FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A fixed amount is a fixed amount of money or percentage deducted from each payment, regardless of how much the employee makes. This fixed percentage helps to fund retirement savings plans, such as 401(k)s. Employees may also contribute a fixed rate of their income to other savings or investment accounts.

The fixed percentage is relevant for investment accounts or savings because it allows employees to save money regularly. In addition, each payment can automatically deduct this percentage, making it easy for employees to save money without worrying about making monthly or annual contributions.

Are you wondering how this percentage would affect your savings? Calculate your investment tax deductions with our calculator. Or read more definitions to get a better idea.

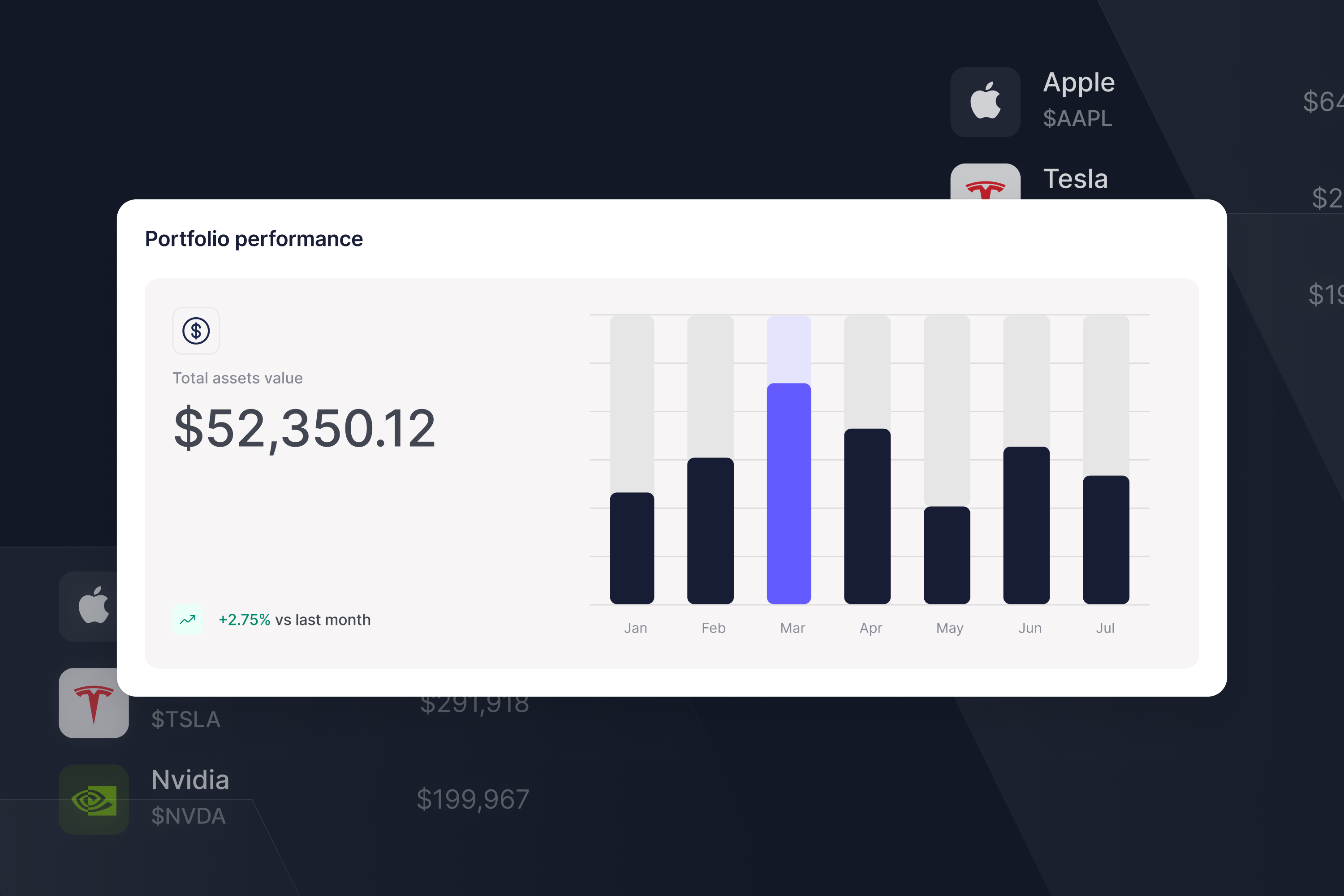

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Founder & CEO

Mani is the founder and CEO of Valur. He brings deep financial and strategic expertise from his prior roles at McKinsey & Company and Goldman Sachs. Mani earned his degree from the University of Michigan and launched Valur in 2020 to transform how individuals and advisors approach tax planning.