FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

An inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. Inheritance taxes are often confused with estate taxes, but the two have important differences. This article will explore how an inheritance tax works, how it is different from an estate tax, and how it can be avoided, and walk through an example of this tax.

An inheritance tax is a tax on the transfer of assets from a deceased person to his or her beneficiaries. The beneficiaries, not the estate, pay the tax. The tax rate is typically based on the value of the assets being inherited by the beneficiary, the relationship between the deceased individual and the beneficiary, and the state the donor lives in.

An inheritance tax and an estate tax are both taxes on assets left behind by a deceased person, but they are assessed differently. An estate tax is imposed on the estate of the deceased person, and it is calculated based on the total value of the assets when they are passed on. On the other hand, an inheritance tax is imposed on the beneficiaries of assets when passed on.

Another critical difference between an inheritance tax and an estate tax is that while there is a federal estate tax levied at a flat 40% rate, there is no federal inheritance tax. However, six states impose their own inheritance taxes.

When a person dies, their assets are distributed according to the terms of their will, or if they did not have a will, according to the state’s laws. Depending on the value of the assets and the beneficiary’s relationship to the deceased, these bequests may be subject to inheritance tax.

There is no federal inheritance tax, but some states have a tax on inheritances. However, even in states with an inheritance tax, it does not apply to any assets distributed to certain family members (generally spouses and young children). In some states, specific types of assets, like family farms, are also exempt.

The states that impose this type of tax are:

A tax exemption is a type of tax relief that allows certain people or organizations to be exempt from paying certain taxes. This can include income taxes, sales taxes, and property taxes. Fortunately, if you live in a state with an inheritance tax, you may still be eligible for a tax exemption for an inheritance tax. Here are some examples of potential inheritance tax exemptions:

There are several ways to avoid or reduce the amount of inheritance tax that your beneficiaries will owe. These strategies generally involve making lifetime gifts to beneficiaries, as inheritance taxes are only imposed on amounts received after the donor’s death.

Some examples may help you understand how the inheritance tax is applied in practice.

Imagine that Bob is a resident of Pennsylvania, which has an inheritance tax. Bob has a child named Tom. When Bob dies, he leaves Tom $4 million of assets. After applying Pennsylvania’s $3,500 “family exemption” and deducting $10,000 of funeral expenses, there is $3,986,500 deemed as having been transferred to Tom. Pennsylvania imposes a 4.5% inheritance tax on inheritances from a parent. So, Tom would owe $179,292 in Pennsylvania inheritance tax on his inheritance.

Bob could have saved Tom at least some of that tax by gifting him assets during Bob’s lifetime. But it might not have been worth it. When Bob died, the income tax basis of his appreciated assets were “stepped up” to fair market value, wiping out any capital gains. So Tom would be able to sell all of Bob’s assets without paying any capital gains tax. But any assets gifted to Tom would have been outside of Bob’s estate when Bob died. That means those assets wouldn’t have received an income tax basis “step-up” to fair market value when Bob died. The value of stepping up the basis of the assets in Bob’s estate to fair market value at the time of Bob’s death could have easily exceeded the $179,292 in inheritance tax that Tom owes.

Jennifer is a Kentucky resident. She doesn’t have any children, so she leaves $2 million to her cousin, Alex. Like Pennsylvania, Kentucky imposes an inheritance tax. Kentucky taxes bequests to cousins at rates of up to 16%. In this case, the inheritance tax on the bequest to Alex will be about $316,000. Because the projected inheritance tax liability here is quite significant, about 15% of the amount of the bequest, Jennifer should consider leaving assets to Alex (or a trust for Alex’s benefit) rather than waiting for Kentucky’s inheritance tax to be imposed.

Inheritance tax can be a significant burden for beneficiaries. It is essential to understand if it applies to you, how it works, and the different strategies that can be used to reduce or avoid it. By understanding the differences between this type of tax and an estate tax, individuals can plan ahead to minimize the amount of inheritance tax their beneficiaries will have to pay.

