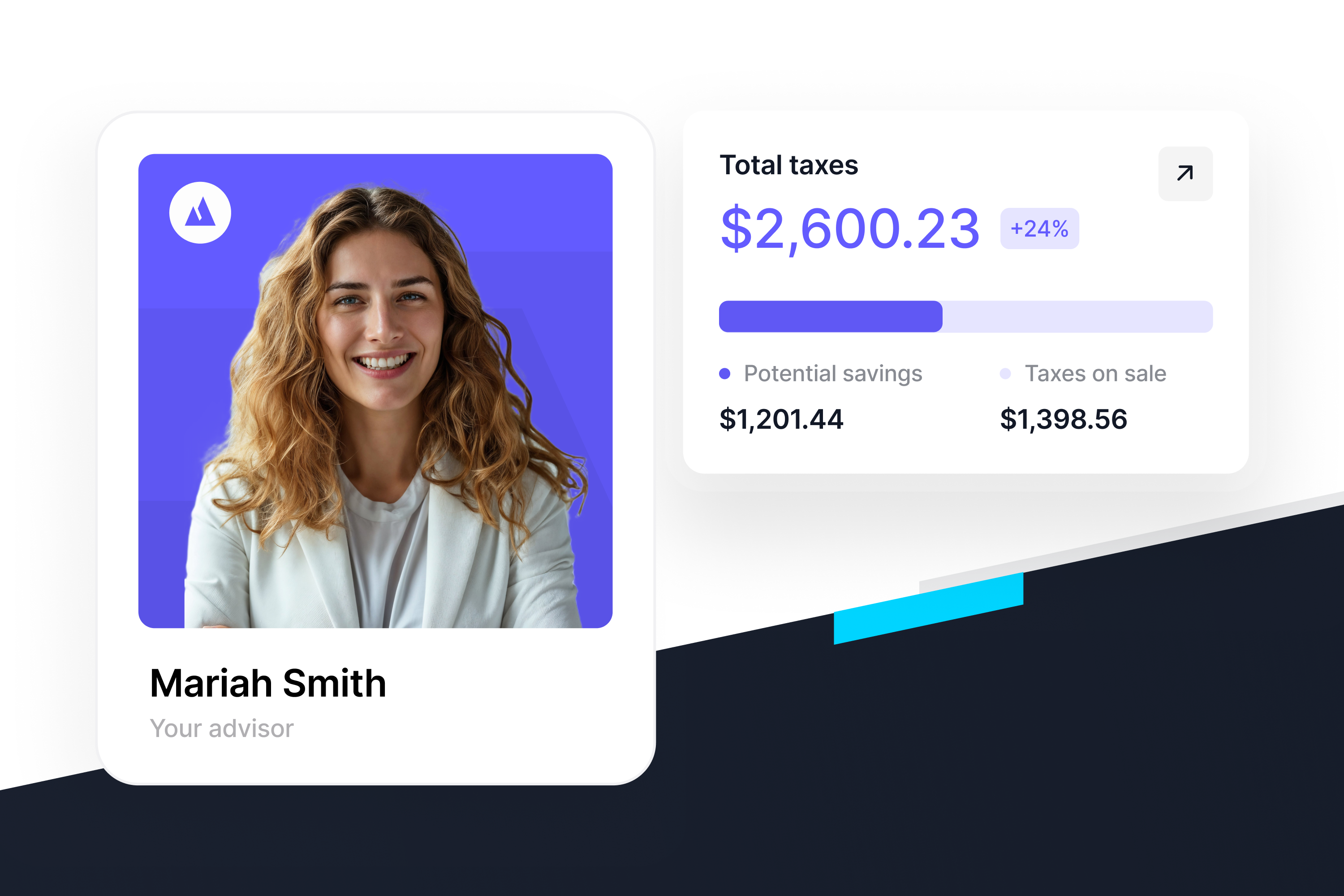

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!