Are you navigating the often-complex world of tax and estate planning and feeling lost in a sea of options? Maybe you know you should be thinking about these crucial aspects of your financial future – like safeguarding your hard-earned wealth or planning for your family’s security – but aren’t sure where to start or who you can truly trust to advise you well.

You’re not alone. Many founders who’ve poured their heart into building a successful company, employees receiving valuable stock options, savvy investors managing diverse portfolios, high-earning professionals focused on career growth, small business owners juggling personal and business finances, and high-net-worth families looking to preserve their legacy find themselves facing the same “cold start” problem. The sheer volume of information and the jargon-filled advice can feel overwhelming, leaving you unsure of the best path forward.

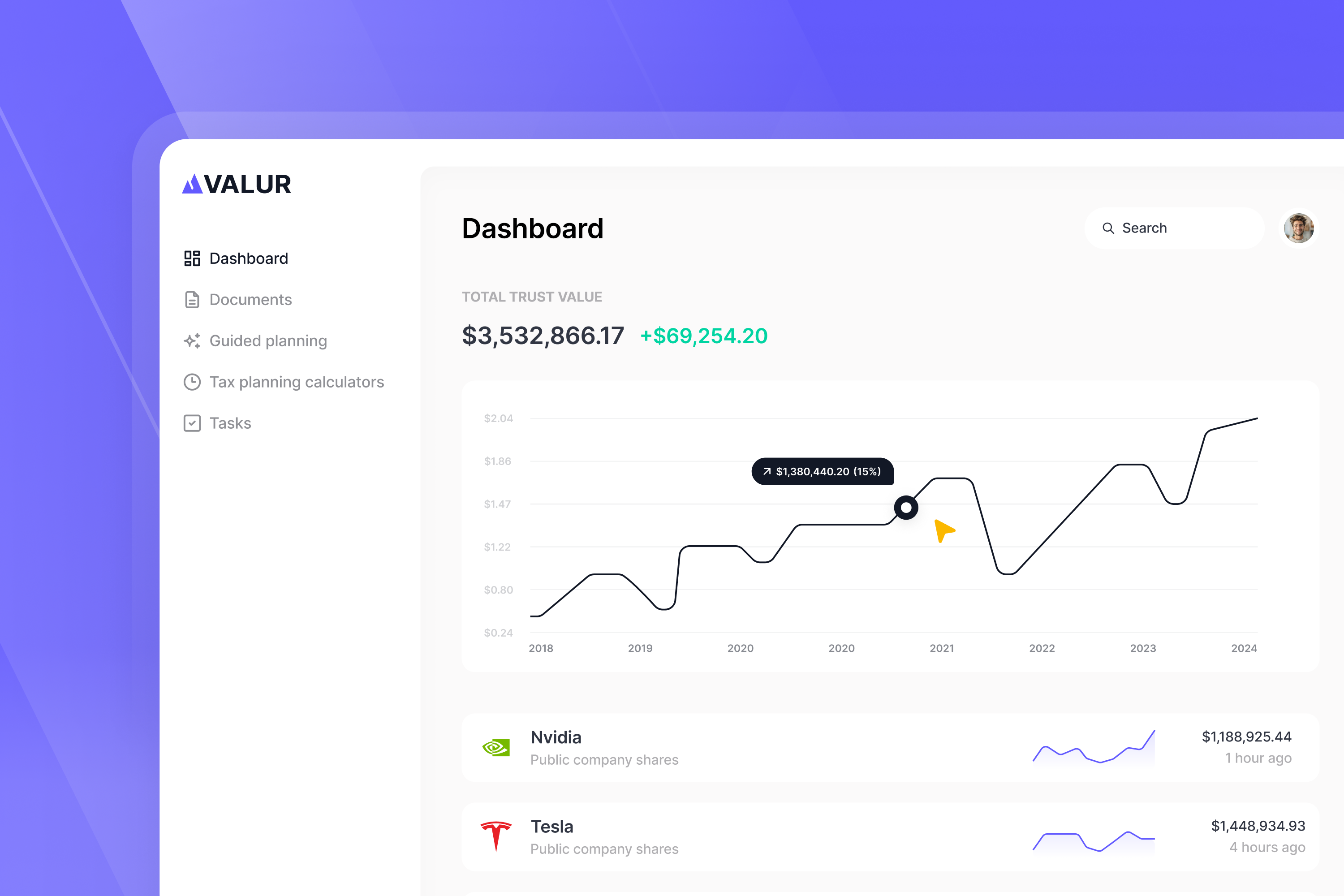

At Valur, we understand. We’re here to bring clarity and control to what can often feel like a daunting landscape. We’ve built a platform that puts expert advice and powerful tools right at your fingertips, simplifying the path to a more secure and tax-efficient financial future. Imagine being able to narrow down the daunting universe of available tax strategies – from complex trust structures to nuanced investment vehicles – to identify the ones that may actually work for your specific situation.

With Valur, you can do just that. We empower you to evaluate those strategies with sophisticated yet understandable tools, helping you find the ones with the largest potential returns and the best alignment with your long-term goals. Then, once you’ve made an informed decision, we’ll implement your chosen plan with efficiency and handle the ongoing management overhead – from intricate accounting and timely distributions to proactive compliance – so you can focus on what matters most: continuing to grow your wealth and enjoying the fruits of your labor.

The Valur Difference: Guidance, Evaluation, and Action

What truly sets Valur apart is our unwavering commitment to providing you with more than just surface-level advice. We empower you with the knowledge and the tools to deeply understand, rigorously evaluate, and confidently act on the best strategies tailored to your unique circumstances and aspirations.

- Your Trusted Advisor in One Place. Forget the headache of juggling multiple advisors – a CPA for taxes, an estate planning attorney, a financial advisor who may or may not specialize in advanced tax strategies. Valur serves as your central hub, integrating expert guidance across the spectrum of your financial planning needs. Whether you’re trying to navigate the complexities of capital gains after a successful exit, optimize your Qualified Small Business Stock (QSBS) benefits from your startup, or craft a strategic estate plan to protect your family’s future, we bring the specialized knowledge you need directly to you through our platform and our team of experienced professionals. You’ll have a single, coordinated point of access to the expertise required for comprehensive financial well-being.

