FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

When we started Valur, our singular goal was to give our users the kind of clear, proactive, and actionable financial planning advice typically reserved for people with nine-figure wealth and an army of professionals behind them – lawyers, accountants, and more.

We started by writing. The hundreds of articles in our knowledge library are the result of that effort. We’ve also built half a dozen calculators that can help you get specific: Which tax-advantaged strategy will lead to the highest return, and how much might that be? And those tools work; it’s gratifying to hear every day from people who have found the right tax plan for them just by reading what we’ve put down on paper and using our simple web apps.

At the same time, we’ve also heard some frustration. “These lawyers and accountants have been doing this forever,” we’re told. “Why can’t they make tax planning simpler?” We’re with you — it’s tough to find a centralized source of tax knowledge, and it’s even harder to understand your options when you do, if the only way to do so is by talking to a professional with a vested interest in complicating things.

We want to help you cut through the noise, and we’ve created a tool that can help. With our Guided Planning tool, you can start from first principles. Are you aiming to maximize your family’s wealth during your lifetime, or are you looking to pass significant assets on to the next generation efficiently?

From there, we’ll take you through a series of questions that will help us help you identify the perfect plan. You can explore, learn deeply about, and even compare head-to-head various tax- and estate-planning strategies.

For example, are you expecting a windfall from late-stage startup equity that’s not eligible for the QSBS exemption? With a few more details, we might point you to a lifetime Standard Charitable Remainder Trust. Will you have a very high ordinary income this year, and do you have all of your immediate needs covered? We might lead you to a Charitable Lead Annuity Trust.

The goal here is to help you find the right strategy for your unique circumstances, and to make sure you understand what you’re seeing along the way.

How do we do that? Here are a couple of key facets of the tool.

