FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Qualified Small Business Stock (QSBS) is a term that most startup people have at least heard before. And for good reason: it’s the best tax break around. Yet, despite its frequent mention, its often tough for startup equity shareholders to determine if their shares are eligible.

Traditionally, answering those questions would have meant engaging a specialist accounting firm and spending $30K+ figures and several months of your valuable time. But not anymore. We at Valur have made the process fast, easy, and low cost. For between $3,750 for individuals and $12,500 for companies, we will analyze a company’s cap table to identify eligible shareholders and share grants, making it easier for everyone to take advantage of these benefits.

If you are interested you can get your QSBS Assessment started here. Otherwise read on for more context on QSBS and understanding what determines your eligibility.

The Qualified Small Business Stock Exemption, or QSBS, allows some startup shareholders to eliminate 100% of their federal and state income tax on gains from the sale of equity. (A few states do not recognize QSBS or apply a modified version.)

The precise size of the exemption depends on your cost basis and the ultimate size of the capital gain. The baseline is that you are exempt from tax on the first $10 million of capital gains. Your exemption may be larger, though — you can take the greater of that $10 million deduction or 10 times your cost basis.

The basic $10 million exemption will be most applicable to founders and early employees; the cost-basis rule may be more helpful, in practice, later-stage employees and investors who have a higher cost basis.

Learn more about QSBS here.

Congress enacted the Small Business Stock Tax Exemption in 1993 to encourage investment in specific businesses. It did this by providing a simple tax benefit: Anyone who starts, invests in, or works for these businesses can exclude certain gains from federal tax when they sell their shares (provided they meet certain conditions, which we’ll outline below).

Although the aim was to encourage small business investment, Congress did not make eligibility easy to understand. For that reason, in most cases you’ll want a formal assessment to confirm that your shares are (or are not) eligible.

That’s where Valur comes in. We are experts in startup and small business tax, and we do QSBS assessments at a fraction of the cost of traditional service providers. Here’s what that entails.

A QSBS assessment is an evaluation process that determines whether a particular stock qualifies as QSBS under the regulations set forth by the IRS. This involves scrutinizing various aspects of the company and the shares.

A QSBS assessment is an essential process that impacts stakeholders in different ways. For stock owners, it’s about getting the maximum financial benefits from their equity. For startups, it’s about maximizing returns and reducing uncertainty for their shareholders and employees. And for venture firms, it’s about serving their LPs and regulatory compliance. Valur understands and serves all of these groups, which is why we’ve invested in making QSBS assessments quick, easy, and inexpensive. Get your QSBS assessment here.

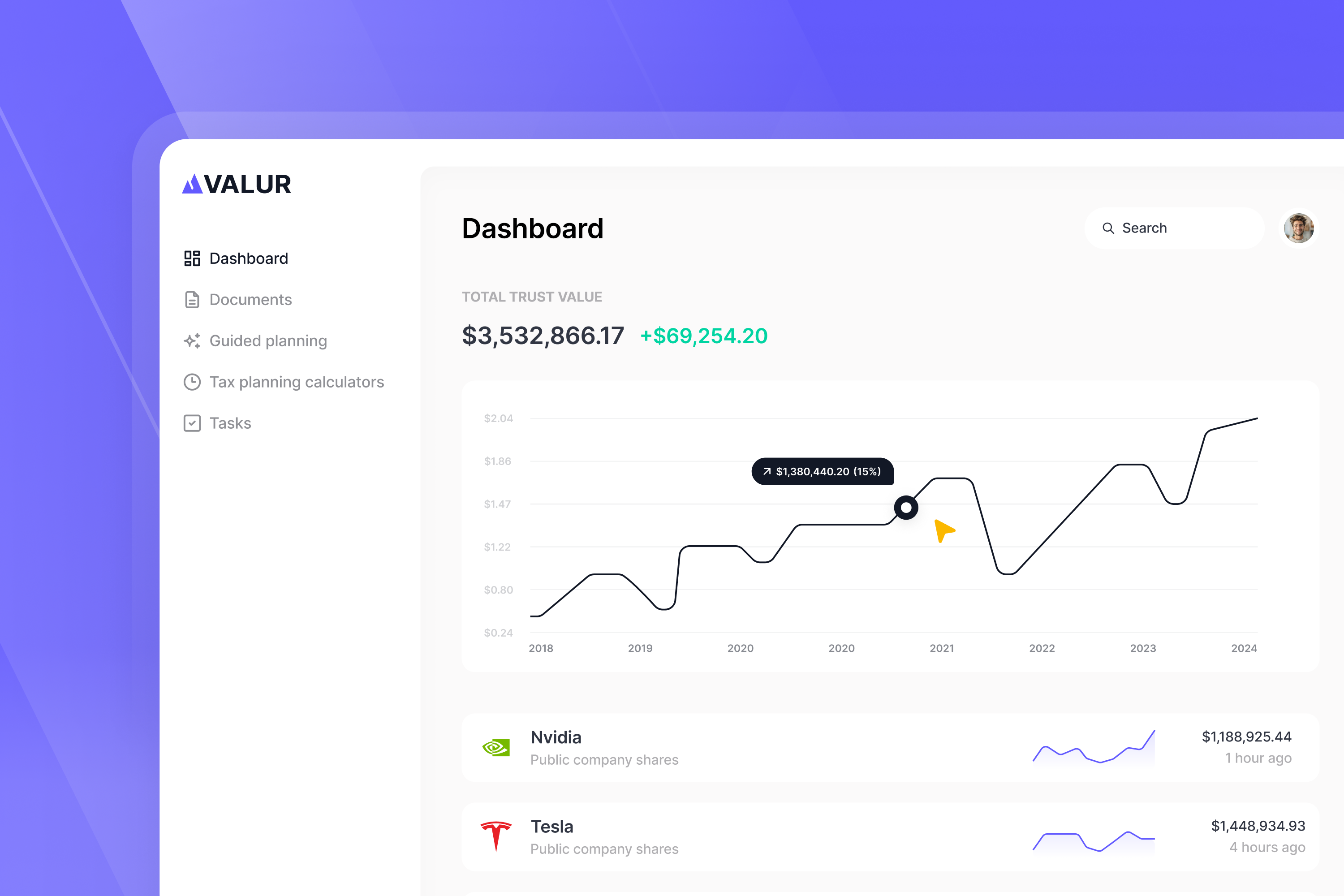

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!