FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Fee income is a type of revenue banks earn from fees charged on services and products. The most common type of fee income is banks’ charges on loans and credit cards. Other expenses that banks may charge include account maintenance, overdraft, and ATM fees.

The bank and the customer earn fee income on loans and credit cards. The bank makes the fee for providing the loan or credit card, and the customer acquires the fee for using the loan or credit card. Credit unions also earn fee money.

In addition to earning an income from loans and credit cards, banks also earn fee money from other services and products. One common type of service that banks offer is account maintenance. Banks may charge a monthly fee for checking or savings accounts or other services such as online banking or paperless statements.

Overdraft fees are standard fees banks charge. For example, if a customer overdraws their account, the bank may charge a fee for the overdraft. Banks may also charge a fee for using an ATM not owned by the bank.

Fee-based income is a type of income that banks earn from fees charged on a pre-determined basis. This fee money comes from account maintenance, overdraft, and ATM fees.

Banks use fee base income to help offset the cost of providing products and services and increase their profits. In recent years, bank fee base income has become an increasingly important source of revenue for banks. This is due, in part, to the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. This act placed restrictions on the amount banks could charge for debit card transactions, which has led to a decline in revenue from this source.

Despite this decline, bank fee base income remains an essential source of revenue for banks. In fact, according to a report by the Federal Reserve Bank of Cleveland, bank fee base income accounted for more than one-third of all bank revenue in 2015. Therefore, it demonstrates how important it is for banks to focus on generating fee base income.

Banks make money from fees by charging customers for services and products. For example, banks charge the most common fee on loans and credit cards.

This income can be seen as a debit because it is a charge for a service.

Want to learn more definitions? Check out our previous post on what Non-interest income is! Or calculate your income and tax deductions you could achieve with our online wealth tools.

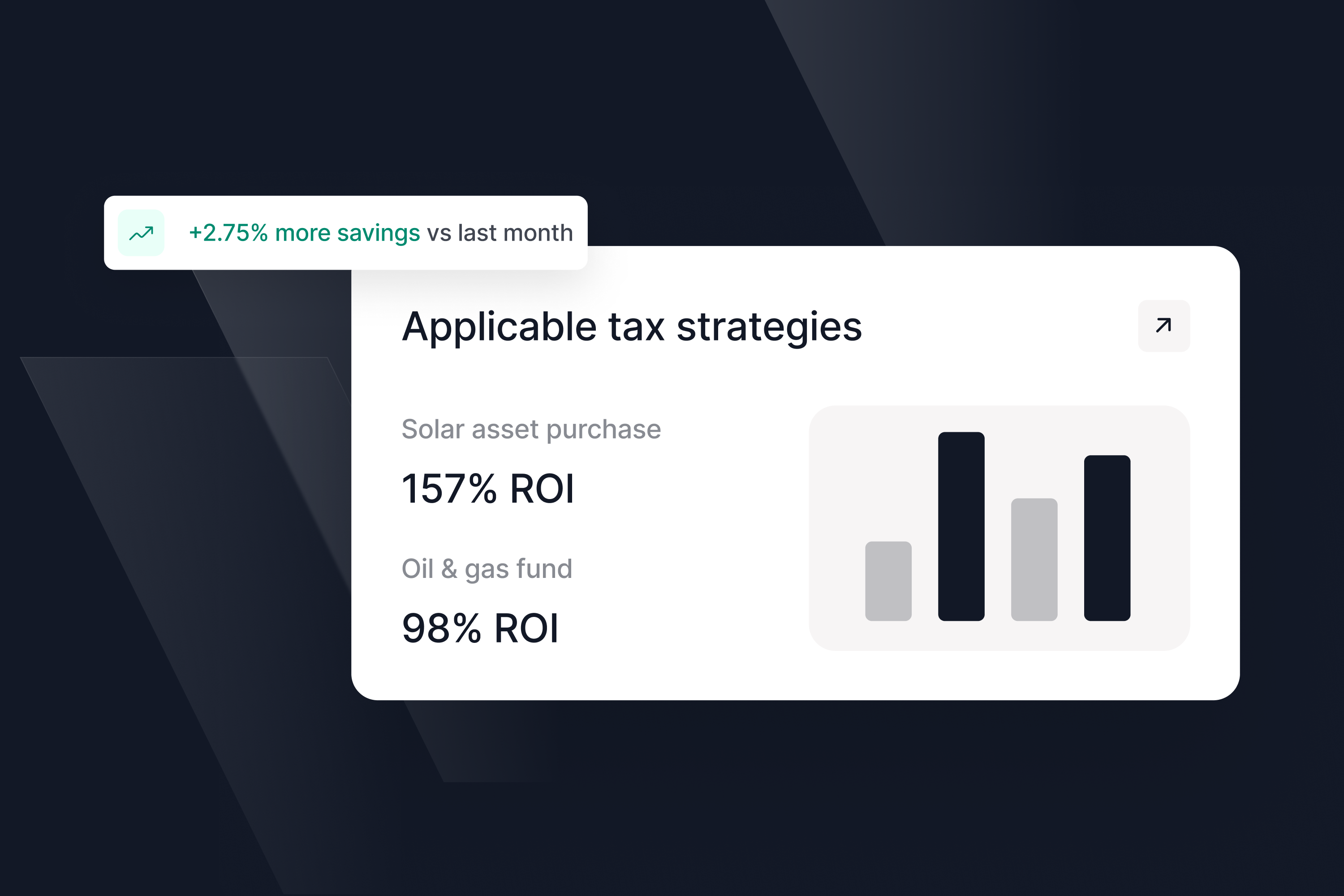

We built a platform to give everyone access to the tax and wealth building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard to access tax advantaged structures so you can build your wealth more efficiently at less than half the cos of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.