FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

When gifting assets to an individual or a trust, asset selection is extremely important. Selecting the proper asset can increase the amount of wealth that the donor’s beneficiaries receive while also safeguarding the donor’s quality of life. This article explains what factors to consider when you’re using gift-tax exemption to make a gift to an intentionally defective grantor trust (IDGT) or a non-grantor trust.

When an asset is transferred to a trust that is outside of the donor’s estate for estate-tax purposes, the asset’s future appreciation occurs outside of the donor’s estate. For example, if you transfer an asset when it has a value of $1 million, and the asset is worth $10 million five years later, you’ll have transferred $10 million to your beneficiary while using only $1 million of your lifetime gift-tax exemption. That’s an efficient use of your gift-tax exemption! On the other hand, if you transfer a $1 million asset to a beneficiary, and in five years it’s worth only $800,000, you’ll have used $1 million of your lifetime gift-tax exemption but transferred only $800,000 to your beneficiary. That’s not efficient!

An asset’s expected appreciation potential is probably the most important single factor to consider when selecting target assets. If a 40-year-old gifts a $1 million asset to a trust for her kids, and that asset generates 12% annual returns for the rest of her life, it will be worth $289 million when she dies at age 90. Her heirs’ estate-tax savings will be in the nine figures. If she had instead gifted a $1 million asset that generated 5% annual returns, it would be worth just $11.5 million upon her death — a huge difference. This makes bonds and other generally lower-returns assets less attractive targets for gifting.

Note that for gifts to grantor trusts like IDGTs, what matters most is the asset’s expected pre-tax value, since the grantor is able to pay the trust’s taxes, but for gifts to non-grantor trusts or individuals, what matters is the asset’s expected post-tax value.

All else equal, partial interests (anything under 100% ownership) in illiquid assets are better assets to gift than liquid assets like marketable securities. The reason is that an illiquid asset can be discounted for valuation purposes. We discuss how gift-tax valuation works in a separate article, but the gist is that when assets other than cash or marketable securities are gifted to a beneficiary, they have to be appraised by a qualified appraiser.

Partial interests are generally “discounted” by 20%-40% below their fair market values to account for the fact that a third-party buyer would not pay as much for a partial interest in an asset as they would for a 100% interest. Accordingly, a 20% interest in a $10 million partnership might be appraised at $1.3 million rather than $2 million. The ability to discount these partial interests means that someone can gift illiquid assets that are “worth” $20 million and use only $13 million of lifetime gift exemption.

Even if your assets are all wholly owned by you, you can generate discounts by gifting partial interests to multiple trusts. For example, if you have three children, you can gift a one-third interest in an asset to three trusts — one for each child — thereby generating roughly 35% in discounts and allowing you to gift a greater value of assets to future generations while avoiding the estate tax.

It’s not always easy to predict whether (and by how much) an asset will appreciate over time. High-volatility assets, like crypto tokens or individual stocks, can have both high upside potential and high downside potential. If an asset that was worth $1 million at the time a gift was made ends up being worth nothing, the donor will have wasted $1 million of her lifetime gift-tax exemption. That’s why another important factor to consider is riskiness. The ideal target asset for gifting is one that both has high appreciation potential and low downside potential. An investment that has a 90% chance of exploding in value can be a good choice even if there’s a 10% chance it will be worth nothing. An investment that has a 50% chance of being worth a lot and a 50% chance of being worth nothing is probably not a good choice, unless its current value is so low that you wouldn’t be using much gift-tax exemption anyways.

Fortunately for people with highly volatile assets, there’s a special type of trust that allows donors to gift those volatile assets without wasting their gift-tax exemption: the zeroed-out Grantor Retained Annuity Trust, or GRAT. When you make a gift to a zeroed-out GRAT, you don’t use any gift-tax exemption, but under IRS rules, any appreciation beyond the IRS-mandated rate (currently about 5% per year) passes to your beneficiary.

