FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

When it comes to estate planning, one of the most important decisions you will make is what to do with your money and assets after you die. One option for preserving your wealth is setting up a trust fund. But what is a trust? How does it work? And what are the benefits? In this article, we will answer your questions about trusts!

A trust fund (or simply a “trust”) is a legal arrangement that allows a third party, known as a trustee, to manage assets on behalf of a beneficiary or multiple beneficiaries. Trusts can be set up to protect and grow assets, minimize taxes, and provide funds for future generations. Trusts are extremely flexible, and the funds in a trust can be used for things like education, healthcare, housing, or investment. Trusts are an essential tool in estate planning and can ensure that the beneficiary’s financial needs are well taken care of.

Trusts are essential for estate planning because they provide a secure way to transfer assets to beneficiaries without the burden of probate. Trusts can also help to minimize taxes, protect assets from creditors, and provide financial security for future generations. Additionally, trusts can be customized to meet the beneficiary’s specific needs, making them an ideal choice for those who want to ensure their money is used for the intended purpose.

There are generally at least three parties required to set up a trust:

In order to understand what makes trusts so unique, it is important to define two key terms: “legal ownership” and “beneficial ownership.”

Legal ownership is the right to dispose of property. For example, if I own a house outright, that means I can sell it whenever I want to sell it. It also means I can paint the house or put decorate it however I desire.

Beneficial ownership is the right to enjoy the benefits of the property. So, for instance, the beneficial ownership of a house is the right to use the house.

While in most contexts, the same person has both legal ownership and beneficial ownership, trusts divide these two forms of ownership: the trustee becomes the legal owner while the beneficiary becomes the beneficial owner. (In some cases, the trustee and the beneficiary are the same person, but that’s often not the case.) This formal division of ownership ends up being very important, and useful, in certain situations. It’s the key to understanding why some trusts are able to protect assets from creditors.

Here are some common types of trusts:

There are tons of different variations of these. So we covered an extensive list of all types of trusts in our trust 101 guide.

A trust fund baby is someone whose family saved up money or assets in a trust fund with the purpose of providing for him or her in the future. The term often has a negative connotation, implying that the trust beneficiary is spoiled, but there are ways to set up a trust to prevent a child from becoming the dreaded trust fund baby.

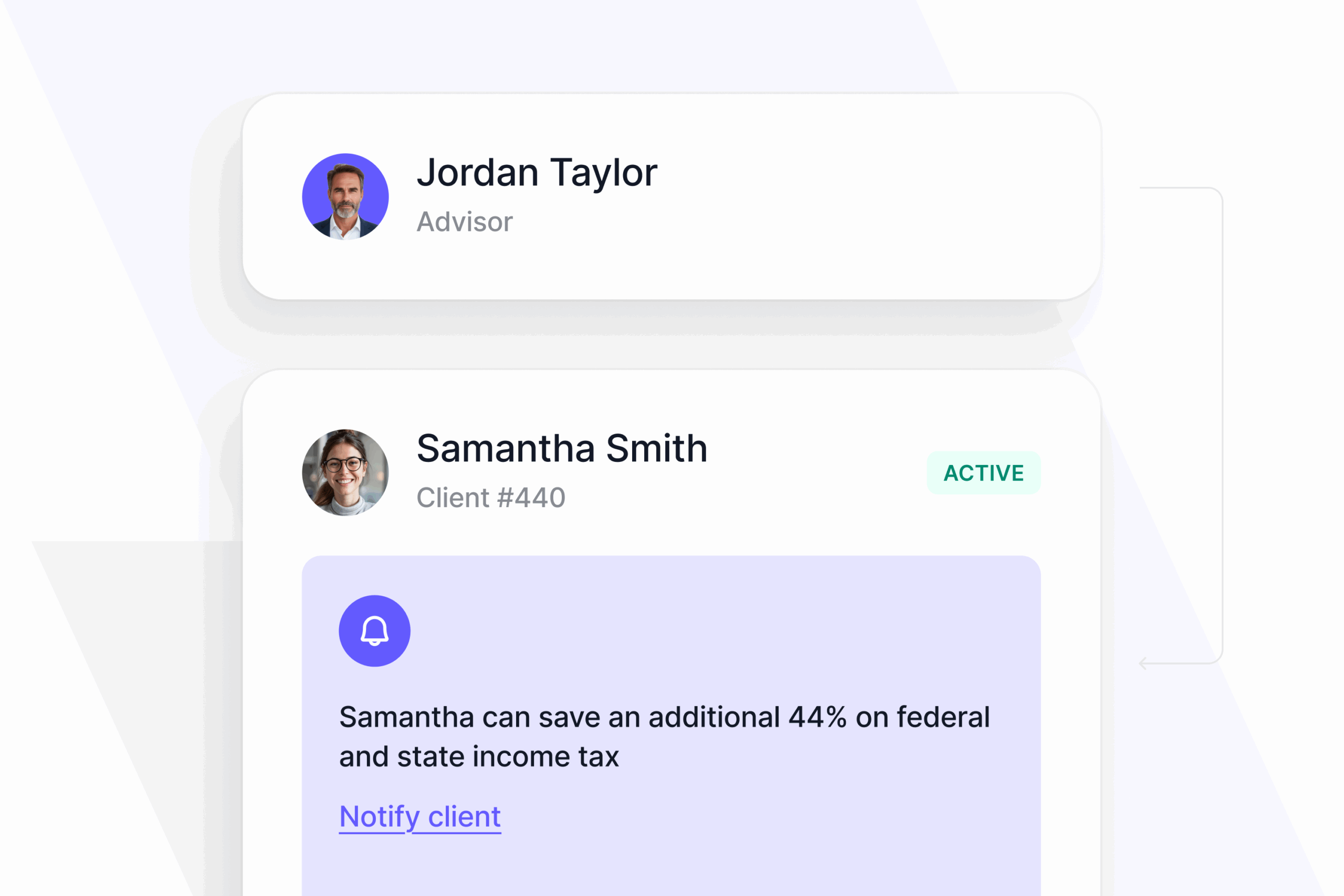

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!