FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

An Investment Analyst is someone who undertakes financial analysis in order to make investment decisions. They are responsible for researching and analyzing stocks, bonds, and other investments to recommend the best ways for their clients or company to invest in the stock market. They also keep up to date with the latest financial news and trends in order to make informed decisions.

The job of an Investment Analyst involves researching and analyzing financial data to make recommendations for their clients or company. They must be able to identify profitable investments, monitor existing assets, and make changes as needed. They must be able to explain their decisions to clients or colleagues and provide advice on the best strategies for investing.

The average worldwide salary for Investment Analysts is around $60,000 per year. Salaries can vary depending on experience, location, and the type of role. The average salary for Investment Analysts in the United States is around $70,000 per year.

To become an Investment Analyst, you may be required to hold specific certifications. Examples of these certifications include the Chartered Financial Analyst (CFA) designation and the Certified Financial Planner (CFP) designation. In addition, some employers may require you to hold a Professional Risk Manager (PRM) certification.

Yes, an investment professional and analyst can be a good career choice, depending on the individual’s skills and interests. Investment analysts typically analyze market trends and financial data, research investments, and make recommendations to clients. They must have strong analytical and research skills, as well as the ability to interpret and communicate complex financial information.

They must also be able to manage their own time and workload in order to meet deadlines. If you have these skills and a desire to work in the financial industry, an investment analyst may be a good career choice for you.

Check out our calculators and how to create one to strengthen your investments and take advantage of them! Or access our previous article on investments to learn more about estate planning strategies!

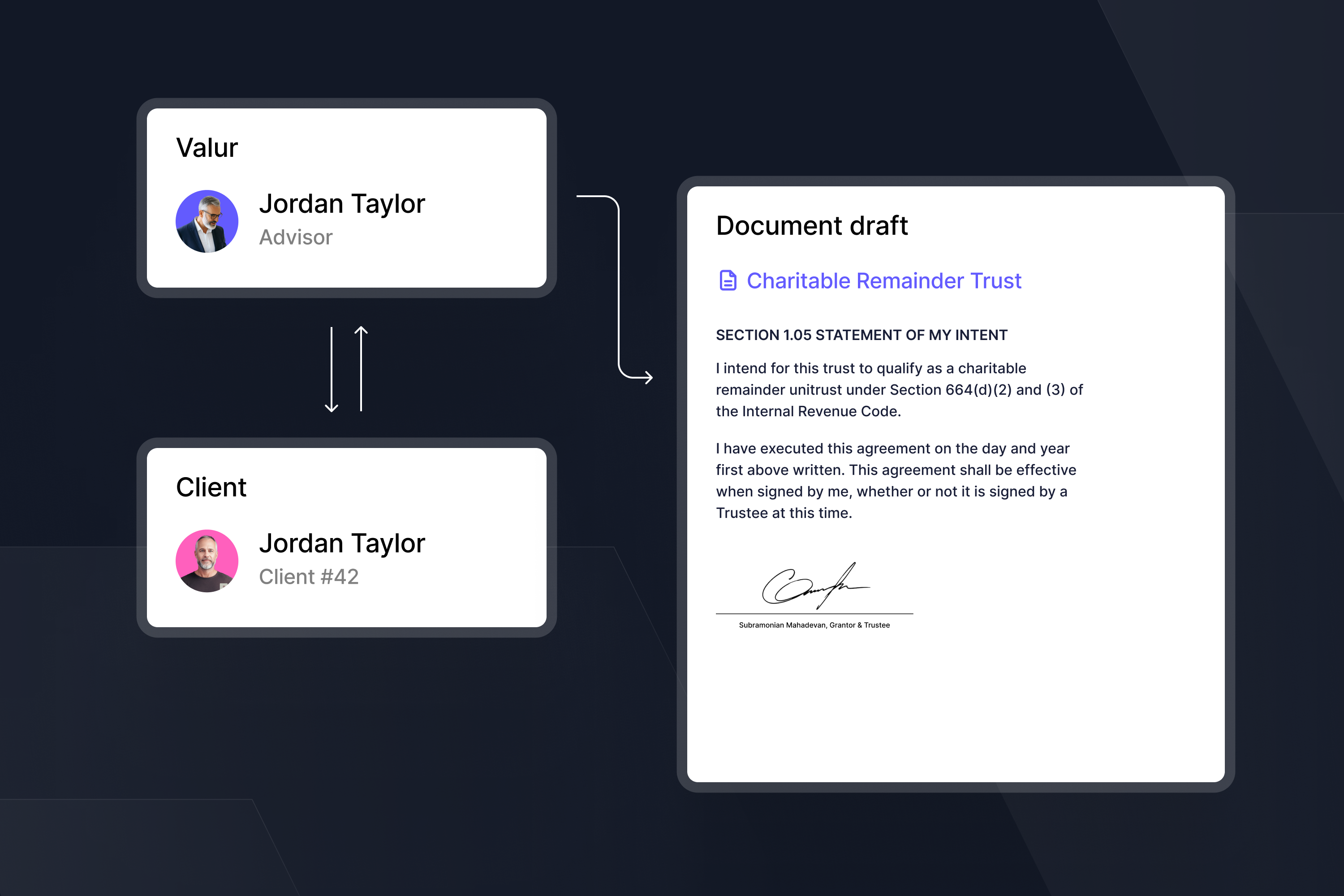

We have built a platform to give everyone access to the tax planning tools of the ultra-rich like Mark Zuckerberg (Facebook founder), Phil Knight (Nike founder), and others. Valur makes it simple and seamless for our customers to utilize the tax-advantaged structures that are otherwise expensive and inaccessible to build their wealth more efficiently.