- Evaluating Your Options, Empowered By Technology. Understanding that a Charitable Remainder Trust (CRUT) exists is different from knowing if it’s the right tool to protect your capital gains and generate the right amount of liquidity while also achieving your growth goals. Valur’s powerful platform allows you to move beyond simple definitions. Our “guided planning” tool – a sophisticated decision engine that intelligently analyzes your specific financial profile – and our deep comparison calculators enable you to quantitatively and qualitatively evaluate various strategies against each other. For example, you might compare the potential tax benefits and income streams of a CRUT versus a Donor-Advised Fund, or see how different Grantor Retained Annuity Trust durations could impact estate tax savings. Crucially, you can also see how these strategies stack up against the baseline of doing nothing, allowing you to make truly informed decisions based on projected outcomes and a clear understanding of the trade-offs.

- Efficiency Redefined. We recognize that your time is one of your most valuable assets. Traditional tax and estate planning can often feel like navigating a bureaucratic maze, filled with endless paperwork, slow communication, and drawn-out timelines that can span weeks or even months. Valur operates differently. We’ve meticulously streamlined every step of the process, leveraging technology to expedite everything from initial information gathering to document generation. In many cases, you can begin the planning process and see initial strategy recommendations in as little as a day, and we always move at your pace, respecting your schedule and priorities. No more frustration of waiting weeks for a lawyer to draft documents or coordinating multiple in-person meetings; Valur brings efficiency to the forefront of complex financial planning.

- Cost-Effective Solutions. The traditional model of charging hefty fees based on a percentage of your assets under management (AUM) can create misaligned incentives and result in significant costs over time, regardless of the complexity or activity of your plan. At Valur, we believe in transparent and fair pricing that prioritizes your best interests. We charge nothing for the initial setup of your chosen strategy – whether it’s establishing a trust or implementing a QSBS stacking plan. Our annual administration fees are fixed and clearly communicated, providing cost predictability and often resulting in substantial savings compared to the AUM-based models you might be accustomed to. This allows more of your wealth to keep working for your financial goals, rather than being eroded by opaque or percentage-based fees.

