FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

All high-net-worth Americans have a serious estate-tax problem. But “fund principals” — that is, partners in venture capital funds, private equity funds, hedge funds, or any other funds with GP/LP structures — have to contend with unique estate-tax rules that basically only apply to them. This article explains how those rules work and how to address the challenges they pose.

For high-net-worth individuals, minimizing estate tax is extremely important. The federal estate tax rate is currently 40% on assets in excess of the exemption amount. In 2026, that exemption is $15 million per person, indexed for inflation.

In New York, which actually has lower estate tax rates than some other jurisdictions, the estate of a person who dies with a $100 million net worth and hasn’t done any tax planning will owe about $45 million of estate tax within nine months of the person’s death. Imagine spending decades of your life working long hours in the office and fine-tuning your investment portfolio in your spare time, with the aim of building generational wealth for your children and grandchildren, only for 40% or more to disappear when you die.

In fact, it gets worse: There’s a second layer of federal estate tax — called the generation-skipping transfer tax — that applies to transfers to your grandchildren. It is levied at a rate of 40%, which means transfers to your grandchildren could be subject to an effective tax rate of 64%, even if you live in a low-tax state like Florida.

Critically, once you gift assets outside of your estate (usually to a trust for the benefit of future generations), all the post-gift appreciation happens outside of your estate. As a result, that appreciation passes to your descendants free of gift or estate tax. That’s why it’s important to gift assets at their lowest valuation, to minimize how much of your gift tax exemption you use and maximize the appreciation that happens outside of your estate. Fortunately, fund interests are perfect for this.

In general, the best assets to gift to an irrevocable trust are those assets that are likely to appreciate substantially. Often, a fund principal’s interests in his or her fund meet that description. If fund interests are gifted early in a fund’s existence, before they’re worth much, the donor won’t use much lifetime gift-tax exemption transferring them, and their appreciation will occur outside of the donor’s estate for estate-tax purposes. The catch is that the transfers have to be structured to comply with the specific rules that apply to transfers of these sorts of assets.

There are actually two unique problems that arise when someone wants to gift (or sell) an interest in a fund. The first problem is vesting — in order for fund interests to be effectively transferred, they must be vested. But fund interests are often structured to vest over a period of years, not all at once. If someone attempts to transfer unvested interests, the IRS may argue that the transfer was ineffective. This vesting issue can be avoided by simply transferring only vested interests.

The second problem is Section 2701 of the Internal Revenue Code. Section 2701 is focused on situations where “junior interests” (like carried interests) are transferred to younger members of a donor’s family (or trusts for their benefit) while the donor (or other older family members) retain the “senior interests” in the fund (the interest in the management fee). When a donor has a mix of junior and senior interests in a fund, and he or she transfers those junior interests to his or her children (or grandchildren) without transferring a proportionate amount of senior interests, the IRS deems both the junior interests and the senior interests to have been transferred for tax purposes. For the unwary taxpayer, this can be a huge trap: A donor might think they’re transferring a $4 million fund interest (just the carry) when they’re really (according to the IRS) transferring an $8 million fund interest (the carried interest plus the management fund interest)!!!

The funny part is that Congress wasn’t targeting GPs when it enacted the legislation creating Section 2701. Lawmakers were trying to shut down a tax-avoidance game that taxpayers (who for the most part weren’t GPs) were playing in the 1980s.

Here’s how the strategy worked: People would set up investment companies with two classes of interests: senior interests and junior interests. The senior interest holders (generally parents or grandparents) had various special privileges, like put rights, call rights, and liquidation rights. The junior interest holders didn’t have any of those privileges, but they’d receive the upside if the company performed well. On paper, the senior interests were much more valuable than the junior interests, which only really had value if the senior interest holders failed to exercise their special privileges. Accordingly, appraisers would value the junior interests at a fraction of the value of the senior interests. The parents or grandparents would transfer these junior interests at a low valuation to trusts for their children or grandchildren.

But, in practice, the senior interest holders wouldn’t exercise their rights, allowing the company’s residual value to primarily pass to the junior interest holders without the senior interest holders having to use any additional gift-tax exemption. It was something of a sham, but none of the tax code’s existing provisions explicitly forbade it.

In order to address this problem, Section 2701 says that in any situation where there are relatively junior and senior classes of interests, and the donor is transferring a higher percentage of junior interests than senior interests, the donor will be deemed to have also transferred the senior interests. This shuts down the strategy described above, but it also causes headaches for taxpayers who just want to transfer fund interests to future generations.

Section 2701 doesn’t apply to funds that contain only a single class of interests, or that have multiple classes none of which are more junior than the others. But most investment funds have a junior/senior interest structure. In that case, there are two ways to address Section 2701.

