FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

One common reason people set up irrevocable trusts is to hold life insurance. Putting life insurance into an irrevocable trust can help minimize estate taxes when the insured dies. As it happens, Valur creates and administers these trusts — known as Irrevocable Life Insurance Trusts (ILITs) — for our clients. This article provides some background on Irrevocable Life Insurance Trusts, explains how they work, and discusses when they are commonly used and their benefits.

A trust is a legal arrangement in which one person (the grantor) transfers property to a person or entity (the trustee), who controls that property for the benefit of another person (the beneficiary). An ILIT is a special type of trust that is designed to hold life insurance policies. Typically, the trustee of an ILIT will acquire life insurance on the grantor’s life and name the ILIT as the beneficiary of the policy. The reason people prefer to have an ILIT purchase and hold life insurance is because when the grantor dies, the proceeds will pass to the trust, which is outside of the grantor’s estate for estate-tax purposes. Assets in the trust are also protected from the grantor’s creditors, the trustee’s creditors, and the beneficiary’s creditors. Finally, ILITs are irrevocable, which means they can’t easily be amended.

The estate tax is a tax on the assets that a person leaves to their heirs when they pass away. The estates of U.S. citizens and residents are taxed on all of their worldwide assets. That includes life insurance proceeds, real estate, retirement accounts, brokerage accounts, crypto, intellectual property, and whatever else a person owns. The federal estate tax rate is currently 40% on assets in excess of a person’s lifetime exemption amount, which in 2024 is $13.61 million and is scheduled to drop to around $7 million in 2026. A number of states impose their own estate taxes as well, bringing the combined effective federal/state estate tax rates to as high as 52% in some parts of the country.

There are many estate planning solutions available, each offering unique benefits depending on your goals. If you’re unsure which solution is best for you, try out our Guided Planner

Since ILITs are created to hold life insurance, it’s impossible to understand how they work without some understanding of life insurance. There are two basic forms of life insurance: (1) term life insurance and (2) permanent life insurance. Any life insurance policy can go into an Irrevocable Life Insurance Trust, whether term or permanent.

Term life insurance is generally very cheap, has monthly or annual premiums, lasts for a discrete term of years, and has a death benefit (what your family gets paid when you pass away) but no “cash value” (a standalone investment component, which we’ll discuss below). So, for example, you might take out a 20-year term policy with a $1 million death benefit. The annual premiums will be a few thousand dollars (the exact premium amounts will depend on your age, health, and other factors). If you survive the 20-year term, the policy will just lapse – but it will have provided a measure of security to your family. If you die before the end of the 20-year term, your named beneficiaries will receive the $1 million death benefit.

Permanent insurance is designed to last your whole life and usually includes both a death benefit and a standalone investment component, also known as the “cash value”. Life insurance is exempt from both state and federal income and capital gains taxes. That’s where the investment component comes in. An investment that generates 10% pre-tax returns but only 6% post-tax returns outside of a life insurance policy will generate 10% post-tax returns inside a life insurance policy (since there’s no tax). Thanks to the magic of compound returns, that 4% spread makes an enormous difference over time. As an example, $1 million that generates 6% returns will be worth $10.3 million in 40 years, but if it generates 10% returns for 40 years it will be worth $43.5 million! That’s the power and value of the investment component of life insurance. It may also be possible to withdraw or borrow against up to about 85% of the cash value if needed.

Permanent insurance tends to have higher insurance premiums and, in some cases, the premiums are due annually; in other cases, you pay premiums for the first few years and then never again. Unlike term insurance, permanent insurance can have high fees, depending on the structure of the policy.

One type of permanent insurance that is becoming increasingly popular in part because of its tax advantages is Private Placement Life Insurance (PPLI). PPLI policies have relatively low fees, a large cash value component that allows you to maximize the income-tax benefits of life insurance, and a significant death benefit. Unlike traditional permanent insurance, PPLI can invest in almost any asset class, including alternative investments like private credit or hedge funds. In fact, PPLI is often used by people who are looking to invest in alternative investments that would otherwise be tax inefficient.

Need some help to understand if a ILIT is the right fit for you?

ILITs stack the estate-tax benefits of irrevocable trusts on top of the income-tax benefits of life insurance. The result is a very powerful tax-planning vehicle.

Imagine that Jeff is a successful, 40-year-old entrepreneur who lives in Washington, D.C. He has $12 million of wealth and expects to be over his $13.61 million (as of 2024) lifetime exemption amount by the time he dies. He’s decided to set up an ILIT so that his trustee can acquire a PPLI policy on Jeff’s life. The premiums will be $600,000 per year for five years, then it will be fully paid up.

Without insurance or an ILIT, if Jeff just invested his money and earned 5% annual cash flow on his investments and 3% annual capital appreciation, he’d be able to transfer about $115 million to his children upon his death in 50 years, net of income tax and estate tax. But with the PPLI policy described above, held inside of an ILIT, he’ll be able to pass on about $287 million to his children. That’s because the cash value component will grow free of income tax, the policy will pay out a death benefit on top of the investment returns, and both the cash value and the death benefit will be outside of Jeff’s estate so he’s able to avoid estate taxes as well. In other words, due to the combination of PPLI and an ILIT, Jeff is able to avoid income, capital gains, and estate taxes!