Some assets simply cannot be transferred, either by law or as a result of some agreement you’ve entered into. Retirement accounts, like IRAs, and annuities cannot be transferred. Unvested options (and other unvested assets) cannot be transferred. Some partnership interests cannot be transferred because of specific restrictions in the partnership agreement (though often partnership or LLC agreements that have transfer restrictions will carve out exceptions for estate-planning transactions).

When a person dies, assets in their estate get a basis “step-up” because the deceased person’s income-tax basis is stepped up to the current fair market value (or in other words if an asset is worth $100 and it was acquired for $10, after the owner’s death the new cost basis is now $100). This is one of the tax code’s most powerful tax breaks as it wipes out any capital gains tax that would otherwise be owed!

But assets that the deceased person gave away before dying — by making gifts to individuals or trusts that are outside the donor’s estate — do not qualify for the basis step-up. As a result, it generally makes sense to gift high-basis assets to trusts. By doing so, you reduce the value of the lost basis step-up.

There’s also a work-around that allows you to have your cake and eat it, too. If you make a gift to a grantor trust, like an IDGT, you can swap the assets out in the future. So if you have a low-basis asset that you expect to appreciate in the future, you can gift it to a grantor trust, wait for it to appreciate, and then swap it out for higher-basis assets with an equal value in the future. The main risk is that you die before you get around to swapping.

It’s important to note that a target asset’s basis doesn’t matter if the asset is going to be sold before your death.

This is only a consideration if the asset is being gifted to a grantor trust like an IDGT, but one factor to take into account if you are gifting to a grantor trust is the asset’s income-tax efficiency. Counter-intuitively, perhaps, the less income-tax efficient (or the more taxes the investment is generating), the more estate-tax efficient. That’s because you’re allowed to pay the income taxes on the income that a grantor trust generates, without those tax payments being considered “gifts” for gift-tax purposes. That means that if you gift high-tax assets to a grantor trust, you’ll have the option of paying the trust’s taxes each year and essentially make tax-free gifts to the trust each year. The less income tax efficient, the larger the gifts. That’s a valuable perk.

It’s important to consider how gifting a particular asset may impact your cash flow going forward. Gifting stock might make sense on paper, but if you’re living off the dividends from that stock, gifting it might not make sense in practice. Likewise, if you gift your primary residence to a trust for the benefit of your children, you’ll have to pay fair market rent to continue living in the house. You might not have the cash flow to pay rent. On the other hand, if the gift is a small portion of your net worth, or you’re not living off the cash flow from the gifted asset, you will be able to gift it without issue.

Real estate can be a good target asset, but there are special considerations when real estate is being transferred.

First, in some states, notably California and Florida, transferring real estate to another individual or trust can have property-tax implications. In California, those impacts can be massive. It’s possible to plan around these issues, but one has to be very careful.

Second, if the property has a mortgage, there may be language in the loan agreement that deems any transfer of the property to be an event of default, triggering immediate repayment of the loan. Sometimes, the bank will waive the transfer restrictions in exchange for a $15,000 (or so) transfer fee. Other times, people ignore the restrictions and hope that the bank doesn’t notice that the property was transferred. But if the bank does notice, it could be a serious problem.

Finally, when personal-use real estate is gifted to a trust (unless the trust is a qualified personal residence trust or a spousal lifetime access trust), the donor will have to pay rent to continue living in the house. That isn’t necessarily a bad thing — the rental payments are not considered gifts for gift-tax purposes, so paying rent can be a way to get more assets out of the donor’s estate — but it does drain the donor of liquidity. If the house is worth several million dollars, the rental payments can be quite significant.

Below is a brief analysis of the pluses and minuses of transferring various types of assets:

We hope this article has helped you understand how to approach selecting which assets to gift! If you think through each of the factors discussed above, you’ll be well on your way to making an informed decision.