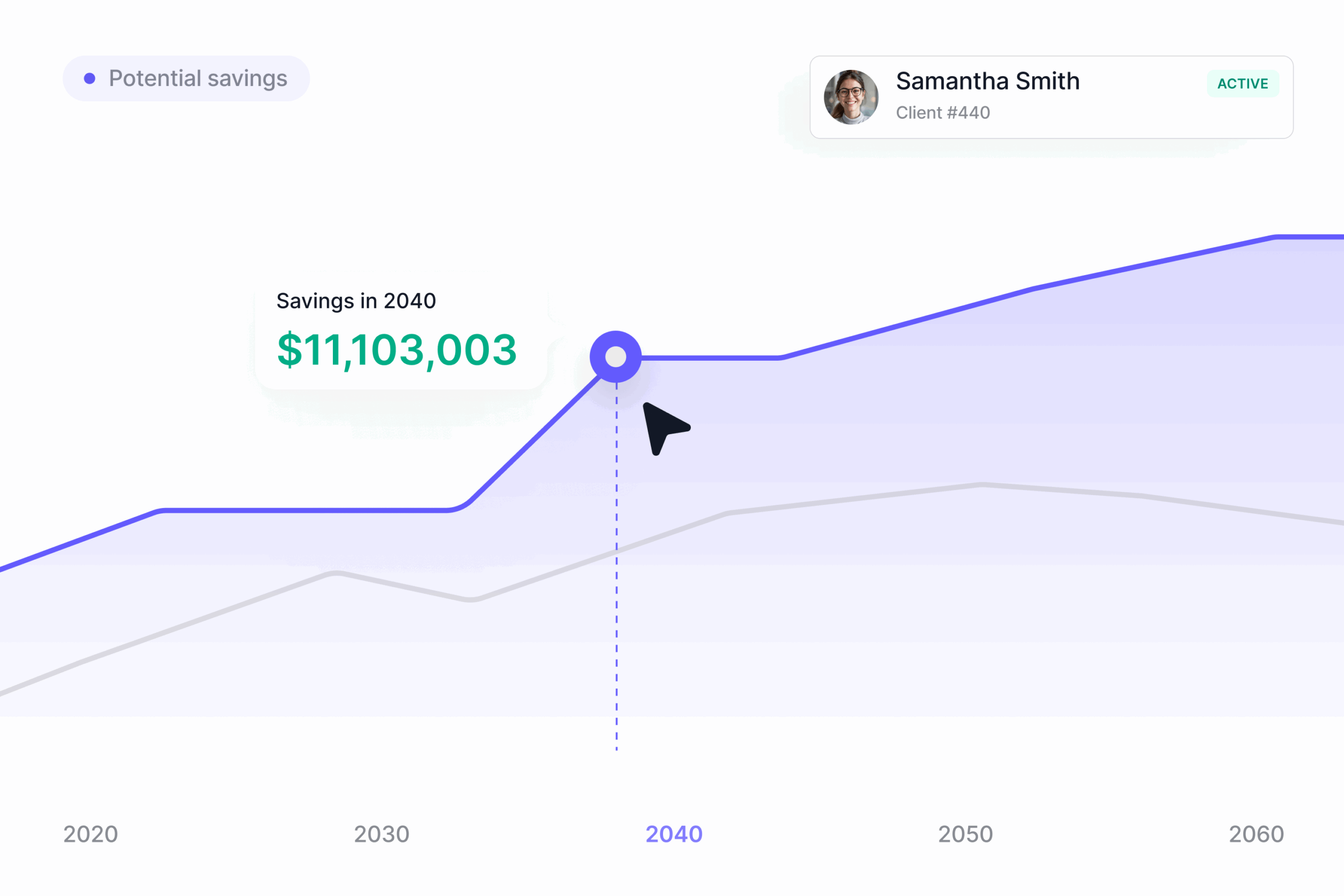

We’ve built a platform to give everyone access to the tax and wealth building tools typically reserved for wealthy individuals with a team of accountants and lawyers. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make things simple. The results are real: We have helped create more than $1.1 billion in additional wealth for our customers. If you would like to learn more, please feel free to explore our Learning Center, check out your potential tax savings with our online calculators, or schedule a time to chat with us!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax