FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

The Rule Against Perpetuities is an old legal rule that limits how long a trust can last. It originated in English common law but became a part of the American legal framework. It dictates that a trust (or any other form of property ownership) cannot last forever — it has to end at some point. Let’s explore what this rule means, how it’s changed in recent years, and why it matters to you.

The traditional Rule Against Perpetuities provides that a trust has to end no more than 21 years after the death of someone who was alive when the trust was created. For example, imagine that your grandfather created a trust in 1992, when you, your parents, and your sister were alive. The trust would have to end no more than 21 years after the survivor’s death. Assuming you outlive your parents and sister and that you die in 2071, the trust would have to terminate by 2092 at the latest. Sometimes this “Common Law Rule” is expressed as the later of (a) 21 years after the death of a person who was alive upon the trust’s creation and (b) 90 years after the trust’s creation.

The original reason for the rule was to prevent landowners from using non-trust legal arrangements to tie up property for centuries, preventing it from being bought and sold. In more recent times, the Rule Against Perpetuities has been viewed as a way to prevent people from setting up trusts that can last forever — s0-called “perpetual trusts.” Perpetual trusts allow wealthy families to avoid a 40% estate tax on trust property at each generation, indefinitely.

In recent years, many states have revised their Rules Against Perpetuities. Around half of the states have either dramatically extended the maximum trust duration or abolished the Rule Against Perpetuities entirely. The remaining states have retained some version of the traditional rule. You can see each state’s maximum trust duration at the bottom of this article (subject to some caveats that are beyond the scope of this article).

Perhaps the biggest threat to building true intergenerational wealth is taxes. In general assets, including assets in trust, are eventually subject to wealth-transfer taxes — like the gift tax, the estate tax, and the generation-skipping transfer tax — when family members transfer assets or die. The transfer tax rates are 40% at the federal level, with some states imposing their own taxes in addition to the litany of federal taxes. There are per-person exemptions, which individuals can take advantage of by gifting assets to trusts that are outside of their estates. Historically, this only worked temporarily, because after a while the Rule Against Perpetuities would force the trusts to end. The assets would then be distributed to the beneficiaries, meaning that the assets would be subject to estate tax when the beneficiaries died.

Abolishing the Rule Against Perpetuities solves this problem. At least under current law, it’s possible to gift assets to a trust, get them out of your estate, and then avoid transfer taxes forever.

Setting up a perpetual trust has one other perk. A trust’s terms are established by its original creator (the “grantor”). Extending the time period that a trust is able to exist also extends the period during which the grantor can influence how the trust assets are managed and distributed. This is a boon to people who are worried about what will happen to the money they leave their heirs.

Critics argue that allowing perpetual trusts gives too much control to wealthy families from long ago over property and assets today. It also reduces tax revenue by making it easy to avoid future estate and generation-skipping taxes with just a little bit of planning. But, from a taxpayer’s perspective, these are features.

If you create a trust, the time limits will depend on the state laws where the trust is administered. If you want to preserve your assets for as many generations as possible, it will make sense to choose a state that has extended or abolished the Rule Against Perpetuities, such as South Dakota.