The Benefits of Working With Valur

Choosing Valur unlocks a comprehensive suite of benefits meticulously designed to provide you with greater control, enhanced efficiency, and profound peace of mind in managing your financial future:

- Streamlined Processes. Our tech-forward platform acts as your central command center for even the most intricate financial strategies. Imagine completing the initial information gathering for your estate plan from the comfort of your home in under an hour, guided by intuitive online tools rather than filling out stacks of paper. We’ve automated many of the traditionally cumbersome steps, from intelligently populating legal documents to securely facilitating account setup, freeing up your valuable time and minimizing the potential for errors.

- Clear Visibility. With Valur, you’re never left wondering about the status of your plans. Our platform provides a transparent, real-time view of your entire planning process and the ongoing status of your chosen strategies. You’ll have secure access to key documents, clear summaries of complex legal language, projected timelines for implementation, and performance updates for relevant strategies (like trusts) – all presented in an easy-to-understand format.

- Expert Support. While our platform is powerful and intuitive, we firmly believe in the importance of human expertise. Our team comprises experienced professionals with deep knowledge of tax optimization and seasoned financial planning experts who understand the nuances of wealth management. They are readily available to answer your questions, provide clarity on intricate topics, and ensure you feel confident and well-informed every step of the way.

- True Peace of Mind. Knowing that you have a well-structured, legally sound, and actively managed plan in place for your financial future provides invaluable peace of mind for you and your family. Valur helps you proactively address potential challenges – from minimizing future tax liabilities to ensuring the smooth transfer of your legacy – allowing you to focus on your passions and enjoy the present, secure in the knowledge that your financial affairs are in capable hands.

- Unparalleled Efficiency. We deeply understand that your time is a non-renewable resource. Our meticulously designed workflows and intelligent automation are engineered to get your personalized financial plans in place quickly and efficiently, without ever sacrificing thoroughness, accuracy, or legal soundness. What might take weeks of back-and-forth with traditional advisors can often be accomplished in days, if not hours, with Valur.

- Significant Cost Savings. Our transparent and predictable fixed fee structure for annual administration, coupled with the elimination of upfront setup fees, can translate into substantial cost savings over the long term compared to traditional percentage-based models. Imagine potentially saving tens or even hundreds of thousands of dollars in fees over the years, allowing more of your capital to work towards your financial objectives.

- Deep Understanding of Your Unique Needs. We recognize that financial planning is not a one-size-fits-all endeavor. Valur focuses on understanding the specific financial challenges and unique opportunities faced by individuals like you – whether you’re navigating the complexities of stock options and restricted stock units (RSUs) as a tech employee, optimizing your high-income compensation package as a successful executive, or strategically planning the transfer of significant wealth as a high-net-worth individual.

- A Modern, Tech-Forward Experience. No more cumbersome paperwork, endless in-person meetings, and opaque processes. Our platform is designed to be intuitive, user-friendly, and even surprisingly pleasant to navigate. We leverage cutting-edge technology to simplify complex financial topics, providing you with a seamless and secure online experience that is always accessible, complemented by readily available human support when you need it.

Addressing Your Key Financial Needs

At Valur, we focus our expertise on providing highly effective strategies to address the most significant personal tax and wealth transfer circumstances our clients typically encounter:

- Ordinary Income. This encompasses the income you earn from your day-to-day work and endeavors, including your annual salary as a software engineer, the vesting of Restricted Stock Units (RSUs) you receive as part of your compensation, your share of profits as a partner in a successful law firm, or the net earnings from your thriving small business. Because this type of income is often taxed at the highest rates, strategic planning is crucial. Read more >

- Capital Gains. These are the profits you realize when you sell appreciated assets. This could include the significant gains from selling publicly traded stock you’ve held for several years, the profit from selling your vested startup equity after a successful acquisition, the gains from trading cryptocurrency, the appreciation on real estate you’ve owned, or the proceeds from selling your small business. The tax rates on capital gains can be substantial, especially for short-term holdings. Read more >

- QSBS Stacking. For founders who’ve built a qualified small business, early employees who received stock options, and investors who’ve backed promising startups, Qualified Small Business Stock (QSBS) offers a potentially game-changing opportunity to exclude up to $10 million in capital gains tax upon the sale of those shares and, with proper planning, to multiply that exemption several times over, protecting $20 million, $30 million, or more from taxation. However, the rules surrounding QSBS eligibility and maximizing its benefits can be intricate. Valur provides in-depth guidance on QSBS “stacking” strategies. ****This involves leveraging sophisticated gifting techniques and strategically utilizing various trust structures to potentially multiply the individual $10 million exemption across multiple family members and over time. We help you understand the holding period requirements, ensure your business qualifies, and implement a comprehensive plan to potentially eliminate millions in capital gains tax when you eventually sell your QSBS. Read more >

- Estate Tax. This is a tax levied on the transfer of your assets to your heirs after your passing. While the federal estate tax exemption is currently high, it still impacts many high-net-worth individuals and families, and state estate taxes can have lower thresholds. Proactive and thoughtful estate planning is crucial to minimize this potential tax burden and ensure a smooth and efficient transfer of your wealth to the next generation according to your wishes. Our comprehensive estate tax planning strategies encompass the creation and expert management of various sophisticated trust structures, such as Grantor Retained Annuity Trusts (GRATs) to potentially transfer appreciating assets tax-free, Irrevocable Life Insurance Trusts (ILITs) to keep life insurance proceeds outside of your taxable estate, and Spousal Lifetime Access Trusts (SLATs) to reduce estate tax while providing for your family. We also guide you on strategic gifting strategies (for example, via Crummey Trusts) to reduce your taxable estate during your lifetime and help you understand the implications of valuation discounts for certain assets. Our goal is to develop an estate plan that aligns with your goals and minimizes potential estate and gift tax liabilities, ensuring your legacy is preserved and passed on efficiently. Read more >

Because we possess this deep and specialized expertise across these critical financial areas, Valur is uniquely positioned to create comprehensive, integrated, and highly effective financial plans tailored to the diverse and complex needs of all the individuals we serve – from ambitious founders and sophisticated investors to established professionals and multi-generational high-net-worth families.

Your Journey with Valur: A State-of-the-Art Approach

Working with Valur is about experiencing a modern, efficient, and empowering approach to managing your financial future, leveraging cutting-edge technology and expert human guidance at every step.

- Step 1: Discovering Your Optimal Strategies with Our Intelligent Guided Planner. Forget sifting through endless articles and generic advice. Our Guided Planner is a dynamic and highly interactive tool designed to delve into the specifics of your unique financial situation, your most important goals, and your individual risk tolerance. Imagine logging into your secure Valur account and being guided through a series of thoughtful, yet straightforward, questions about your age, where you live (as state tax laws vary significantly), your current net worth and annual income, your family status and any specific needs, your primary planning aims (e.g., minimizing taxes, preserving wealth, charitable giving), as well as a few tailored questions about your individual assets and earnings (e.g., do you own stock options? Do you have significant capital gains?). This sophisticated decision engine intelligently analyzes your responses using complex algorithms and our deep understanding of a wide range of financial scenarios to identify a curated set of potentially valuable tax and estate planning strategies that are truly tailored to your specific circumstances.

- Step 2: Evaluating Your Choices with Unparalleled Clarity Through Our Calculators. Once the Guided Planner intelligently highlights the most promising strategies for your consideration, our suite of powerful and intuitive calculators takes center stage, empowering you to make truly informed decisions. Our comparison calculators allow you to conduct a side-by-side analysis of the potential impact of different strategies on your specific financial situation. You’ll see clear, easy-to-understand charts and graphs comparing the projected growth of your assets under various strategies, the estimated tax savings in real dollar amounts over different time horizons, and a “break-even” analysis to understand the point at which a strategy’s benefits outweigh its costs. Our individual strategy calculators provide an even deeper and more granular dive into the mechanics and potential benefits of each specific strategy. You can often adjust key variables – such as the duration of a trust or the assumed rate of return – and see the immediate and long-term effects on your potential tax savings and wealth transfer. This level of detailed quantitative analysis, combined with clear and concise qualitative explanations of the underlying principles and potential risks, ensures that you are making decisions based on robust data and a thorough understanding. This level of analytical rigor and transparency is often a significant advantage compared to traditional advisory settings where the financial modeling may be less transparent or accessible.

