FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

One issue that has been making waves in Washington in recent years is the taxation of carried interest. Today, the rules for taxation of investment partner compensation — and, in particular, compensation in the form of a share of investment profits, or carried interest — create a tax-savings opportunity. By taking a portion of compensation as carry, investors can convert earnings that might otherwise be ordinary income into long-term capital gains. And that makes a big difference. For a Californian or New Yorker, it could lower the effective tax rate on that income from 50% to 35%!

This may all change soon. Congress has considered reforming carried interest taxation — “closing the carried interest loophole” — many times over the years, and specific reforms even made it into an early draft of the Inflation Reduction Act that became law in 2022. So what does all this mean for investors, and particularly for the General Partners (GPs) who derive much of their income from carried interest? In this article, we discuss taxation of carried interest and how to plan for potential changes.

Fund managers are often compensated in part with “carried interest” in their funds. “Carried interest” is a a type of profits interest commonly seen in private equity funds, venture capital funds, and hedge funds. It is a way for limited partners or LPs (the primary investors in investment funds) to incentivize GPs to invest in ways that generate superior risk-adjusted returns. The better an investment fund performs, the more profits GPs generate for themselves and the LPs, and the happier everyone will be.

Carried interest can be structured in a number of different ways:

Let’s analyze a specific example of how a carried interest clawback might play out in practice!

Let’s say a fund is doing well in its early years, and is on track to deliver a 10% return compared to its 8% hurdle. The fund might distribute carry out to its GPs early before the fund closes. However, if by the end of the fund it has only returned 5%, the LPs may be entitled under the terms of their investment agreement to “claw back” a portion of the carry paid to the GPs to cover the shortfall when the fund sunsets. This clawback provision is a key part of the argument as to why carried interest isn’t taxed as ordinary income.

Carried interest is currently treated as capital gains, which means that it is taxed at a lower rate than ordinary income. This tax treatment has become highly controversial. Some argue that it is unfair that certain fund managers are taxed at capital gains rates on income that is essentially compensatory in nature. Opponents of the current tax treatment argue that carried interest should be taxed as ordinary income. However, supporters argue that this tax treatment encourages investment, which in turn spurs economic growth. Further, supporters argue that the classification of carried interest as capital gains is not a loophole, because investors with carried interest are taking on real risk.

The debate over carried interest is likely to continue in the years ahead, as lawmakers seek ways to reduce the federal deficit and pay for other priorities. We’ve even seen prominent firms like Sequoia Capital change their fund structures and distribution plans to mitigate the risk of higher taxes from potential legislative changes.

The so-called carried interest loophole has been a political hot topic since 2007, and legislation that would increase the tax rates on carried interest has been on the brink of passage multiple times since then, including this year. In 2017, as part of the Tax Cuts and Jobs Act, Congress raised the threshold for qualifying as carried interest. The case for further tightening these rules is primarily about optics: it’s good politics to say that you’ve increased taxes on wealthy fund managers and passed the revenue on to another, more needy constituency.

So why hasn’t Congress changed these rules? Two reasons:

At the same time, the political winds are changing. Efforts at progressive redistribution have been successful since the Democrats took power — witness the recent federal student loan forgiveness — and carried interest reform has gotten more positive press in the latest debates in Congress. With those developments in mind, it’s smart to plan for a world in which the tax treatment of carried interest becomes less favorable.

Proactive firms have pursued a couple of solutions that are worth considering.

The most effective way to get ahead of potential reforms is to distribute carry before any rule changes come into effect, so that the distributions will be taxed under the current rules. It’s not typically possible to distribute proceeds before they’re liquid, but some firms have come up with a clever solution. By distributing fund investments to a new SPV now, the distributions may be taxed as long-term capital gains under the current rules, even if the carried interest rules change in the future.

To be sure, distributing carry proceeds to an SPV can create a taxable event today, whereas waiting for later distributions allows you to defer the gains. The tax rate could be lower, but this is a trade-off that may or may not make sense depending on the size of the expected gain and your liquidity timeline. The greater the asset appreciation that is expected to happen after carried interest reforms, the more valuable this option may be.

This isn’t an option that’s necessary to implement today; a firm can choose to take this step if and when the carried interest rules change. But it is worth noting that firms like Sequoia are starting to make precisely these plans.

Preemptive distribution of shares requires serious foresight. It’s not worth doing unless the taxation of carried interest changes, and once reform legislation is approved, it’ll be too late.

There is, however, another strategy for reducing the tax on carry even after any reform is enacted: Early distribution of investment proceeds. Typically, GPs wait to distribute the proceeds from an investment until there is a liquidity event, like an acquisition or IPO. If the carried interest loophole closes, though, we may see LPs and GPs begin taking distributions earlier. Distributing shares earlier enables all of the post-distribution appreciation to be tax as capital gains, while simultaneously limiting the ordinary income tax exposure to the initial distribution value. It will incentivize firms to distribute shares when the shares have a lower value (and therefore a lower cost basis for the purpose of capital gains taxation).

