FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

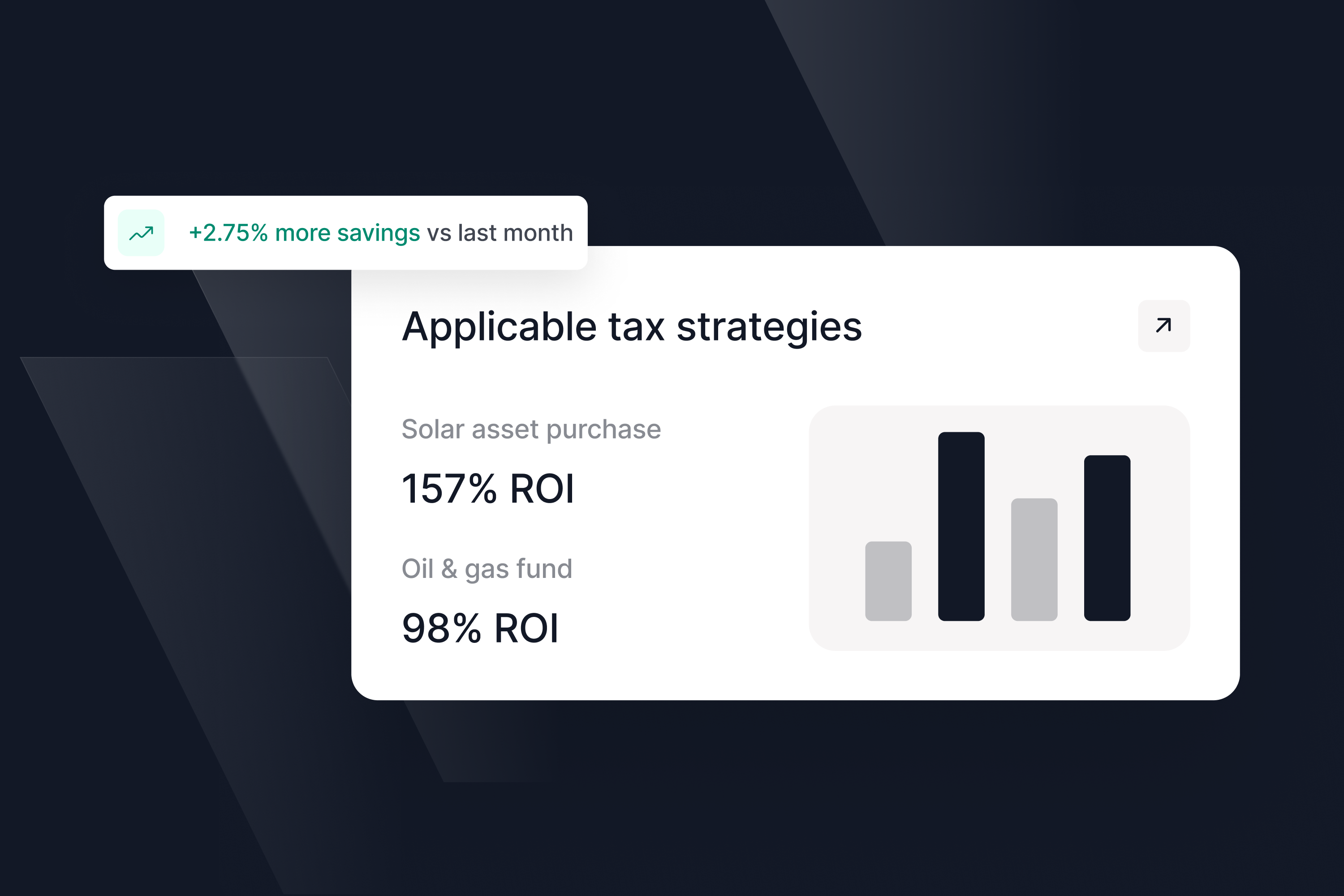

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A transcript is a document that the IRS produces that shows all the tax information for a particular tax year, including income adjustments, credits, and deductions. It can be helpful proof of your tax filing status and verification of your income.

There are five types of tax transcripts that you can request from the IRS:

– Tax Return Transcript: This is a document of the tax information filed with the IRS. It includes all data from the tax return, including income, adjustments to income, credits, and deductions.

– Tax Account Transcript: This is a transcript of the tax account information for the tax year. It includes all information about payments, balances, and any tax liens or levies placed on the account.

– Wage and Income Transcript: This is a transcript of all W2s and 1099s reported to the IRS for the tax year. It includes all information about wages, salaries, tips, pensions, and other types of income.

– Record of Account Transcript: This is a document of the tax account information for the tax year and any changes made to the account since you filed the tax return.

– Verification of Non-filing Letter: This is a letter from the IRS verifying that you did not file a tax return for the year.

You can either go online or call the IRS to request your transcript.

Online: You can order this type of document using the IRS Get Transcript tool. You will need to create an account on the IRS website and provide some basic information. Once you have made your account, you can order tax transcripts for the current and past three tax years.

Call: You can also order these tax documents by calling the IRS at 1-800-908-9946. You will need to provide basic information, including your Social Security number, date of birth, and address.

We built a platform to give everyone access to the tax and wealth building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard to access tax advantaged structures so you can build your wealth more efficiently at less than half the cos of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.