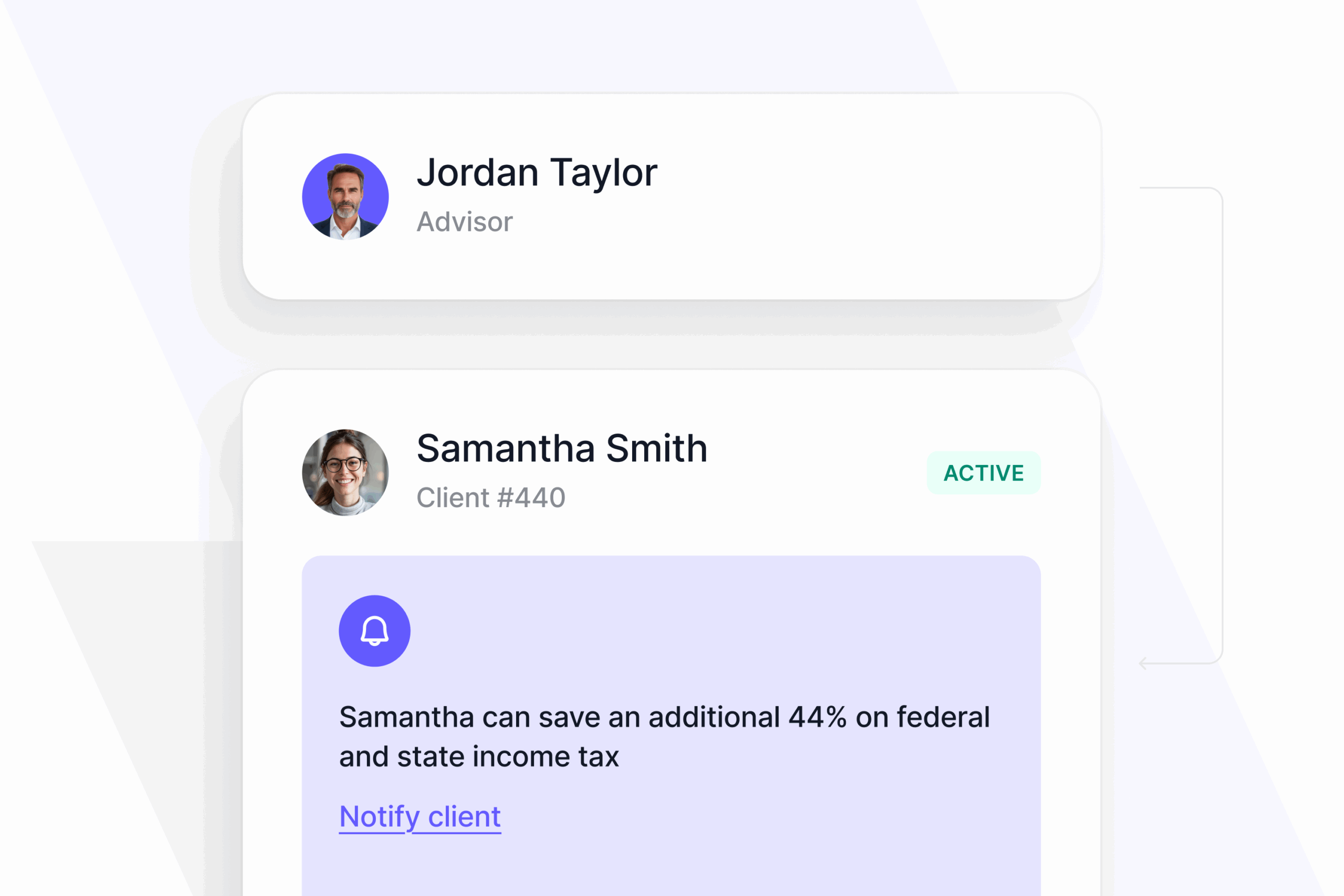

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!