Take Joe, a VC fund principal. Joe just started a new fund. He has a carried interest and a management fee interest. Neither is worth very much for the time being, but Joe expects the fund to appreciate considerably over time. Joe wants to save his children as much estate tax as possible, so he decides to gift half of his carried interest and half of his management fee interest to trusts for the benefit of his children. Because he’s transferring a proportionate amount of each interest, the transferred amount is considered a “vertical slice” and therefore there is no Section 2701 issue.

At the time of the transfer, Joe gets an appraiser to appraise the transferred interests; the appraiser is able to discount the values of the interests for gift-tax purposes since they’re non-marketable, minority interests. Joe figured the transferred interests would be appraised at $1 million. But after the valuation discounts are applied, he’s actually able to report a $650,000 gift. If, when the fund terminates, the transferred interests are worth $8,000,000, Joe will have transferred $8,000,000 to trusts for his children while only using $650,000 of gift-tax exemption.

We hope this article has helped you understand some of the nuances surrounding gifting fund interests to members of younger generations or trusts for their benefit. It’s a complicated topic, but one that’s important for an increasing number of people.

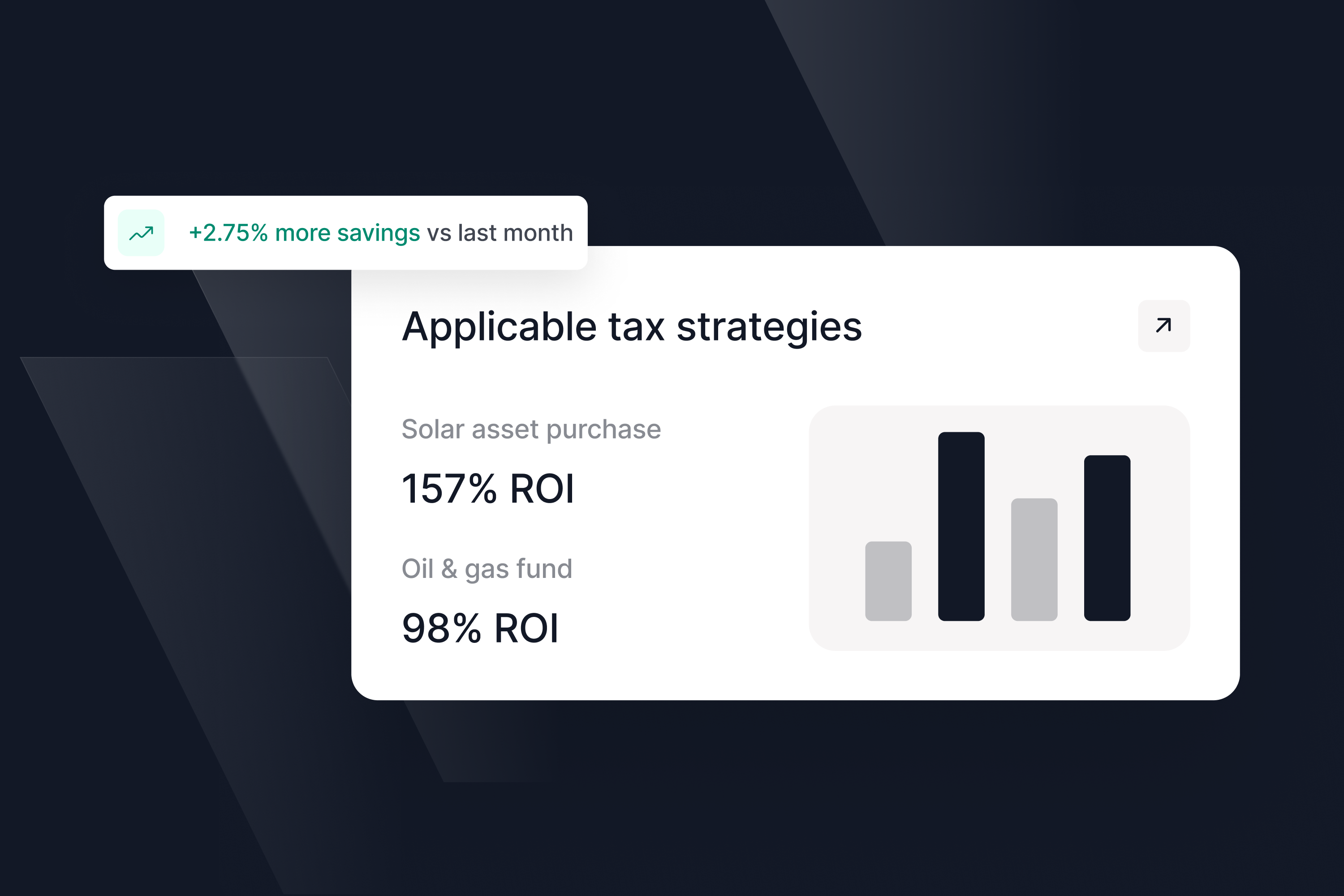

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax