FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

The holding period is when an investor holds onto a stock before selling it. Therefore, it can also be called the “hold period.” Typically, these periods range from minutes, days, or weeks to months and even years.

When stock periods of holding are shorter than one year, capital gains on the stock sale are taxed at a lower rate than incomes from holding it for more than one year.

This type of period also affects how profits or losses on investments are subject to taxation. This period is critical in portfolio construction and asset allocation strategies, as investors must decide how long they plan to hold onto a particular stock.

This period can range anywhere from a few seconds to several years. Day traders often hold stocks for minutes or hours, while long-term investors may keep them for months or years. Ultimately, this type of period depends on the investor’s goals and risk tolerance.

For example, if an investor is looking to make a short-term profit and is willing to accept a higher level of risk, they might hold their stock for minutes or hours. On the other hand, investors looking for long-term growth and want to minimize risk exposure may opt to hold their stock for months or years.

The length of time an investor owns and holds the property determines the period of holding a property. Generally, holding mo for real estate investments ranging from a few months to several years.

For example, if an investor buys a house intending to flip it within six months, their period would be six months.

You can calculate the holding period using the following formula:

Holding Periods = (Stock Sale Date – Stock Purchase Date) / 365

For example, if an investor purchases a stock on April 1, 2020, and sells it on June 15, 2021, this period would be 17 months. You can calculate as follows:

Holding Periods = (June 15, 2021 – April 1, 2020) / 365 = 17 Months

It’s important to note that if the holding period is less than one year, capital gains are subject to a lower tax rate than holding the stock for more than one year.

This type of period is a crucial factor to consider when investing in stocks or other financial assets. It impacts how profits or losses on investments are subject to taxation and can affect an investor’s overall portfolio construction and asset allocation strategies. By correctly understanding the holding period and calculating it, investors can make more informed decisions when developing their investment strategy.

Explore our tax planning tools to reduce your taxable income with the right trust. Access more of our ordinary dividends to know more!

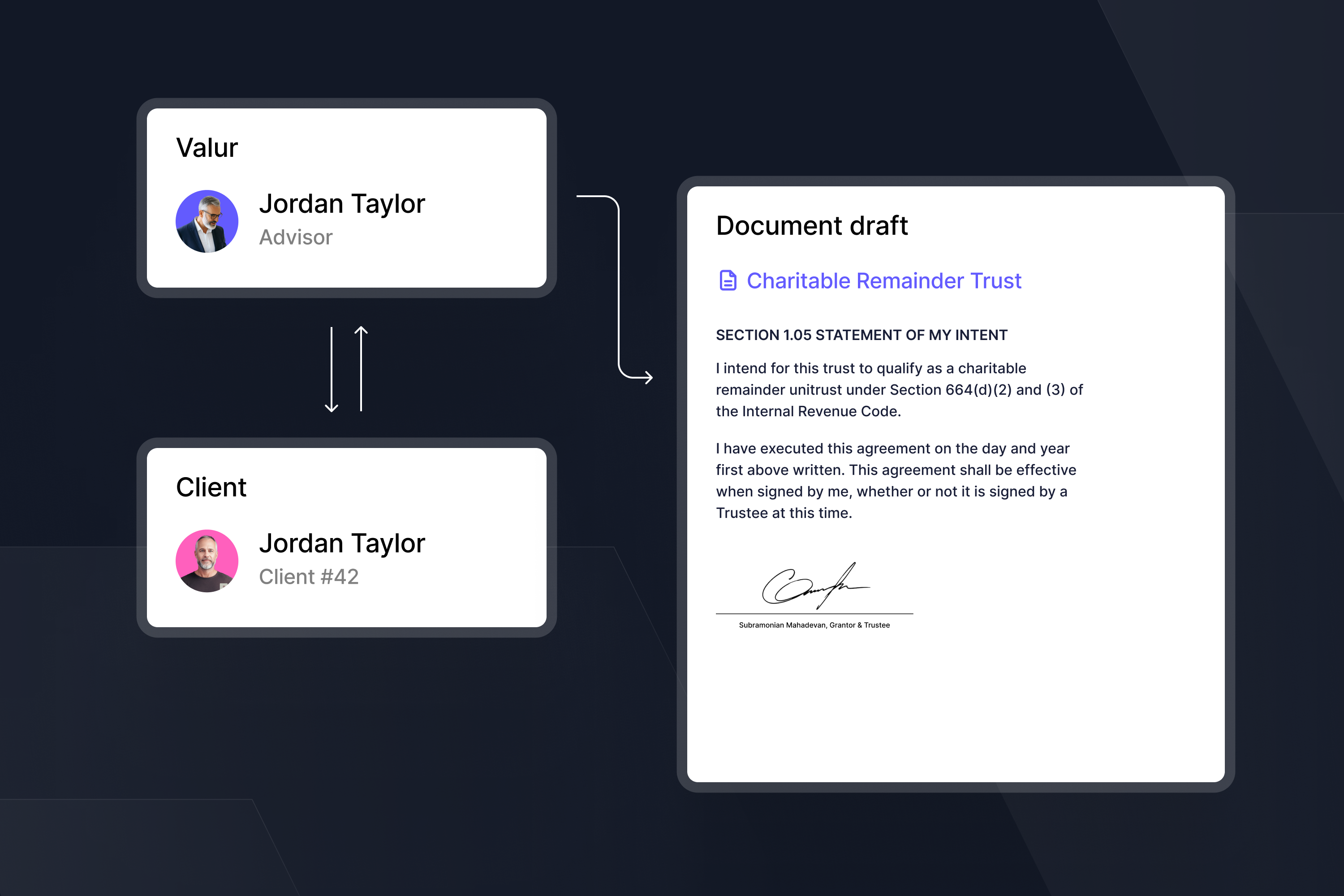

We built a platform to give everyone access to the tax and wealth-building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.