FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Fortunately, there are very few constraints here; these trusts are almost as flexible as your own investment account, and you can invest in almost anything (with a couple of narrow exceptions). As you’d imagine, though, there are pros and cons to each investment strategy, and which is right for you will depend on your goals and financial situation.

When thinking about the common investment strategies, most people are typically solving for one of two outcomes:

There are a number of important factors that will help drive your choice of strategy, including your financial goals and your liquidity needs, which will in turn dictate the use of a different type of Charitable Remainder Trust.

There is no one-size-fits-all approach, even within a particular investment strategy, and there will, of course, be some overlap. But even where the same assets are used to fulfill different strategies, the way you deploy and take advantage of them may differ. Here are a few common asset classes and how they fit into these investment themes:

Active Yield Strategy

Passive Appreciation Strategy

Comparing investment strategies inside of a trust

Each type of Charitable Remainder Trust investment strategy has different distribution and tax rules that impact the investment strategy, and taking those features into consid eration early will help you identify what’s important and maximize the value of your Charitable Remainder Trust.

Active Yield. Because high-yield assets throw off ordinary income and/or short-term capital gains, this strategy is typically taxable at the highest tax rates.

Fortunately, both the Standard CRUT and the NIMCRUT will help with long term wealth creation by reducing those taxes. How? By protecting some yields from immediate taxation; since Charitable Remainder Trusts distribute cash only up to the IRS-dictated annual payout rate, any yield or other income above that rate won’t be distributed and, accordingly, can be re-invested and will continue to grow tax free inside of the trust. This two-step can increase your returns from yield farming and other income strategies by as much as 60% over the length of your trust.

Passive Appreciation. Because the goal here is long-term appreciation, this strategy involves holding assets for more than 12 months to achieve long-term capital gains status and the favorable tax rate that comes with it.

This strategy can create the largest returns when combined with a NIMCRUT, but that trust format has some drawbacks as well.

How do the returns stack up?

Using a Charitable Remainder Trust typically leads to a greater ROI compared to not using a trust at all, whichever investment strategy you choose. But which has higher returns?

When comparing the Active Yield Strategy and the Passive Appreciation Strategy, in terms of absolute dollar returns, the passive strategy paired with a NIMCRUT will usually bring the highest returns. The primary reason is that you are keeping more money in the trust to compound longer, thus leading to the largest absolute dollar amount available from the trust over your lifetime.

If you value Active Yield and want consistent distributions from the trust, things tip in the Standard CRUT’s favor. A Standard CRUT and a NIMCRUT will deliver identical returns using this strategy, provided that your yield is higher than your payout rate. If your yield is lower than your payout rate in some years, though, the Standard CRUT will offer more consistent returns, since its distributions don’t depend on the trust’s income like they do with a NIMCRUT. For that reason, a Standard CRUT might be preferable if you are thinking about creating a steady income stream for your retirement.

At the same time, using a NIMCRUT does give you the option to switch investment strategies mid-stream so you can take advantage of the higher overall returns of a passive strategy and capture yield when the rates make sense.

As a common example, many of our customers are currently using a NIMCRUT to take advantage of the high yields currently offered via crypto stablecoins, but they plan to shift to a more passive strategy if/when these yields decrease in the future.

Ultimately, your choice of investment strategy will come down to your and your family’s needs. The ROI can vary drastically, and that’s why we’ve created tools like our calculator for tax saving, which can help you understand the financial implications of each CRUT type. Or read our content on how to apply growth investment strategies with CRUTs.

Interested in exploring a Charitable Remainder Trust further? Get in touch with us today and we can discuss how your investment goals can impact the viability of these structures.

