FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

The gift and estate tax system presents one of the biggest challenges for high-net-worth clients seeking to build lasting, multigenerational wealth. In a significant recent development, the federal gift and estate tax exemption has been increased to a new, historically high level of $15 million per person.

This change, part of the One Big Beautiful Bill Act, replaces the previously scheduled 2026 “sunset” and creates a new window of opportunity. While this is welcome news, the political climate remains uncertain, and future administrations could lower this exemption just as quickly as it was raised. The good news? There’s still a clear path to help your clients “lock in” this generous exemption and Valur can be your partner in doing just that.

The estate tax is a tax on wealth transfers when someone dies. The estates of U.S. citizens and residents are taxed on all their worldwide assets including real estate, retirement accounts, life insurance, and more. The federal estate tax rate is currently 40% on assets in excess of $15 million. When combined with state-level estate taxes, the effective rate can exceed 50% in some parts of the country.

The gift tax is a tax on wealth transfers made during a person’s lifetime. It’s also levied at 40% and shares the same $15 million exemption with the estate tax. This means if you use a portion of your gift tax exemption during your lifetime, your estate tax exemption is reduced by that same amount upon your death.

Furthermore, the generation-skipping transfer (GST) tax applies an additional 40% layer of tax to transfers made to grandchildren or subsequent generations, making strategic planning absolutely essential.

The previous exemption level was set by the Tax Cuts and Jobs Act (TCJA) of 2017, which doubled the then-current amount but included a provision that would cut it in half on January 1, 2026. The recently passed One Big Beautiful Bill Act has superseded that provision, raising the exemption to $15 million. This legislative update reflects a new fiscal direction, but like any tax law, it is subject to future revision by Congress, making the current high exemption a valuable but not necessarily permanent planning tool.

For an individual who would otherwise pass away with more than $15 million in assets, the exemption is worth a minimum of $15 million *0.40, or $6 million in tax savings.

However, the true value is often far greater. This calculation doesn’t account for the future growth of assets removed from the estate or the powerful impact of valuation discounts on lifetime gifts.

For example, imagine Julia, a single 60-year-old businesswoman with a $40 million net worth. If, in 2026, she gifts the full $15 million exemption to a trust for her descendants, and those assets generate 5% annual inflation-adjusted returns with an initial 35% valuation discount, the trust could hold over $95 million (in 2026 dollars) by the time she passes away in 2054. Had she not acted, that wealth would be subject to estate taxes, potentially costing her heirs over $32 million, depending on her state of residence.

Fortunately, there’s a straightforward way for high-net-worth clients to preserve today’s historically high exemption: encourage them to make strategic gifts now. Gifts made today are protected from future “clawbacks,” meaning the IRS cannot retroactively apply a lower exemption level to gifts made under the current $15 million limit.

For most clients, trusts are the ideal vehicle for locking in this exemption. They offer tax efficiency, asset protection, and long-term control making them a powerful tool for multigenerational wealth transfer. But evaluating and implementing the right trust strategy can be complex.

That’s where Valur comes in.

With our platform, you can:

Typically, people use trusts to make large gifts. Trusts are creditor protected and tax efficient, among other advantages. Valur’s in-depth articles and Guided Planner can help you decide which type of trust is right for you but here are an overview of commonly used vehicles you can use before 2026 to minimize your estate taxes.

You can also compare the quantitative returns and tax savings of these different strategies using our estate tax savings calculator and customize it to your own situation

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

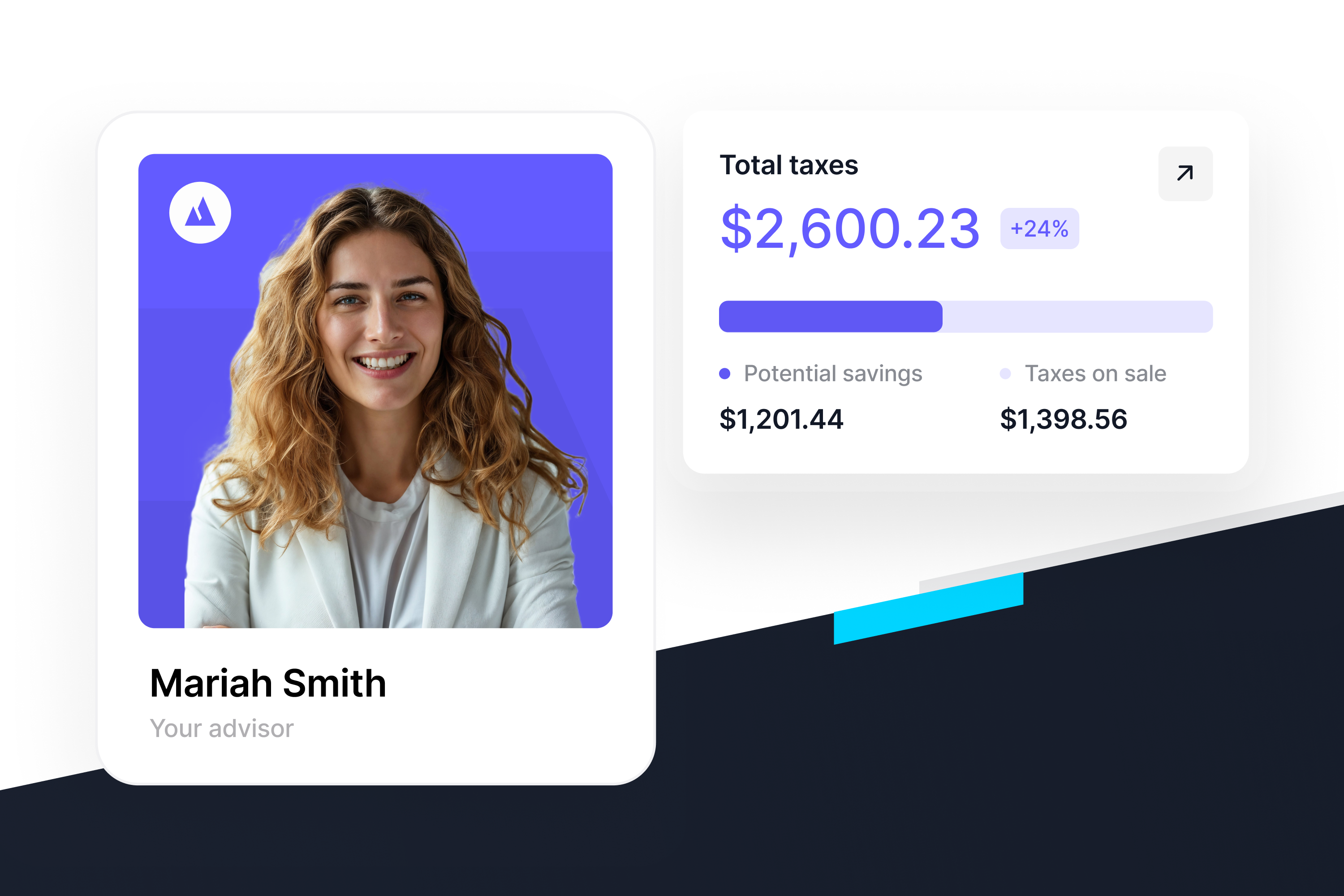

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax