FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A Crummey trust is a type of irrevocable trust that is designed to receive gifts that use up the donor’s gift-tax annual exclusion. Creating and funding a Crummey trust is a simple way for individuals to set aside assets for their heirs while minimizing their future estate-tax exposure. In this article we’ll explain how Crummey trusts work, provide some background on estate and gift taxes, and walk through why people use Crummey trusts.

Crummey trusts are a lot like other irrevocable trusts. Each Crummey trust has a “grantor” who funds the trust, a trustee who manages the trust, and a beneficiary who benefits from it. The trustee of a Crummey trust is usually a family member or friend of the grantor, though it can be the beneficiary if he or she is an adult. The assets gifted to the trust are invested in stocks, bonds, or other investments. If the grantor consistently gifts to a Crummey trust for the benefit of a minor, there’s a good chance that there will be enough money in the trust by the time the beneficiary reaches adulthood to buy a house — or at least make a significant down payment on one. Gifts to a Crummey trust are structured so that they don’t use the grantor’s lifetime gift-tax exemption, and yet the assets in the trust are able to grow outside of the grantor’s estate.

What sets a Crummey trust apart from any other irrevocable trust is that it gives the beneficiary a temporary right (usually lasting 30-60 days) to withdraw amounts gifted to the trust that year. This temporary withdrawal right, known as a “Crummey power,” is what qualifies the annual gifts for the gift tax’s annual exclusion (discussed in more detail below). If the beneficiary is an adult, he or she will receive formal notice (a “Crummey notice” or “Crummey letter”) of the gift. Typically, the beneficiaries don’t actually withdraw the money, which remains in the trust after the withdrawal period ends, but they can.

Most people have heard of the federal estate tax. When a U.S. citizen or resident dies, the federal government imposes a 40% tax on the person’s net worth in excess of the estate-tax exemption amount. In 2025, the exemption amount is $13.99 million per person, though it’s scheduled to be cut in half on January 1, 2026.

Most people aren’t going to leave their heirs millions of dollars. But for those that do, the estate tax is a big deal. In 2024, a $14.61 million estate will owe $248,000 of estate tax (0.40 * ($14.61 million – $13.99 million)), a $23.61 million estate will owe $3.84 million of estate tax (0.40 * ($23.61 million – $13.99 million)), and a $63.61 million estate will owe $19.8 million of estate tax (0.40 * ($63.61 million – $13.99 million)). A number of states impose their own estate taxes as well, bringing the combined federal/state estate tax rates to as high as 52% in some parts of the country.

The gift tax is essentially a mirror image of the estate tax, except it applies to gifts made during the giver’s lifetime (the estate tax applies to transfers made upon an individual’s death). The gift tax and the estate tax share a single exemption amount. So, to the extent that you use gift-tax exemption during your lifetime, you reduce the estate-tax exemption that you have left over when you die. Because of this, if you think that you might owe estate taxes in the future, you have to be strategic about how you use your lifetime gift-tax exemption.

One way to conserve your lifetime gift-tax exemption is to take advantage of the gift tax’s “annual exclusion.” The annual exclusion is the amount that you can give a particular beneficiary without using any of your lifetime gift-tax exemption. In 2025, the annual exclusion is $19,000 per beneficiary. That means that if you have three kids, you can give each kid $19,000 per year, for a total of $57,000, without touching your $13.61 million lifetime exemption amount. If you’re married, your spouse can also gift $19,000 per year to each child. In some cases, people will choose to make annual exclusion gifts to their children and no one else. In other cases, they’ll make gifts to their children and grandchildren. Some people will make gifts to their parents or siblings. You can even make gifts to your friends.

The key thing to understand is that, even though these annual gifts may only comprise a small share of your total assets, they can really add up over time. The assets in the trust will be outside of your estate for estate-tax purposes, which means as these assets are reinvested, the growth won’t face gift tax or estate tax. Simply put, the more of your assets you are able to get out of your estate during your lifetime, the less tax your heirs will owe.

For example, imagine a married couple based in New York City with three children, a high income, and a net worth of $5 million. If they set up Crummey trusts for their children, make gifts to those trusts each year, and then die 25 years later, they’ll have saved their children about $5.5 million of estate taxes and pass on all that instead to their kids (assuming roughly 9% annual investment returns). If they instead live 50 years, then by simply setting up and funding Crummey trusts, they’ll have saved their children about $53.5 million of estate taxes!

There are four common ways to use annual exclusion:

Need some help to understand how Crummey Trusts can help you save taxes?

Crummey trusts have a number of advantages relative to these other approaches, including for people who are not particularly concerned about the estate tax. But for people who are concerned about the estate tax, Crummey trusts are a no-brainer.