- Step 3: Human in the Loop. While our technology provides unparalleled analytical power and efficiency, we firmly believe in the critical role of human expertise and personalized guidance. Following your initial exploration with the Guided Planner and calculators, you’ll have the valuable option to meet with our team of experienced professionals for a personalized consultation. This isn’t about a sales pitch – Valur is growing quickly because we know the most and we share our knowledge, not because we’re pushing any particular strategy. Accordingly, this is an opportunity to have your specific questions answered, walk through the available strategies in as much depth as you want, and receive tailored insights based on your unique circumstances and goals. Our experts will provide you with the clarity and confidence you need to make well-informed decisions about how to move forward with your financial plan.

- Step 4: Implementing Your Plan with Unprecedented Ease and Efficiency. Once you’ve confidently chosen the strategies that best align with your objectives in consultation with our team, Valur’s cutting-edge platform takes center stage to streamline the often-cumbersome implementation process. In the traditional world of tax and estate planning, this crucial step often involves hiring a lawyer, which can mean significant fixed or hourly fees, as well as weeks or even months of waiting for the human on the other end to draft complex legal documents and guide you through the often-confusing finalization process. With Valur, this step is remarkably efficient and transparent. You’ll securely provide us with the necessary information online through our streamlined and user-friendly onboarding process. We’ll ensure you have the comprehensive background information you need to confidently decide on the specific features of your chosen strategy. Then, our platform rapidly generates your initial draft documents – always in less than 24 hours, and often in as little as one or two. Crucially, we also provide clear, annotated documents that explain each key clause in plain, understandable language, so you know exactly what you’re agreeing to. We facilitate secure online notarization in most states, saving you the significant time and inconvenience of scheduling and attending in-person appointments. We also seamlessly handle the often-tedious process of opening any required financial accounts and efficiently coordinate the transfer of your assets – all behind the scenes, automated, and with minimal effort required from your end. Most importantly, you can have confidence that the complex details are being handled accurately and efficiently, without you having to become an expert yourself, so you can focus on what matters: continuing to grow – and enjoy – your wealth.

- Step 5: Ongoing Management and Proactive Optimization for Long-Term Success. Our commitment to your financial well-being extends far beyond the initial setup of your plan. For sophisticated strategies like certain capital gain and estate tax trusts, our platform provides comprehensive ongoing administration and accounting services, ensuring compliance with all relevant regulations and simplifying the often-complex management responsibilities. But we go beyond mere administration. We proactively monitor your financial situation and the evolving tax landscape, looking for opportunities to optimize your strategies over time to ensure they continue to align with your changing needs and goals. This might include implementing strategies like adjusting distribution rates from a Charitable Remainder Trust (CRUT) to balance your income needs with your growth objectives, or strategically utilizing Grantor Retained Annuity Trust (GRAT) swap powers to potentially enhance wealth transfer efficiency as market conditions change. Even for non-trust strategies, we ensure you have the necessary accounting documentation and facilitate ongoing tracking of your projects to ensure they remain on track and deliver the intended benefits. This proactive and continuous management is a key element of the value Valur provides, ensuring your financial plan remains effective, efficient, and aligned with your evolving needs and the ever-changing financial landscape for the long term.

Experience the Valur Advantage: A Tech-Forward Approach

Our unwavering commitment to providing you with a seamless and efficient experience is powerfully enabled by our user-friendly, cutting-edge, tech-forward platform. We firmly believe that sophisticated financial planning doesn’t have to feel complicated, intimidating, or inaccessible. Our platform is meticulously designed to be clear, intuitive, and provide you with the vital information you need, precisely when you need it, all within a secure and user-friendly online environment.

Take the First Step Towards Financial Clarity

Ready to take decisive control of your financial future and experience the Valur difference firsthand? Schedule a complimentary call with our dedicated team of experts today. We’ll take the time to thoroughly understand your unique financial situation, listen attentively to your specific goals, and walk you through the personalized strategies that could make a significant and positive difference for you and your family’s long-term financial well-being. Don’t let the complexities of tax and estate planning continue to feel like an insurmountable barrier. Discover the clarity, the control, and the potential for significant savings that Valur can offer you. Your journey towards a more secure and tax-efficient financial future starts now.

About Valur

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!