| State | Trust Length Limit |

| Alabama | Common Law Rule |

| Alaska | Perpetual |

| Arizona | 500 years |

| Arkansas | 365 years |

| California | Common Law Rule |

| Colorado | 1,000 years |

| Connecticut | 800 years |

| Delaware | Perpetual |

| District of Columbia | Common Law Rule |

| Florida | 1,000 years |

| Georgia | 360 years |

| Hawaii | Common Law Rule |

| Idaho | Perpetual |

| Illinois | Perpetual |

| Indiana | 360 years |

| Iowa | Variation on Common Law Rule |

| Kansas | Common Law Rule |

| Kentucky | Perpetual |

| Louisiana | 20 years after beneficiary’s death |

| Maine | Common Law Rule |

| Maryland | Perpetual |

| Massachusetts | Common Law Rule |

| Michigan | Perpetual |

| Minnesota | Common Law Rule |

| Mississippi | Common Law Rule |

| Missouri | Perpetual |

| Montana | Common Law Rule |

| Nebraska | Common Law Rule |

| Nevada | 365 years |

| New Hampshire | Perpetual |

| New Jersey | Perpetual |

| New Mexico | Common Law Rule |

| New York | Common Law Rule |

| North Carolina | Common Law Rule |

| North Dakota | Common Law Rule |

| Ohio | Perpetual |

| Oklahoma | Common Law Rule |

| Oregon | Common Law Rule |

| Pennsylvania | Perpetual |

| Rhode Island | Perpetual |

| South Carolina | Common Law Rule |

| South Dakota | Perpetual |

| Tennessee | 360 years |

| Texas | 300 years |

| Utah | 1,000 years |

| Vermont | Common Law Rule |

| Virginia | Common Law Rule |

| Washington | 150 years |

| West Virginia | Common Law Rule |

| Wisconsin | Perpetual |

| Wyoming | 1,000 years |

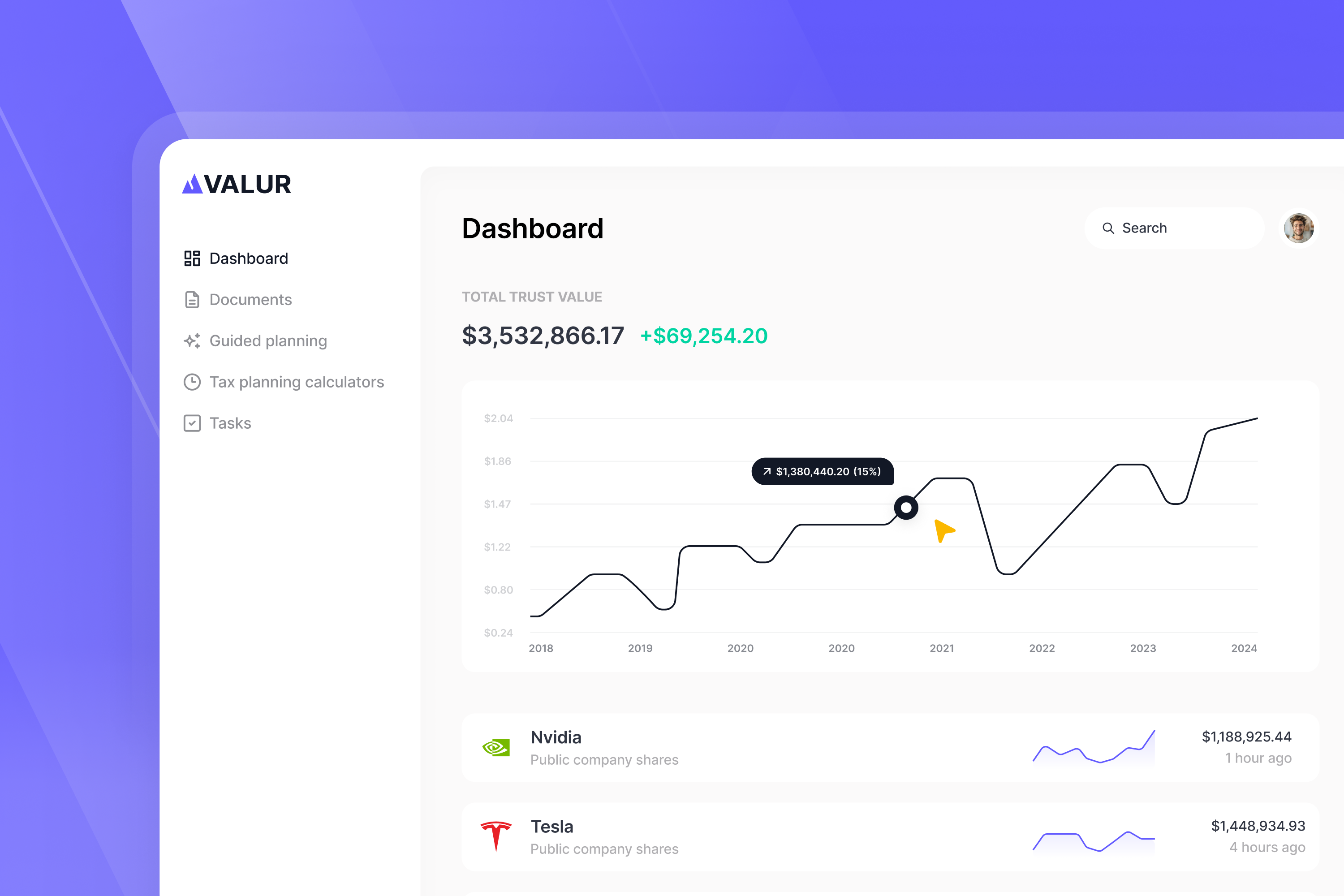

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!