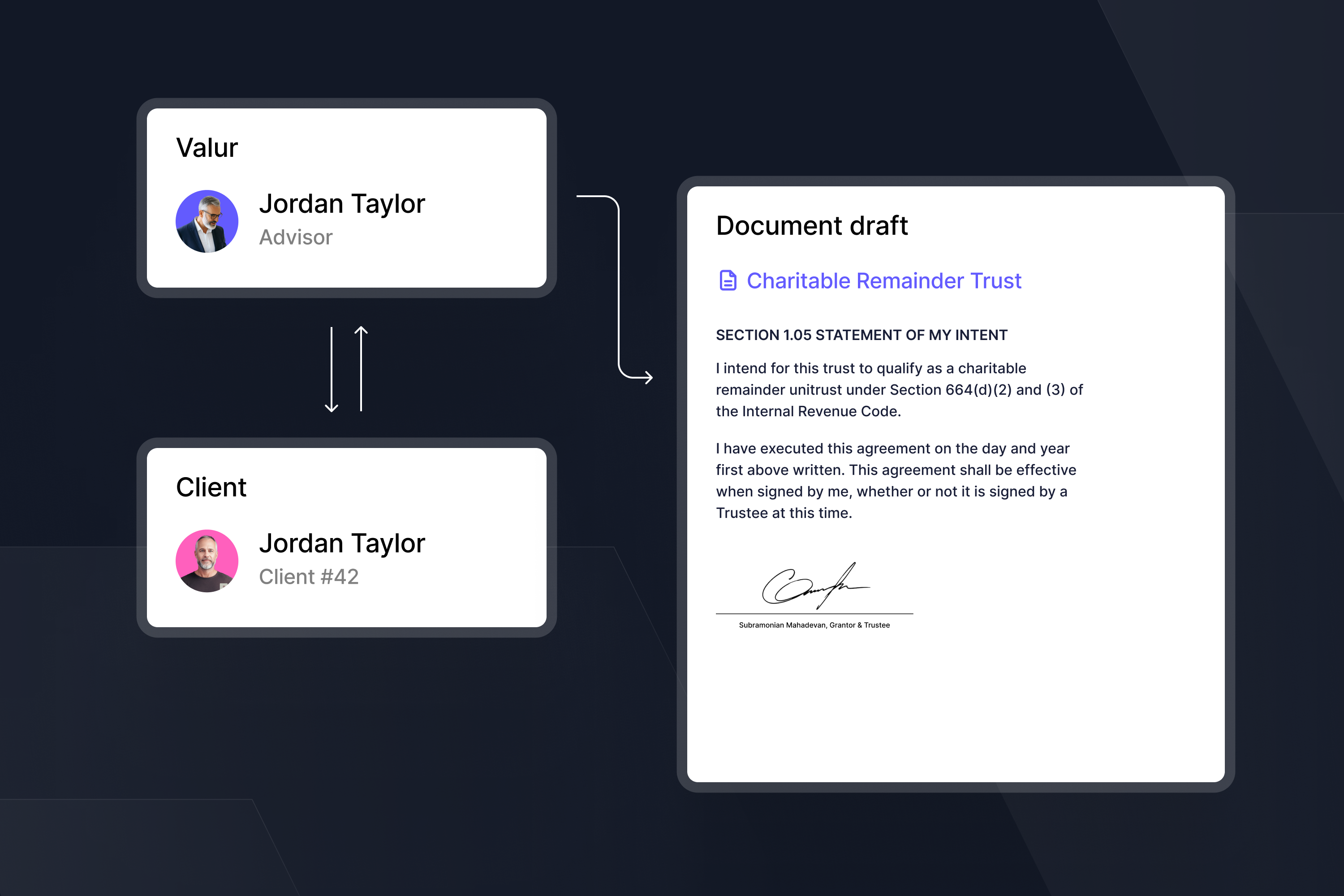

We have built a platform to give everyone access to the tax planning tools of the ultra-rich like Mark Zuckerberg (Facebook founder), Phil Knight (Nike founder) and others. Valur makes it simple and seamless for our customers to utilize the tax advantaged structures that are otherwise expensive and inaccessible to build their wealth more efficiently. From picking the best strategy to taking care of all the setup and ongoing overhead, we make take care of it and make it easy.

Ready to reduce your capital gains tax?

Free 15-min consult · No obligation · Capital Gains