FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Two of the most important questions customers often ask us is “How much does a charitable remainder trust cost?” and, just as importantly, “How does it compare to the competition?” In this article we are going to explain the key charitable remainder trust expenses, what Valur charges , and how Valur compares to the competition!

Each layer of tax and estate planning will typically cost you something. So what are the various charitable remainder trust expenses you need to be concerned about? Let’s outline each of them below:

Below we’ve included the costs for Valur and some of the most popular trust administration companies to show you how we stack up to them. These providers offer a variety of services but we’ve exclusively outlined the basic costs for charitable remainder trust administration.

| Company | Minimum Annual Fee | First $1 million | First $5 million | Above $5 million |

|---|---|---|---|---|

| Valur | $1,500 | 0.25% | 0.25% | 0.25% |

| J.P. Morgan | $15,000 | 0.55% | 0.55% | 0.35% |

| Charles Schwab | $5,000 | 0.50% | 0.50% | 0.25% |

| Northern Trust | $20,000 | 0.40% | 0.40% | 0.20% |

| Wilmington Trust | $8,000 | 0.60% | 0.40% | 0.25% |

Valur is clearly one of the lowest cost solutions in the market when it comes to trust administration. But those are only the costs for trust administration, how much does it cost to set up a charitable remainder trust as well? Let’s see what that would look like with a real customer example.

Let’s run through a realistic example of what it would cost a customer to set up and administer their Charitable Remainder Trust. Assume this individual is selling their business for $8 million.

| Company | Trust Education & Formation | Annual Trust Administration | Total First Year Costs |

|---|---|---|---|

| Valur | $0 (included in our services) | $20,000 | $20,000 |

| J.P. Morgan | $15,000* | $38,000 | $53,000 |

| Charles Schwab | $15,000* | $32,500 | $47,500 |

| Northern Trust | $15,000* | $26,000 | $41,000 |

| Wilmington Trust | $15,000* | $29,500 | $34,500 |

Typical attorney cost ranges from $10,000-$25,000. We are not indicating that these firms will provide you with a lawyer or services, only that by using them you’ll likely incur those costs with a lawyer directly.

In this situation, on a trust expected to last 50 years (average for a 30 year old) the higher Charitable trust administration costs from JPMorgan could ultimately cost this customer more than $10 million dollars in lower distributions for them and their family.

As you can see our integrated model enables us to set up, administer and offer these structures to you at a significantly lower cost and over time these saved fees really add up and cost you and your family. Not only do we provide more services at a cheaper price but we make a point to provide these services at a higher quality.

Our team at Valur makes it a point to make setting up and administering CRTs seamless for you all at a lower cost compared to the competition.

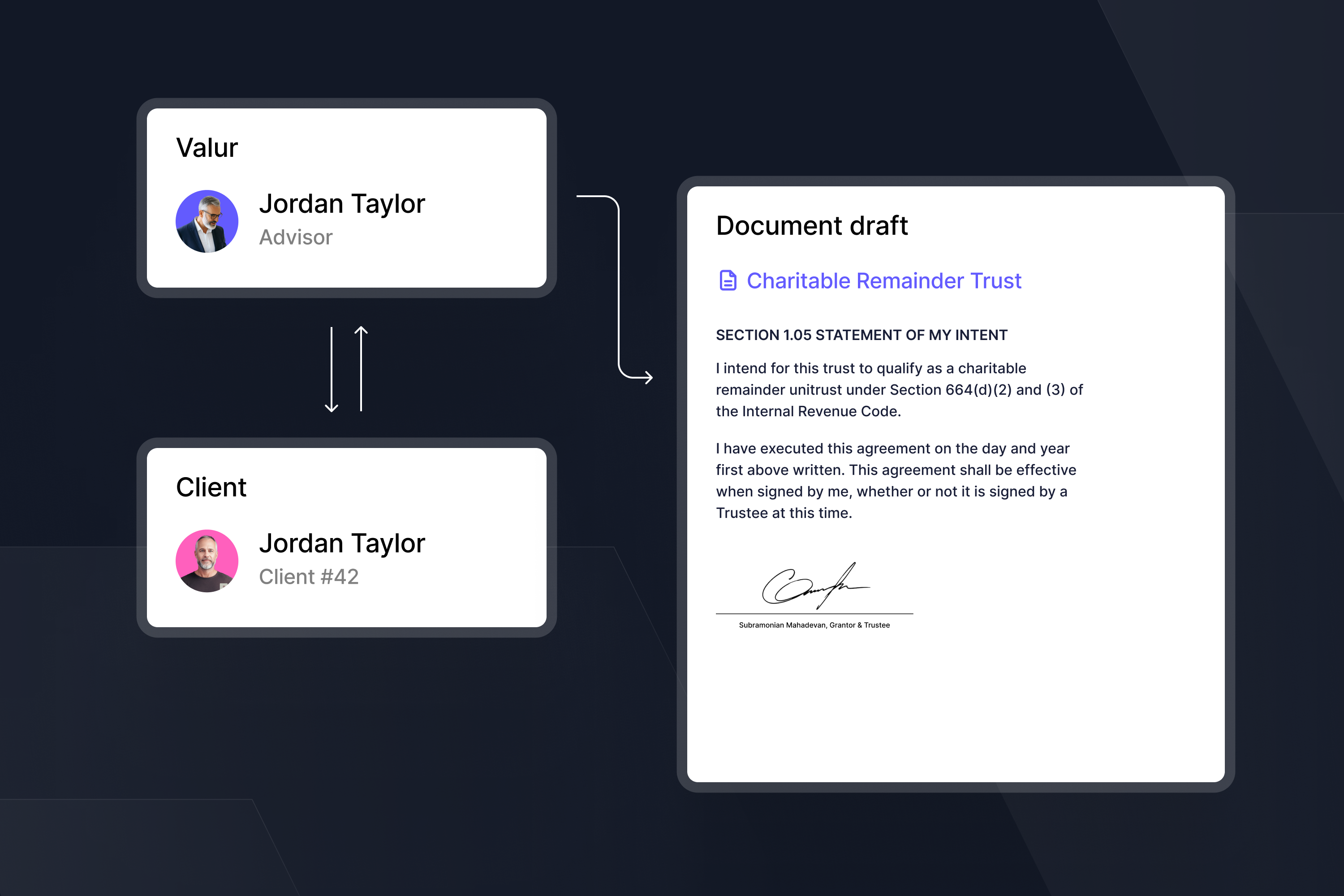

When compared to the competition, Valur offers a valuable Charitable Remainder Trust at the lowest cost. All while managing every step of the process from deciding which trust to setup, creating the trust documents and setting it up and administering your trust. People often ask us how we are able to do this. It comes down to our proprietary technology platform which automates our offerings instead of relying upon expensive lawyers and trust administrators.

Access – at no cost – our easy-to-use calculator to evaluate the potential return on investment given your situation. And if you have any questions, contact us through our chat button below, or schedule a meeting with our team.

We’ve built a platform to give everyone access to the tax and wealth building tools typically reserved for wealthy individuals with a team of accountants and lawyers. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make things simple. The results are real: We have helped create more than $3 billion in additional wealth for our customers.

If you would like to learn more, please feel free to explore our Learning Center, check out your potential tax savings with our online calculators, or schedule a time to chat with us!