FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Irrevocable trusts are legal arrangements used to protect and preserve assets for beneficiaries. This article discusses what irrevocable trusts are and what they do.

An irrevocable trust is a legal structure created when a grantor transfers assets or property to a trustee to be held, managed and distributed for the benefit of one or more beneficiaries. Once the trust has been formed, the grantor’s ability to modify the trust agreement, or reclaim the trust assets, is limited. The trust assets are managed for the benefit of the beneficiaries.

Once the trust has been created and assets have been transferred to it, the trustee takes over. The trustee is responsible for managing the trust assets and distributing them to the beneficiaries according to the terms of the trust agreement. The trustee is legally obligated to act in the best interests of the beneficiaries and must adhere to the terms and conditions of the trust agreement. Often, the trustee and the grantor are different people. Depending on the type of irrevocable trust, it may not be possible for the grantor to act as trustee without causing adverse tax consequences.

Creating an irrevocable trust can have important state and federal tax consequences. For income-tax purposes, there are two general categories of trusts: grantor trusts and non-grantor trusts. Grantor trusts are disregarded for income-tax purposes, while non-grantor trusts are treated as separate taxpayers. Both types of trusts have the potential to save estate taxes. A full discussion of these tax issues is beyond the scope of this article, but the articles linked in this paragraph provide a more in-depth analysis of these issues.

Irrevocable trusts can be used for various purposes, such as providing for family members after the grantor’s death, protecting assets from creditors, avoiding probate, transferring assets to a beneficiary in a tax-efficient way, or supporting charity. Valur generates trusts that are geared toward minimizing estate and gift tax, state income tax, and capital gains tax.

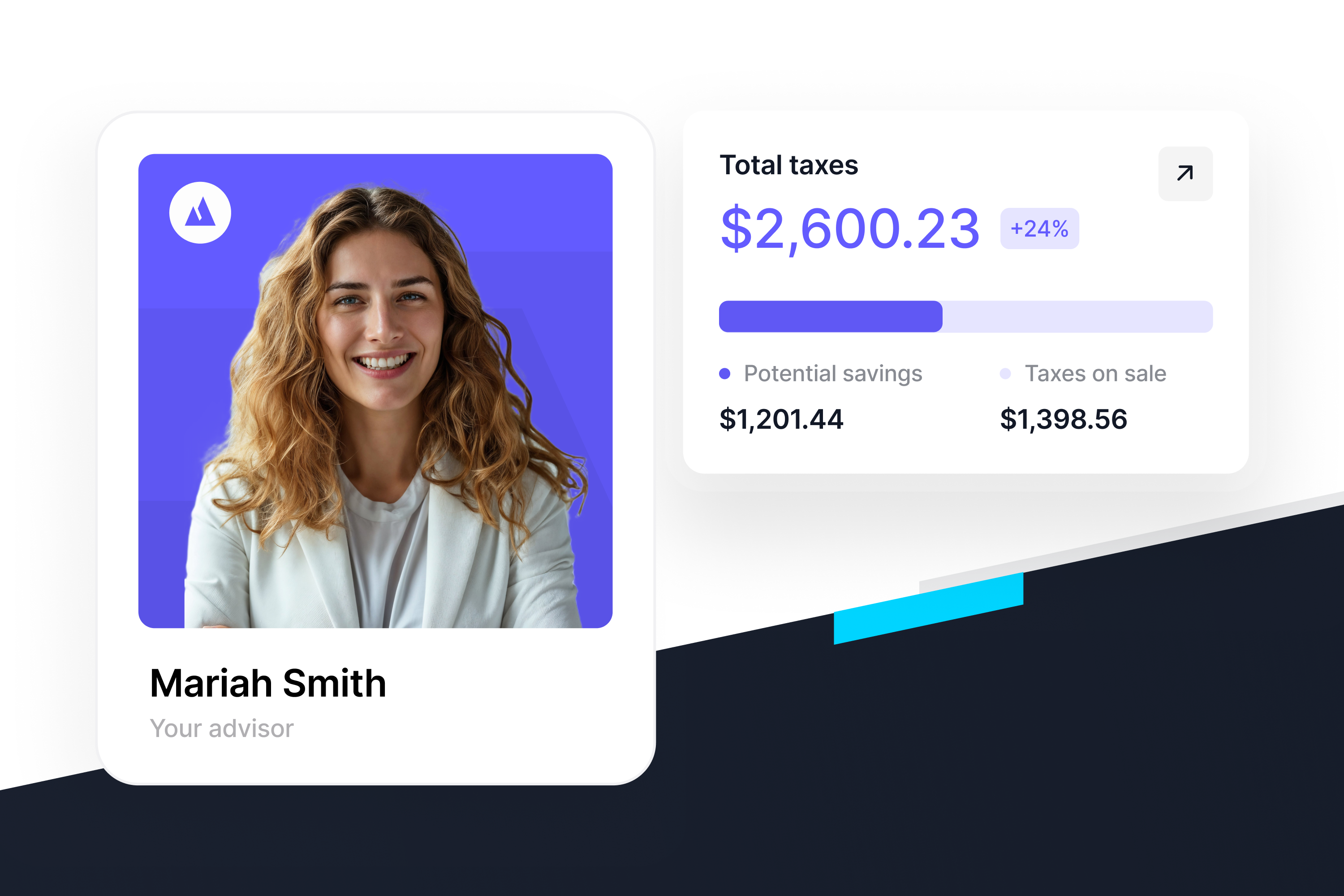

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!