FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

An inheritance tax is a tax on a beneficiary’s receipt of assets from a deceased person. This article explores how inheritance taxes work generally.

An inheritance tax is a tax on a beneficiary’s receipt of assets from a deceased person. The beneficiary pays the tax as a percentage of the assets inherited. Rates generally vary based on the relationship between the estate owner and the beneficiary.

When a person dies, their assets are distributed according to the terms of their will or revocable trust, or if they did not have a will or revocable trust, according to the state’s laws. Depending on the value of the assets and the beneficiary’s relationship to the deceased, these gifts may be subject to inheritance tax.

There is no federal inheritance tax, but some states have their own inheritance taxes. However, even in states with an inheritance tax, spouses and, in most cases, children are exempt. Often, specific types of assets are exempt from inheritance tax as well.

The five states that impose an inheritance tax are:

Need some help to understand the most convenient tax planning structure to reduce your taxes? Our team of tax-planning experts can help!

Since Texas is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero). As a result, you won’t owe Texas inheritance taxes.

An inheritance tax and an estate tax are similar in the sense that both are taxes on the transfer of assets to a deceased person’s heirs. But they work differently. An estate tax is imposed on the estate of the deceased person, and it is calculated on the total value of the assets when they are passed on. In contrast, an inheritance tax is imposed on the beneficiaries themselves, based on their receipt of the assets. There is a federal estate tax, but no federal inheritance tax. Only five states impose an inheritance tax, but 12 states and the District of Columbia impose an estate tax.

The inheritance tax can be a significant burden for beneficiaries. It is essential to understand if it applies to you, how it works, and the different strategies that can be used to reduce or avoid it. By understanding the differences between inheritance tax and estate tax, as well as the specific rules, individuals can plan to minimize the amount of taxes their beneficiaries will have to pay.

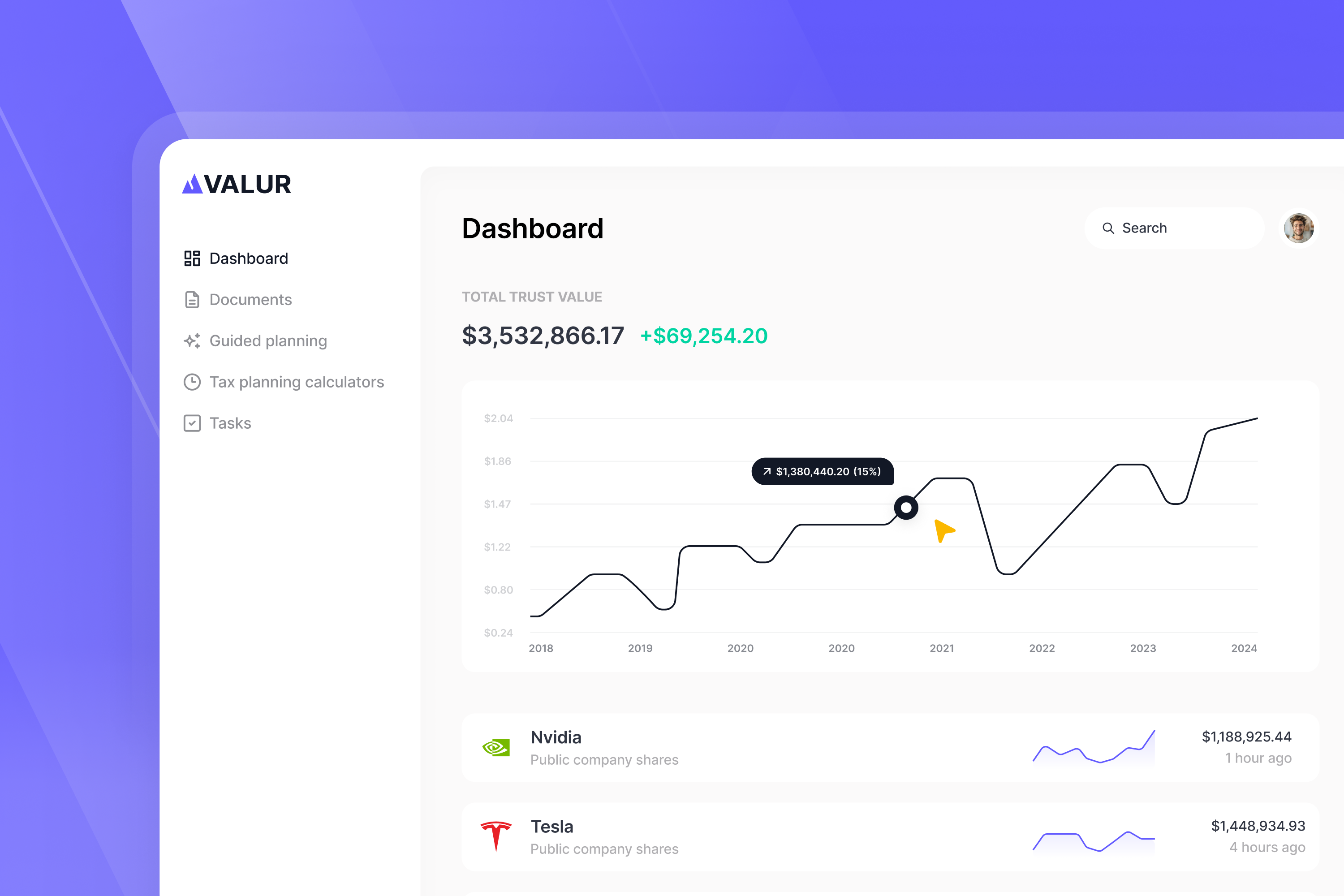

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!