FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

In our QSBS overview, we covered the basics of what the QSBS exemption is and how it impacts individuals. In this article we’ll cover QSBS stacking and packing, and everything you should know on how you can multiply (or “stack”) your QSBS exemption to protect $20 million, $30 million, or up to $500 million of your capital gains with proper planning.

The QSBS exemption’s requirements are fairly straightforward: Every taxpayer gets to pay 0% federal taxes (and 0% state taxes everywhere except California, Pennsylvania, New Jersey, Alabama, and Mississippi) on their first $10 million of capital gains or 10X their investment from the sale of a QSBS-eligible company’s stock. As of July 4, 2025 – when the One Big Beautiful Bill Act (OBBBA) was signed – any QSBS issued after that date enjoys a higher exclusion cap. QSBS issued on or before July 4, 2025 is still capped at $10 million (or 10× your investment basis). Beginning after July 4, 2025, the cap increases to $15 million (or 10× basis, whichever is greater). This benefit is available federally and in most states.

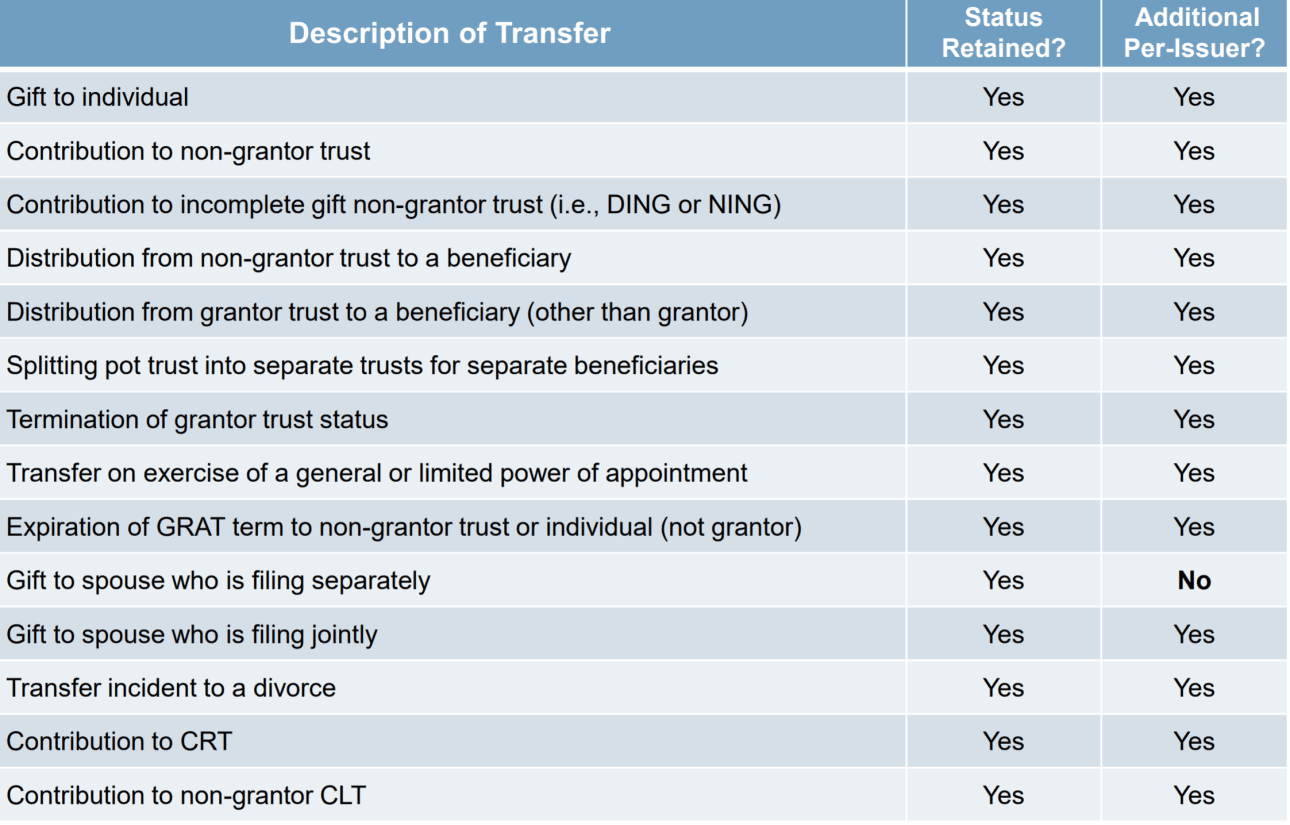

The key to any QSBS stacking strategy is right there in the requirements: There’s a new $10 or $15 million exemption for every taxpayer, and for every company whose stock the taxpayer owns. In other words, if two people each own qualifying shares, they both get a $10 or $15million exemption, and if one person owns qualifying shares in two (or more) companies, that person gets a separate $10-$15 million exemption on the sale of each company’s shares.

