FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

In today’s world, financial advisors are being pushed to offer more than investment advice: tax optimization is becoming increasingly important to winning over — and retaining — clients.

But taxes are complicated. How can you find the optimal strategies to help your clients pay less in taxes? And, once you find an appropriate strategy, how can you explain it to the client and implement it quickly and inexpensively?

That’s where Valur comes in. We are a VC-backed fintech company that has helped hundreds of clients save over $1 billion of wealth since our launch in 2021. We provide tools and educational content to help advisors and their clients understand, analyze, and select the best tax-planning strategies. We also allow you to implement these strategies directly on our platform.

Other companies generate basic estate planning documents (like revocable trusts and health care directives) and help advisors visualize estate planning structures. Valur is different.

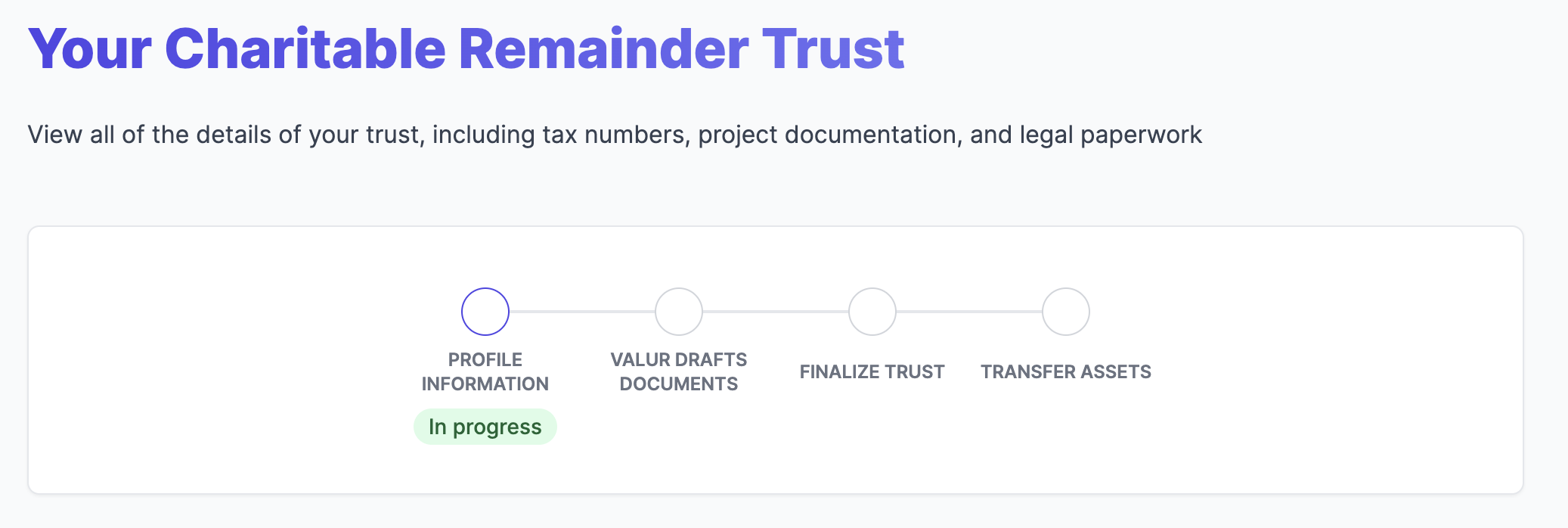

We provide free, on-demand software to help everyone understand the best-practice solutions for each tax situation and analyze the ROI. But we don’t stop with education and analysis. We allow you and your clients to create trust documents in real time, and optimize the administration of the tax structures you put in place, all without needing to hire attorneys and accountants.

Valur can help address capital gains tax, ordinary income tax, and estate and gift tax. Our products include intentionally defective grantor trusts, charitable remainder trusts, grantor retained annuity trusts, non-grantor trusts, spousal lifetime access trusts, Crummey trusts, and irrevocable life insurance trusts. We also have marketplaces for solar energy tax credits and oil and gas investments.

We don’t charge anything for our educational content, analysis, or trust generation. Instead, we charge for ongoing administration of structures that we — or outside attorneys — helped your clients set up. Our streamlined processes allow us to provide our services at a fraction of the cost of traditional trust companies.

Need some help to understand how we can help?

We’ll be as involved, or uninvolved, in this process as you’d like. Maybe you want to drive each stage of the conversation and work with Valur on the backend. Or maybe you prefer to have a partner like Valur take care of everything so that you can focus on other things. Our attorneys can even join your client calls if you want!

Regardless, here are the five basic ways we work with advisors:

Through our Guided Planner, we aim to help you understand each situation and present the tax-planning options that may be a fit.

We’ll take your client’s inputs — where they live, what assets they are planning for, their family situation, and liquidity needs, among others — and explain the potential solutions through our Customizable Calculators.

We’ll implement your client’s chosen strategy faster than traditional trust lawyers and trust companies — at no cost. We’ll do the necessary payout calculations, draft the trust agreement, and formalize it (including notarization). Then we’ll go a step further, facilitating custodian onboarding and asset transfer.

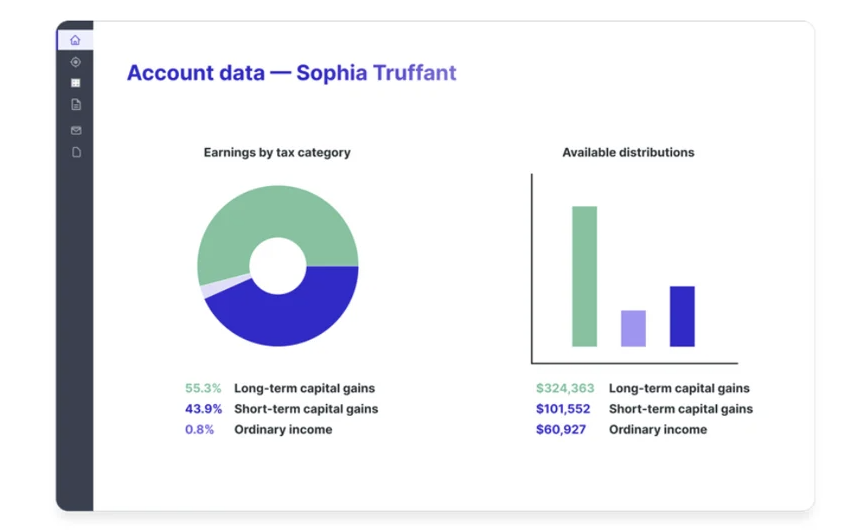

We are a resource to help you optimize the trust investments by helping you understand the trust accounting principles and their implications for your chosen investment strategy. We also help you identify and capitalize on tax-planning opportunities as they arise.

We play the role of a (better, more efficient, less expensive) trust company here, taking care of ongoing customer needs, including trust administration, accounting, and filings. We also provide any personal tax return documents (like K-1s) required directly to your client, or to you if that’s what you prefer.

As you can see, it’s entirely up to you on how closely you work with Valur to serve your clients. But there’s one constant: Our goals are aligned with yours, in that we’re always aiming to make your client happy so they’ll stick around for the long haul.

We invite you to explore our website if you haven’t already. The calculators, content, Guided Planner, and other features are free. We’d also love to speak with you and answer any questions you may have.

If interested, let’s schedule a call to share more of how we can work together. We’re excited to save your clients many millions of dollars!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Advisors