Here are five reasons to set one up:

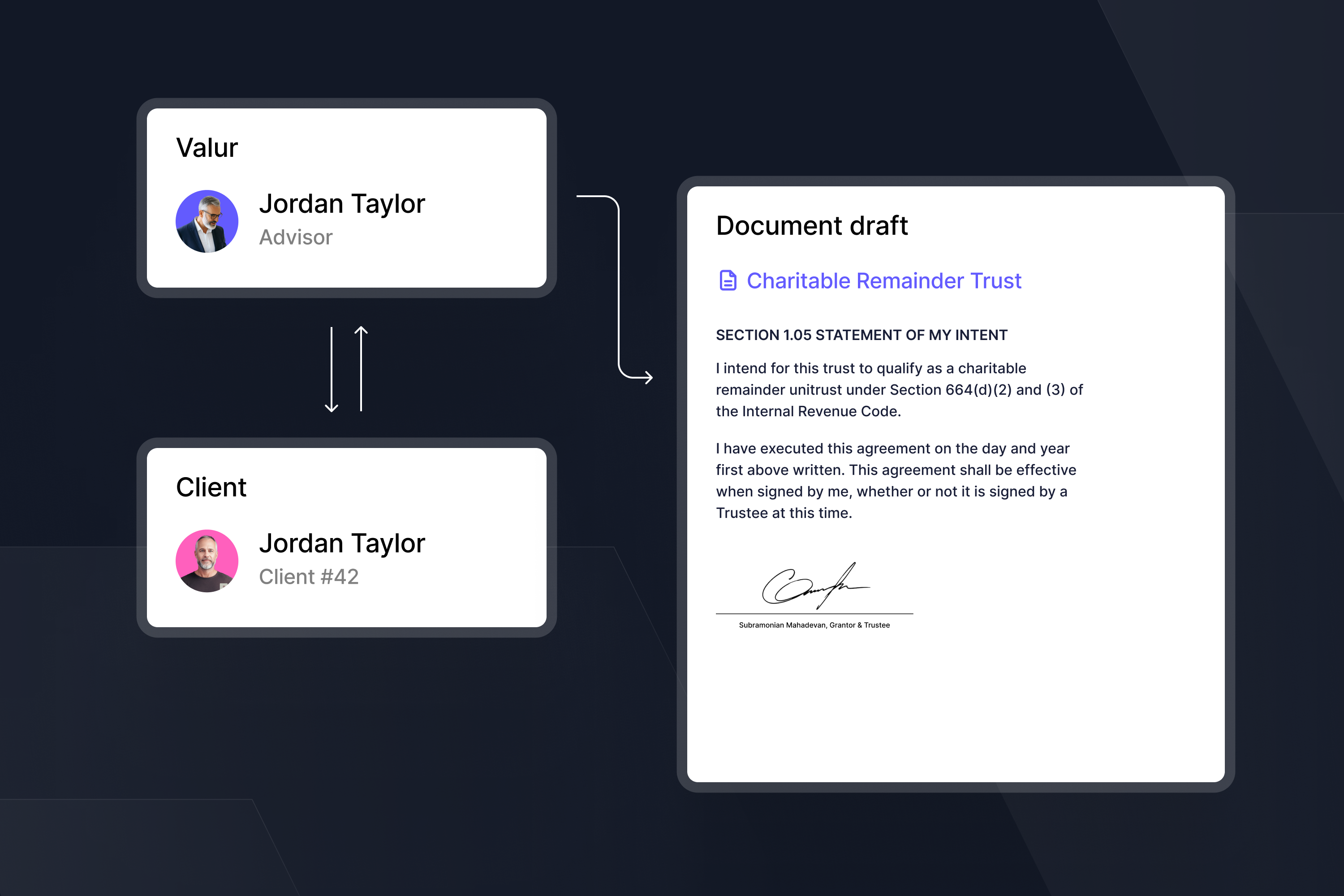

Before Valur, the biggest barrier to setting up a Crummey trust was the expense. Law firms typically charge between $5,000 and $15,000 to set up a Crummey trust. In contrast, most other approaches to making annual exclusion gifts are basically free, at least for the initial set-up. Fortunately, with Valur setting up a Crummey Trust is also free.

A Crummey trust’s ongoing administration costs may be higher than that of a custodial account but the estate-tax savings from setting up a Crummey trust easily justify that expense. But if you’re not worried about estate tax, you may decide that the ongoing administration costs don’t justify the other benefits.

Crummey trusts are among the simplest trusts. They generate almost no filing requirements: They’re usually set up as “grantor trusts,” which means they don’t need to file lengthy income-tax returns, and as long as the grantor sticks to making annual exclusion gifts, gift tax returns don’t need to be filed. Often, the trustee of a Crummey trust will invest in some combination of stocks and bonds, which keeps the investment side simple as well.

Many people like the idea of making small, recurring gifts rather than a few large, one-time gifts. These small gifts are relatively painless and non-disruptive to the donors making them.

For someone with less than $10 million, setting up a Crummey trust for each of their heirs may be all the estate-tax planning they need to do. But for someone with a higher net worth, Crummey trusts by themselves may be insufficient. For those higher-net-worth individuals, a Crummey trust can be paired with more advanced techniques, like intentionally defective grantor trusts, non-grantor trusts, and irrevocable life insurance trusts that hold private placement life insurance.

Crummey trusts are a popular estate-tax-planning tool. They allow individuals to pass wealth to their heirs without using any lifetime gift-tax exemption. The estate-tax savings from setting up a Crummey trust can reach into the millions of dollars. Crummey trusts also protect assets from creditors and prevent beneficiaries from getting enormous lump sum payments at a young age. These trusts should be a key component of any family’s tax-planning repertoire.

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!