FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A gain is an increase in net worth. Most often, this concept appears as income that is greater than expenses. This gain can be from various sources, including but not limited to investments, salary, and business profits.

In accounting, a gain is an increase in net worth. It can be due to various factors, such as investments, income, and profits. Therefore, it’s essential to keep track of them and losses to understand a company’s financial status accurately.

In the United States, gains are taxed as income. Therefore, any increase in net worth is subject to taxation. Therefore, keeping track of all income and profits is essential.

Gains can be a great source of income, but it’s essential to understand the tax implications before taking action. Consult with a tax professional if you have questions about how these may affect your taxes.

Compounding gains are when the earnings from an investment are reinvested back into the investment, allowing the initial payments to generate revenues. These can create a snowball effect, leading to larger and larger profits over time. While compounding gains can be a great way to grow your money, it’s essential to understand the risks involved.

Make sure you research before investing any money into a compounding scheme if you’re looking for a way to grow your money. Make sure you understand the risks involved, and consult with a financial advisor if you have any questions.

Want to learn more definitions? Check out our previous post on Fee Income!

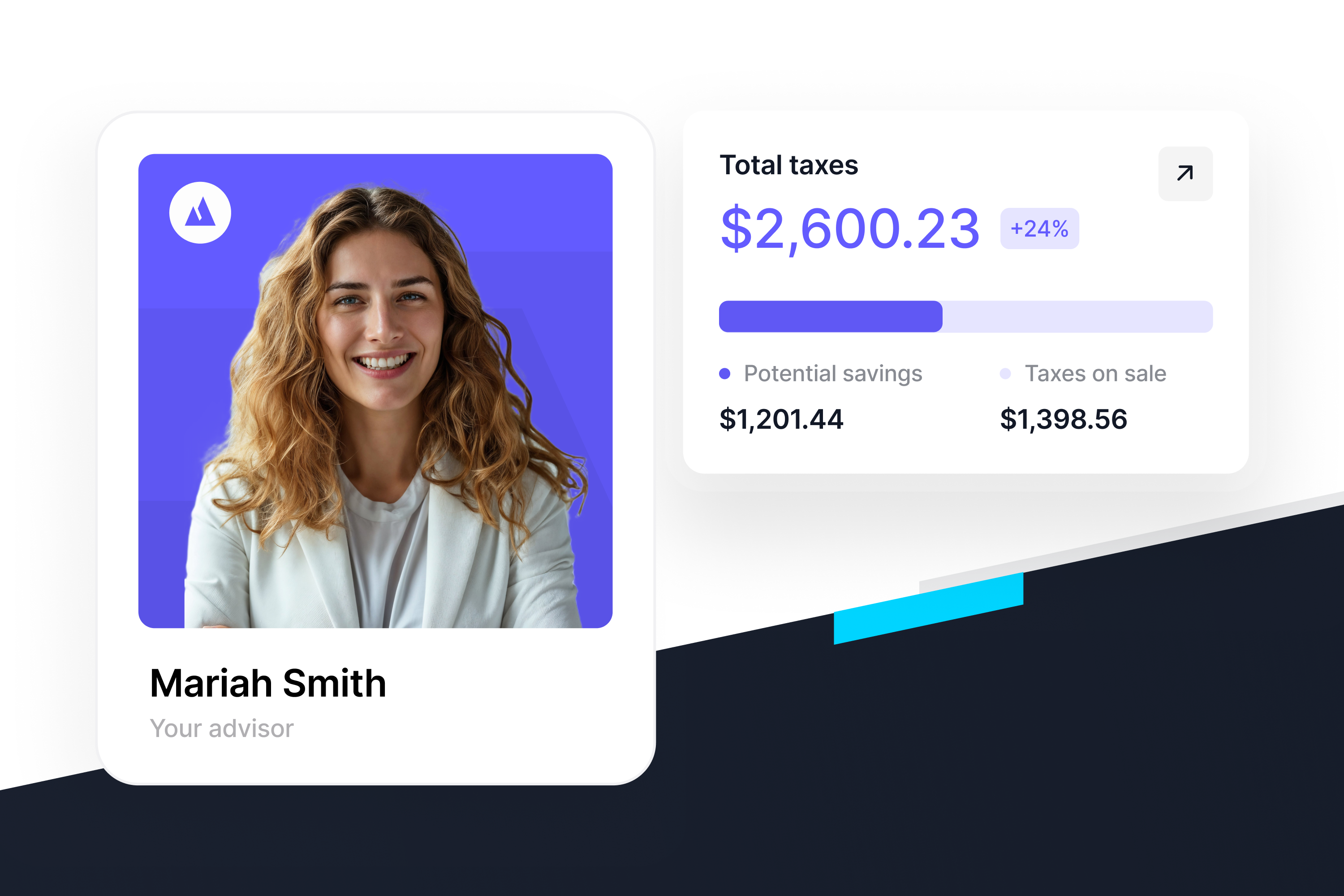

We built a platform to give everyone access to the tax and wealth-building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.