FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

✅ An investor in public companies who expects a ~$15 million capital gain could stand to earn about $33 million more over his lifetime if he puts his shares into a Charitable Remainder Trust before he sells them.

By now, you’ve likely read our short primer on Charitable Remainder Trusts—the tax planning tool that most of our startup and crypto customers choose—and you’re probably comfortable with the basics. In this post, we’ll use the example of a retail investor to help illustrate the benefits (and, of course, the tradeoffs) of CRTs.

Consider Tim, a 45-year old who lives in San Diego and bought Tesla options in 2017, when the stock was flatlining around $22 per share. He stuck it out, and by the beginning of 2022 that was looking like an incredible decision; the stock had risen about 1500%, and his shares were now worth around $15,000,000. Unsurprisingly, he was ready to take some money off the table.

If Tim had just sold his shares, he would have owed the federal government about $3,165,000 in taxes on his capital gains, and another $1,635,000 would have gone to the state of California, for a total tax bill of $4,800,000. That’s just too much, so Tim came to Valur to help him set up a Charitable Remainder Trust. How has it worked out?

Cost basis: $1,00,000

Value at sale: $15,000,000

The first benefit Tim received was an immediate tax deduction. There’s some complicated math here, mandated by the IRS, but the bottom-line is simple: He was entitled to deduct about 10% of the current value of the shares he puts into the trust, or $1.5 million, from his personal income this year. Since he lives in a high-tax state, the tax savings are substantial: That deduction translates into cash savings of about $525,000 on next year’s taxes.

So Tim starts about $525,000 ahead of the game. The next major (and we mean major) benefit of a CRT is that he got to defer all of the taxes—state and federal—he would otherwise have owed on his big gain. So instead of paying the $4.8 million in taxes that we calculated above, he got to keep that money and invest it.

We’re starting to see the numbers take shape, but there’s one more significant data point we haven’t gotten to yet: How does Tim plan to use his money? Everyone’s situation is different, but Tim wanted a steady income from his trust, since he’s near retirement. For that reason, he chose a Standard CRUT. There are many ways to get liquidity out of a CRT, and we discuss them in some depth. But due to the structure of Standard CRUTs, this is actually very simple: Tim had access to a growing share of money every year, starting as soon as he created his trust.

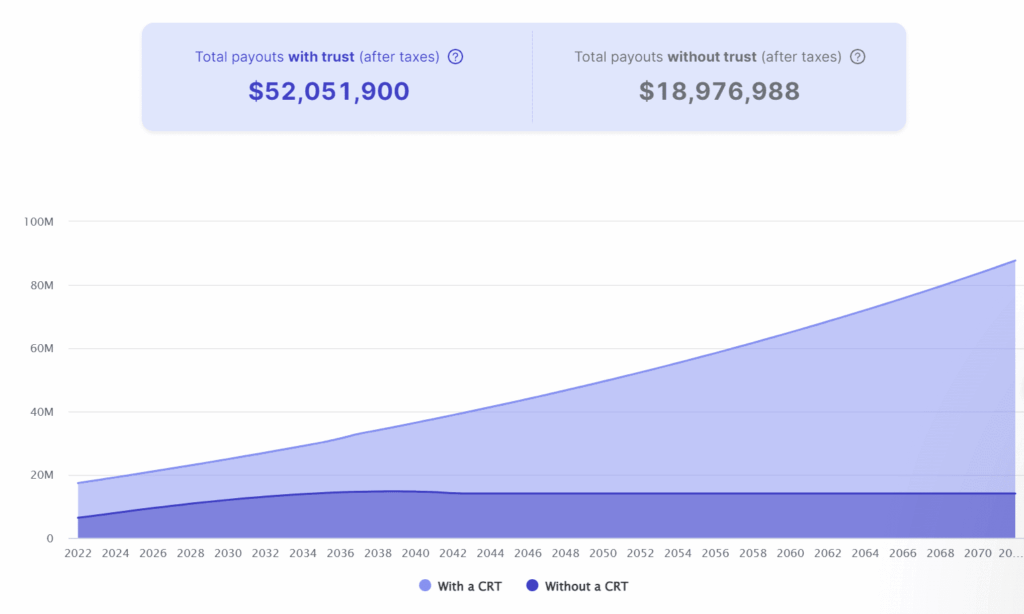

What will all of these tax savings, investment gains, and withdrawals mean for Tim’s bottom line? At the end of his trust (which is expected to last about 50 years), Tim and his family will end up with about $63 million in total payouts, after taxes. About $11 million of that will go to the charity of his choice—that’s the bargain he struck when he chose a Charitable Remainder Trust, after all—so he ends up with about $52 million in his pocket.

If, instead, Tim had kept his money in a regular, taxable investment account, he would have instead ended up with about $19 million.

In other words, even after making what can only be described as a very generous donation to charity, Tim still pockets an extra $33 million, all because he put his Tesla shares into a Charitable Remainder Trust before selling.

Schedule a time to chat with our team or get started at no cost and with no commitment!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to reduce your capital gains tax?

Free 15-min consult · No obligation · Capital Gains