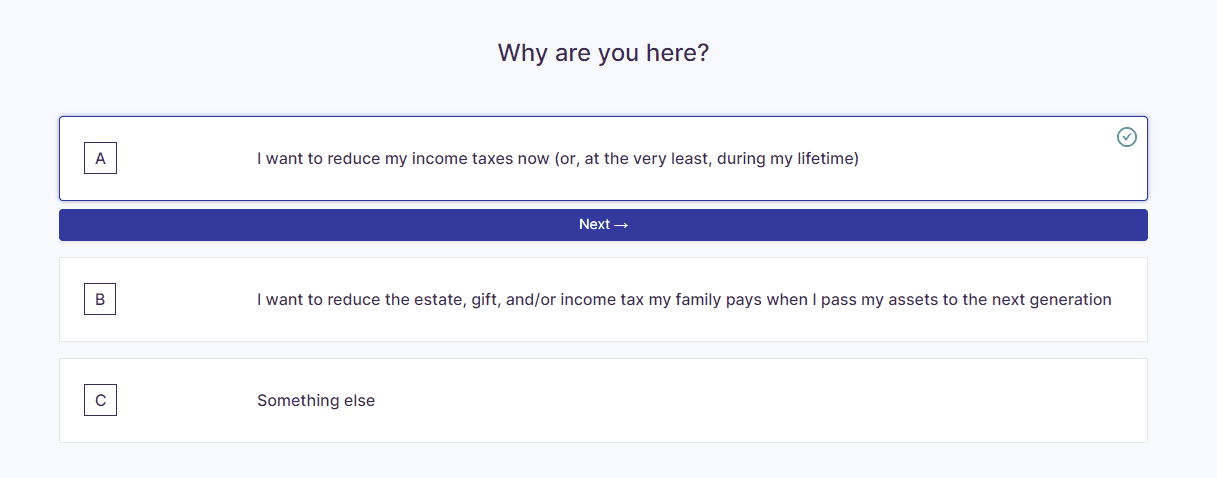

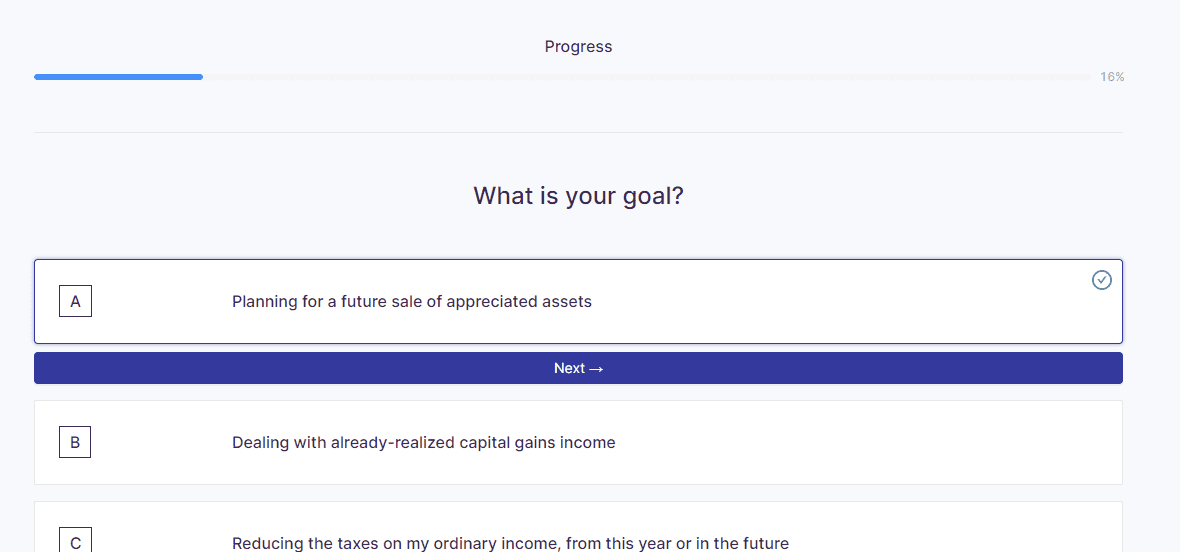

First up is the killer feature I’ve already previewed: Our proprietary tax planning decision matrix. Answer just a few questions about your situation – no more than your goals and a bit about your assets – and we can guide you down the appropriate path.

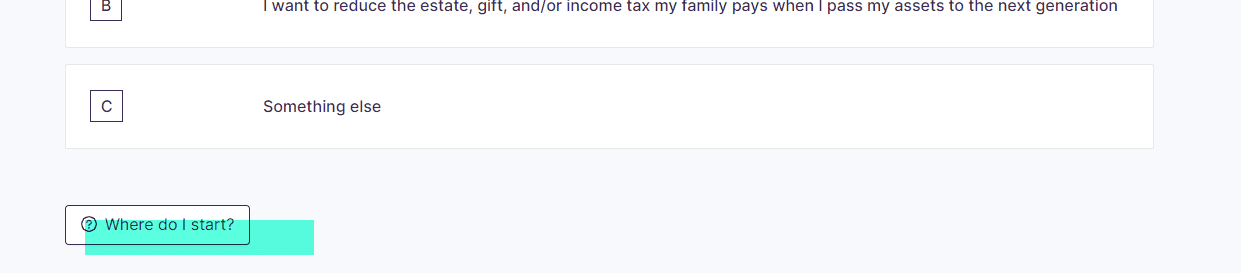

Along the way, we’ve integrated key education materials into the experience. We’ll answer common questions on every screen, and we’ve curated important foundational articles in our rich sidebar .

And if you’re ever lost or unsure, or if you just want the security that comes from talking to an expert, you can reach out via our live chat. It’s staffed by members of our team with collective decades of experience on these questions.

