FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

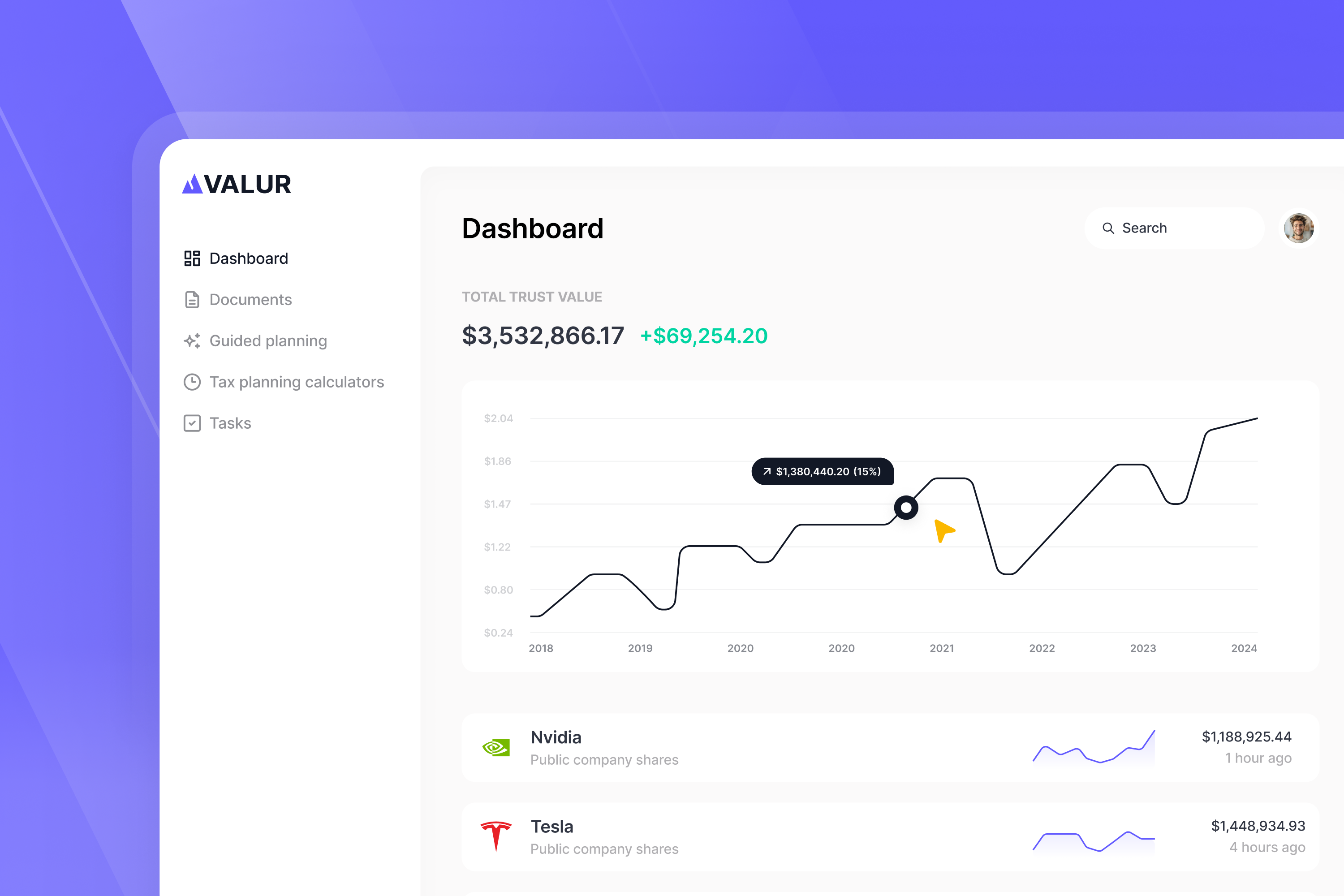

Simply put, Valur takes the tax-mitigation and asset-protection tools of the ultra-rich and makes them accessible to everyone.

With a tax code that is thousands of pages long and growing at a rate of 130,000+ words a year, the United States has the most complex tax system in the world. That complexity is detrimental to most Americans (because it makes it hard for them to get the most out of the tax code) and beneficial for people who have the money to hire full-time tax professionals. Valur is striving to fix this imbalance.

We believe that the tools necessary to grow your assets more efficiently should be simple, inexpensive, and available to everyone. That is why we are using technology to streamline the solutions used by the top 0.01% and to make these solutions affordable for a much larger group of Americans. For example, thanks to Valur, you no longer need fancy lawyers or a private family office to do things like set up a trust in a no-tax state, benefit from tax-advantaged investment opportunities like renewable energy credits or oil and gas wells, or use trusts to sell assets while deferring the capital gains tax.

So you can minimize your tax burden and efficiently grow your wealth.

Valur has many products available and we’re adding more all the time. Several of our products make use of trusts in South Dakota. These South Dakota trusts allow our clients to: (a) mitigate their tax burdens and (b) add a layer of asset protection. The specific product that is right for you will depend on many factors, including your geographical location and your financial goals. Please contact us at help@valur.io to learn more.

Many people hear about Valur and think, “That sounds too good to be true. What’s the catch?”

Our high-level answer is that those people have a point; there is no such thing as a free lunch, and you often have to give something up in order to get something in return. However, Valur is here to help you make sure that what you get in return will be more valuable than what you have to give up.

Our more specific answer to that question is: it depends. What you have to give up varies based on what state you reside in and what you are trying to accomplish, so there is no “one-size-fits-all” answer. Some people may be able to create a trust in South Dakota without giving up anything other than having to pay a small annual fee. Some people may need to give up direct control of certain assets (while retaining a sufficient amount of “indirect control” to feel comfortable). It really depends on the specifics of your situation. Valur tries to get out of your way as much as possible. To the extent there are any catches, they are imposed by the tax code, not us!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Explainer