FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

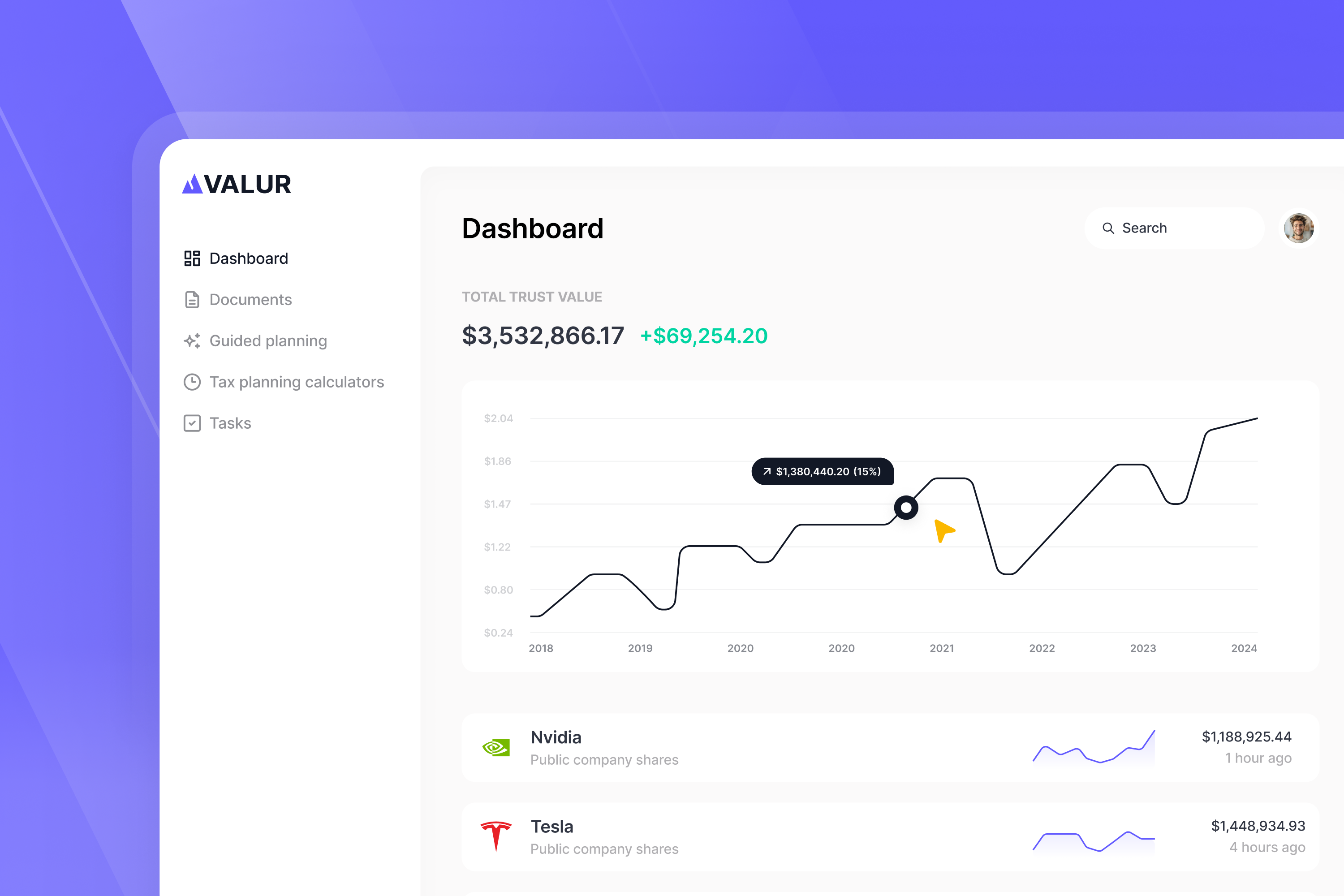

Valur’s goal is to make sophisticated tax planning accessible to everyone by simplifying the creation and administration of tax planning structures. Potential customers often ask us what this means we do, so we thought we would outline our key contributions and the value you get for paying us! We’ve done that below, starting with the simplest tasks we handle and proceeding to the most complex.