The challenge with distributing shares early is estimating the exit value of these investments and correctly allocating the profits to LPs and GPs. While clawback provisions can help, they are unlikely to work for investment firms without long relationships with their LPs.

In the meantime, there are a number of ways that investors can save money on their carried interest taxes simply by taking advantage of carried interest’s structure. All of these typically center around transferring the carried interest out of your name when a new fund is formed, in order to take advantage of carry’s low cost basis before any investments have been made. The solution typically depends on where you live and if you are focused on income tax planning or estate tax planning.

Sometimes fund principals have the investment fund distribute shares of the underlying investments (instead of the proceeds of the sale of those assets) to the fund principals. It gives you more flexibility to take advantage of more tax-advantaged planning, like QSBS stacking and Charitable Remainder Trusts, among other options.

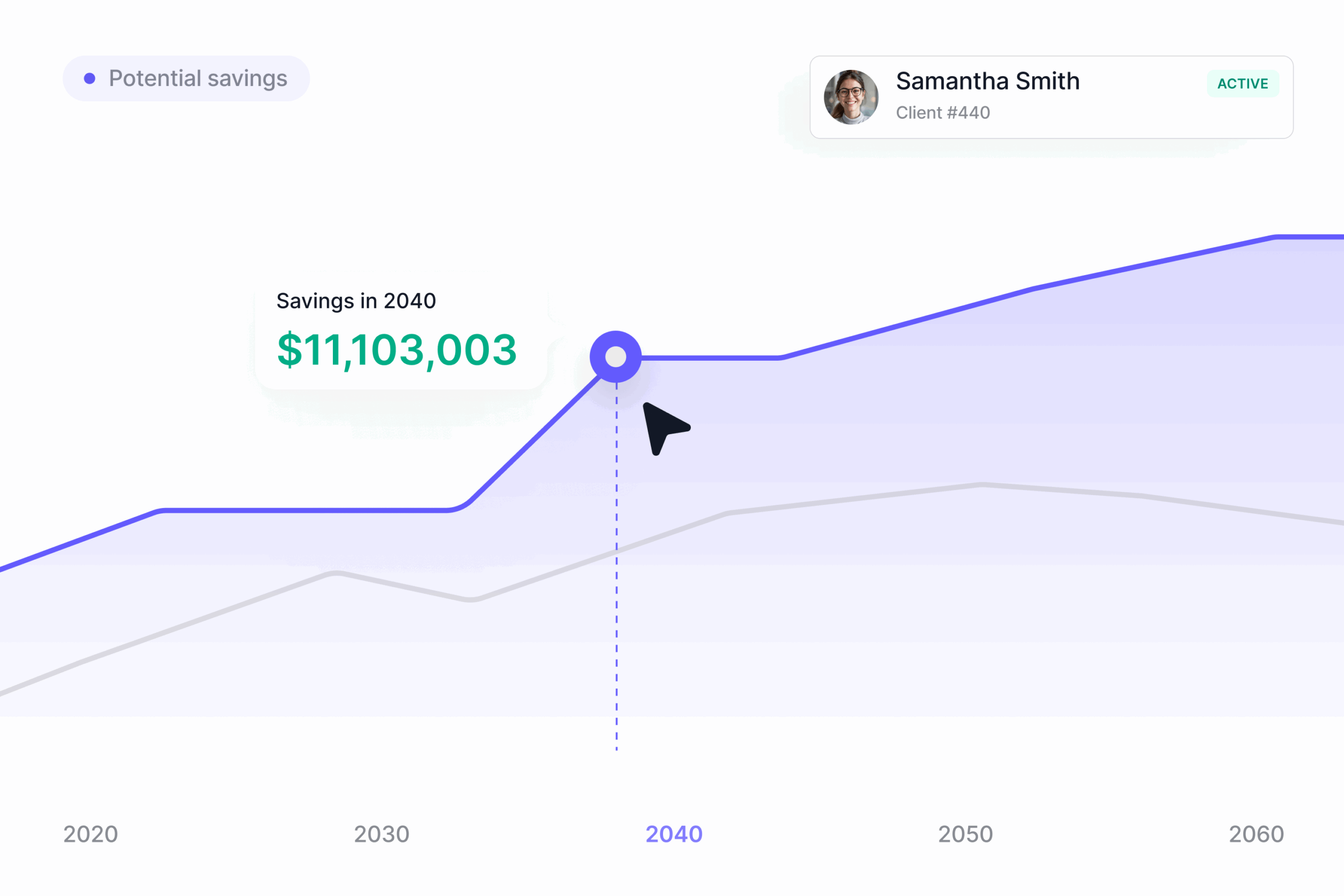

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!