In addition to avoiding estate tax on the insurance proceeds, ILITs can provide a source of liquidity for an otherwise illiquid estate. For example, let’s say that Jeff is heavily invested in real estate. When he dies, the assets in his estate (not counting the assets in the ILIT) are worth $100 million, and almost all of that is real estate. His estate will owe about $44 million of federal and Washington, D.C. estate tax. Ordinarily, his family might have to sell a bunch of real estate in order to pay the estate tax bill. But Jeff’s family will be able to access an ILIT with about $187 million of cash in it. The trustee of the ILIT can loan Jeff’s estate the cash it needs to pay the estate tax, and then the family can pay back ILIT later. The trustee of the ILIT will have to charge an interest rate, but that interest rate will be set at the lowest level the IRS allows — known as the Applicable Federal Rate — which will likely be much lower than what a bank would charge.

Most insurance policies require the owner to make regular premium payments. But if a trust owns an insurance policy, where can it get the cash to pay the premiums? There are four basic options:

While most often insurance policies are purchased by an ILIT (or a limited liability company owned by an ILIT) directly, it’s also possible to either gift or sell a life insurance policy to an ILIT that didn’t exist when that policy was taken out. When existing policies are transferred, however, you have to be mindful of two special tax issues.

First, there’s a three-year look-back period for estate-tax purposes, meaning that if you transfer a policy to an ILIT and then die within three years, the IRS will still count the policy as part of your estate even though it was technically in the ILIT when you died. You have to live for at least three years after the transfer in order for it to be effective for estate-tax purposes.

Second, when life insurance is sold to a trust (or anyone else), there’s a special rule called the “transfer for value” rule, which can cause income-tax issues. There are ways to avoid the transfer for value rule, but it has to be taken into account whenever an insurance policy is sold.

Irrevocable Life Insurance Trusts offer a range of benefits, including asset protection, estate tax reduction, and greater control over life insurance benefits. For people who think their estates may be subject to estate tax and are interested in purchasing life insurance, ILITs are really a must-have. Valur can work with you to set up an ILIT for free:

Do you want to set up an ILIT for free?

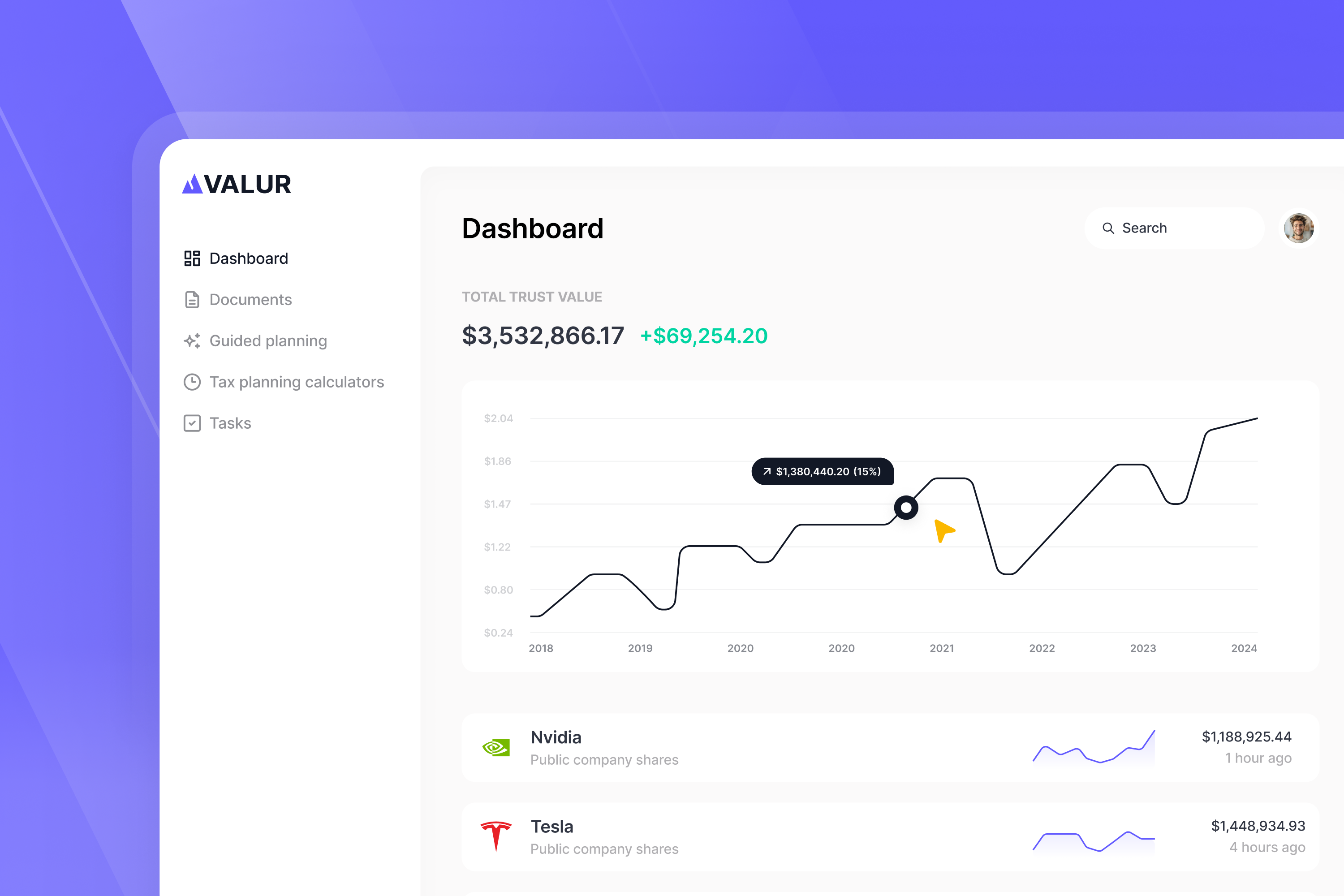

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!