Tl;dr | Valur brings the entire services stack in house: We provide education to help you choose a structure, we generate your legal documents, we offer financial management, and, critically, we handle trust administration.

The first thing Valur offers, and the way most people initially interact with us, is a deep set of materials to help you understand tax mitigation and our tax-advantaged strategies. Valur digs into the basics of trusts, how Valur works, and the advantages and drawbacks of the specific tools we offer. Our team has also developed models and calculators to help you estimate the tax savings and return on investment associated with each structure.

In addition to those education materials, one of the most critical things Valur does is to collaborate with our professional service partners to identify best practices for our customers’ most common use cases, with the goal of optimizing your returns. One surprising thing we have learned is that lawyers and accountants — even those who have been at this for decades — don’t often see the whole playing field. This could be because best practices change over time, or because each individual service provider only sees a handful of cases every year. Whatever the reason, we find that we are in a better position to present you with the best options for you and to show you how to capitalize on them..

Now that you’ve decided on a charitable trust and even picked a structure, how does Valur make trust setup simple and easy? We’ve spent thousands of hours testing and designing our proprietary onboarding system to collect the necessary information and automatically generate the trust for you. It’s as simple as creating an account and spending 30 minutes or less to answer all of the essential questions and then our software generates your trust!

Next up is getting your document notarized, as required by the IRS. This used to be a tedious process that would require you to schedule a time and travel to your lawyer’s office for an in-person meeting. Not with Valur. We’ve optimized this part of the experience, too, by partnering with one of the largest on demand notary services in the United States to process signatures in 15 minutes or so.

All in all, that’s just an hour of your time to set up the trust and have it finalized.

Even after you’ve decided to set up a trust, we’re just getting started. Setting up a trust involves a lot of moving parts. The key things Valur handles are:

Once your trust is established and funded and you’ve diversified your holdings, this is where our most complex work begins: managing the ongoing administrative requirements to ensure that you are able to withdraw funds when you need them, handling the annual state and federal filings to maintain your trust’s legal status, ensuring that the trust follows the required rules, and managing the trust’s accounting.

That last task — the accounting — is more complex than you would expect. In particular, there are several accounting tasks that can trip up many people who try to run a charitable trust themselves.

First comes the task of calculating your quarterly and annual distributions. The complexity varies depending on which charitable trust structure you choose, but it’ll definitely involve tracking your cost basis, annual unrealized gains and losses (current and prior years), tax loss harvesting transactions, and prior year payout deficits. Our software takes care of the heavy lifting, and we have human-led processes in place to make sure we’re serving you optimally.

Second is the annual valuation of assets, which determines the distributions that you’re able to take each year. Each asset is unique and requires a different valuation methodology. We’ve vetted various third-party accounting firms that are equipped to prepare a valuation when your trust needs it. This can take between 2 and 6 weeks, but we’ll handle the back-and-forth.

Third, we determine the tax character of the money being paid to you ever year. Charitable trust distributions are subject to a four-tier accounting system. You can read our full-length article to learn more about how the system works, but, in short, this requires that your trust administrator pay out the earnings subject to the highest tax rate first. We work with you to define your goals and design an investment strategy that meets your aims while complying with the trust’s rules.

The fourth — and most time consuming — accounting task is to maintain accurate ledgers of the trust’s balance sheet each year. Simply put, everything that happens inside your trust — losses, gains, dividends, buybacks, and more — can affect your future payouts and can require annual tax filings. This system demands accurate tracking and categorizing of all dollars moving in and out of your trust. You don’t have to be a CPA to get the basics, but an understanding of accounting principles, IRS requirements, and charitable trust accounting is essential.

What’s next now that you’ve learned about trusts, set up your account, figured out your investment strategy, and taken distributions? Taxes. Taxes come up in two ways: Each year, the trust will be required to file a variety of tax forms for itself (even though it’s tax exempt), and you’ll need information about your distributions for your own tax returns. We handle everything here. We’ll put together an annual tax packet for your signature, plus a Form K-1 to file with your personal income taxes. We can even work directly with your personal accountant to remove yet another task from your plate.

Managing a charitable trust is a complex endeavor, and we aim to make it seamless. That’s why our customers (from billion-dollar companies to financial advisors to founders and employees) partner with Valur. We make this our full-time job so that you don’t have to!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Advisors