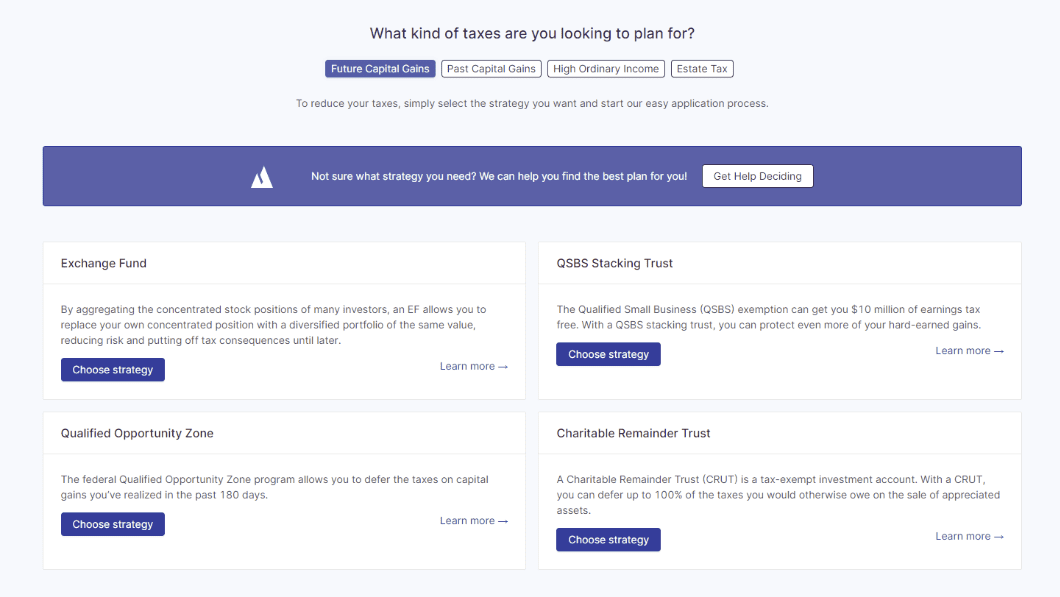

From the menu. If you know what you need – maybe you’re one of the surprising number of users who have already spent hours scouring the internet for information on lifetime Flip CRUTs, or a lawyer or other professional has told you which vehicle to look for – you can short circuit the whole process and get right to setting up your tax-advantaged entity.

Guided decision. But if you’re like most people, you’ll take the time to go through our decision process – because you need to or because you want the peace of mind. You can do that by clicking here to get help deciding. Fortunately, it turns out that in most cases you’ll find that after only a few answers, you’ll reach a conclusion. That’s because there are typically only a few viable choices, and they’re a good fit off the shelf for most people. If you do that, you’ll arrive at our product comparison pages, which give you a detailed look at the pros and cons of each strategy that is a potential fit.

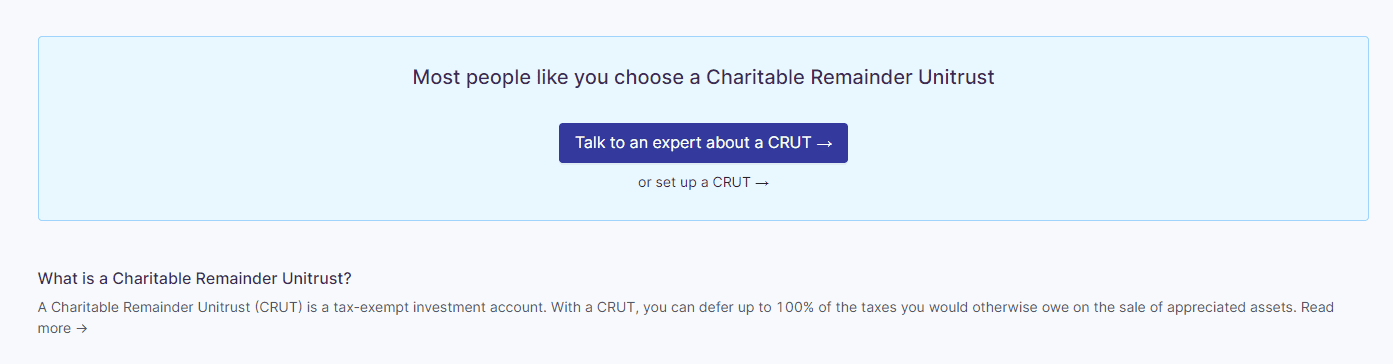

For example, imagine that you’re planning for the capital gains taxes from a future sale of cryptocurrency. In that case, there’s only one option on our menu: A Charitable Remainder Unitrust. If instead you selected a real estate sale, you would be presented with a few choices: A 1031 exchange, a Qualified Opportunity Zone, and a Charitable Remainder Unitrust.

From there, you can select a product. At that point, we find that it typically makes sense to do a quick Zoom chat so we can answer your questions and talk about the way forward. You can book that call right on the platform or at the top of any page on our site. In almost every case, a quick call can help our users level up their understanding and get to a decision.

And that’s it. We hope you find our tax planning tools useful, and we’d love to hear from you at team@valur.io.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!