How can you take advantage of these rules? By giving some of your qualifying shares to a Charitable Remainder Trust (or another qualified trust). If a taxpayer gifts or bequeaths QSBS shares to a trust (or someone else), the recipient of the shares will be able to take advantage of its own exemption, effectively uncapping the amount of gains that are tax free.

What’s more, if you give qualifying shares to a trust, the trust will get to inherit your eligibility — if the shares were eligible for the exemption when you received them, they remain eligible, and the recipient gets to take over your holding period. (Recall that you have to hold your shares for at least five years to get the exemption.)

Access our podcast episode on QSBS to know more about these exemptions!

With the above definition in mind, founders and investors with large stakes in qualifying companies may consider the following strategies to multiply their QSBS exemptions:

Want to learn if QSBS stacking can work for your stock?

Take Jenn, a New York City founder who plans to sell all of her $25 million of equity once her company IPOs. Jenn early exercised all of her shares at incorporation and her cost basis is ~$100. She has one son and plans to have another kid in the next couple of years. Without QSBS protection, she’d have to pay taxes on the full $25 million of gains, so she’d owe about $8.5 million in federal, state, and local taxes. With her own QSBS exemption, however, she can pay zero taxes on the first $10 million of gains. And with QSBS stacking, the entire $25 million can be tax free.

The first $10 million: Jenn keeps $10 million of equity in her name and is able to avoid federal and state taxes on these gains as a New York resident. This is the simple baseline QSBS exemption.

Option 1 for the remaining $15 million: If Jenn wants to maintain control over the shares and have access to the capital, she can split the remaining gains between two CRTs. (Up to $10 million in a single CRT.)

Option 2 for the remaining $15 million: If Jenn is fine giving up some control and access to the funds, so she sets up two separate “non-grantor trusts,” and she names her son and her future child as the respective beneficiaries. She gifts $7.5 million of equity to each trust, and, after her company’s IPO, the trusts sell the equity, realize those gains, and claim their own QSBS exemptions.

As a result of this simple (if clever) planning, Jenn’s family will collectively pay zero taxes on her entire $25 million equity stake!

Not bad results at all! And you can also play with our online calculator to customize it with your own numbers and see your potential savings here.

You can also read a more detailed QSBS stacking example here.

Let’s assume the QSBS has been issued prior to July 4th, 2025. There are two rules that are important to keep in mind when thinking about QSBS packing. First, a taxpayer’s aggregate per-issuer gain exclusion for a given taxable year is generally limited to the greater of (a) $10 million, minus the aggregate prior gain excluded with respect to such issuer, or (b) 10 times the taxpayer’s original adjusted tax basis in the issuer’s QSBS sold during that year. More simply put, you can claim QSBS exemptions on the greater of $10 million or 10x your basis in the stock. In most scenarios, $10 million is larger than 10x your basis, but it’s possible to use “packing” to take advantage of the 10x basis rule.

Second, only domestic C corporations with up to $50 million in assets are eligible to issue QSBS. But if the company starts as an LLC, S corporation, or some other type of entity and then becomes a C corporation, the ownership shares can become eligible for QSBS treatment five years after the conversion.

In theory, you could transform the company from an S corporation to C corporation when it has $49.9 million of assets and then claim $499 million in QSBS exemptions (10 * $49.9 million), potentially saving $150 million or more in taxes on the sale. You can see how strategies that maximize a taxpayer’s basis in QSBS-eligible shares can be extremely powerful.

Timing is key to the QSBS stacking and packing strategies. The more you know about the ultimate value of your shares, the better, since you may want to gift only enough shares so that each recipient can claim the maximum exemption. Accordingly, most people wait until they have at least some sense of the likely acquisition value of their shares.

In short, getting started early — even if it’s only the planning phase and you don’t actually move any assets today — will help you avoid missing out on these potentially life-changing tax savings.

Read more in our introduction to the QSBS exemption if you haven’t already. Schedule a time to chat with our team or get started with our calculator on QSBS at no cost and with no commitment!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to reduce your capital gains tax?

Free 15-min consult · No obligation · Capital Gains