FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

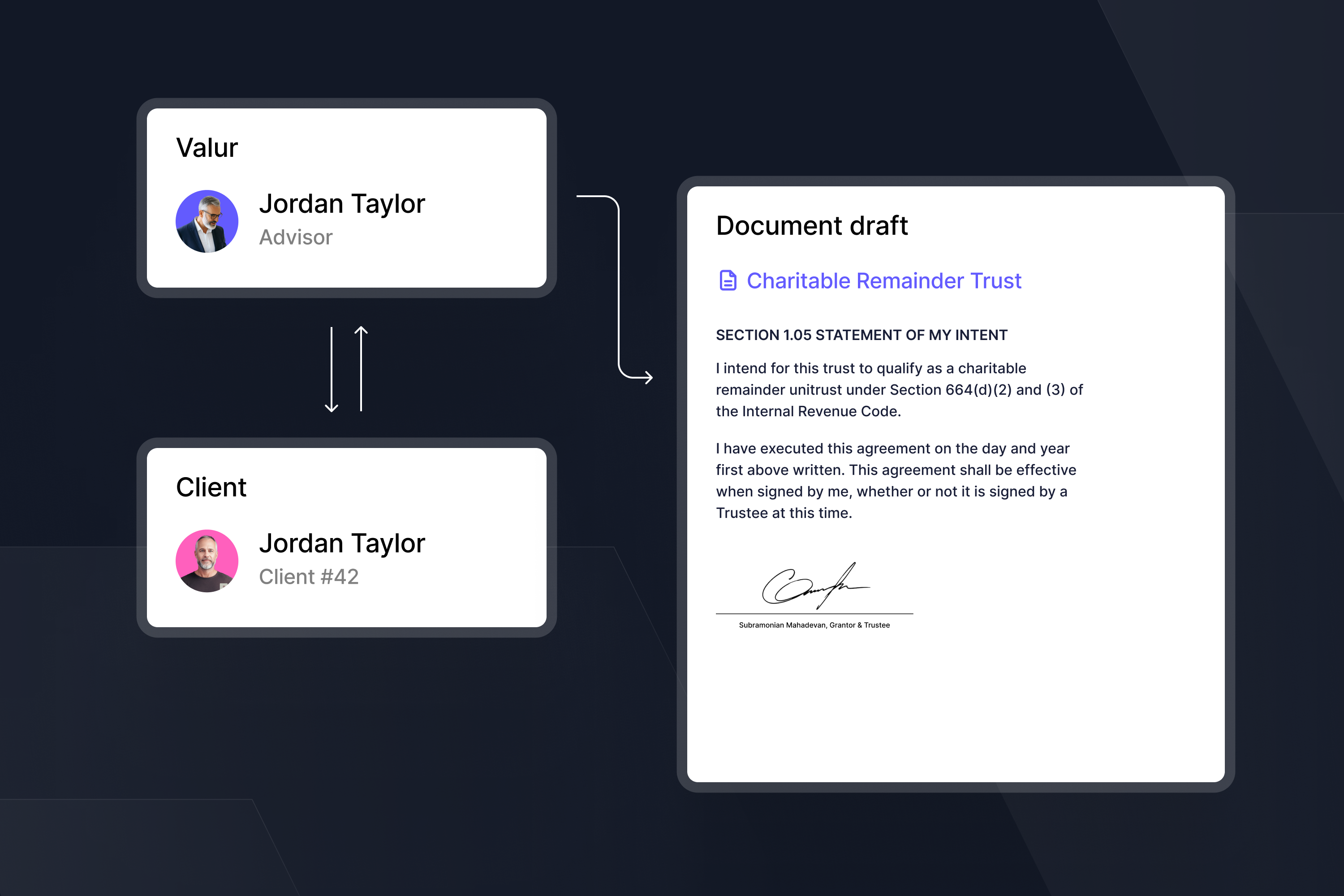

If you have a South Dakota trust that Valur will be administering, there are certain documents that we will need from you so that we can comply with federal law. The good news is that the documents are pretty straightforward. After you’ve signed your trust agreement, we’ll reach out to you with any additional required documentation. Here are the types of documents that may be needed:

We request driver’s licenses from trust grantors when they set up trusts. But we also need them for any investment advisor or distribution advisor who is currently acting. If you’ve named an investment advisor or distribution advisor for your trust, we will ask for a photo of that person’s driver’s license. Passports are acceptable in lieu of driver’s licenses.

Every grantor and adult beneficiary of a trust must fill out and sign either a Form W-9 (if a U.S. citizen or permanent resident with a Social Security Number or Taxpayer Identification Number) or a Form W-8 (if a non-resident). You’ve probably filled out one of these before, perhaps when you started a new job. These are fillable forms, and you can just e-sign.

Finally, we need each grantor to sign a short form with some biographical information about them, like their job. These are fillable forms, and you can just e-sign.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!