FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Equity for advisors is a term that refers to the percentage of ownership in a company. Advisors can receive equity for several reasons, including bringing in new investors, helping the company reach a milestone, or being a part of the team. Equity can be a valuable asset for advisors, giving them a financial stake in the company and providing protection if it fails. It can also be a way to reward advisors for their hard work and help keep them motivated.

Several parties could address equity for advisors, including the company, angel investors, venture capitalists, and other individuals or organizations. Therefore, understanding the different equity types and implications is essential before accepting any offer.

There are several benefits to advisor equity, including:

– Financial stake in the company: Advisors who hold equity in a company have a financial stake in its success. It can give them a sense of ownership and motivation to help the company grow.

– Protection if the company fails: If the company fails, equity holders may be among the last to lose their money. They can also provide some security for advisors if things go wrong.

– Rewarding hard work: equity can be a way to reward advisors for their hard work and dedication. It can help keep them motivated and engaged in the company’s success.

While advisor equity can provide several benefits, it also has several disadvantages. These include:

– Dilution: When a company issues new equity, it dilutes the ownership of existing shareholders. Therefore, it can be a problem for advisors who own a small percentage of the company and could see their ownership stake cut as the company grows.

– No control: Advisors who hold equity in a company have no control over its operations. It can be a problem if they disagree with the company’s direction or want to make changes.

– Loss of money: If the company fails, equity holders may lose all or part of their investment. It’s a risk that you should consider before investing in equity.

Overall, advisor equity has benefits and drawbacks that you should consider before taking action.

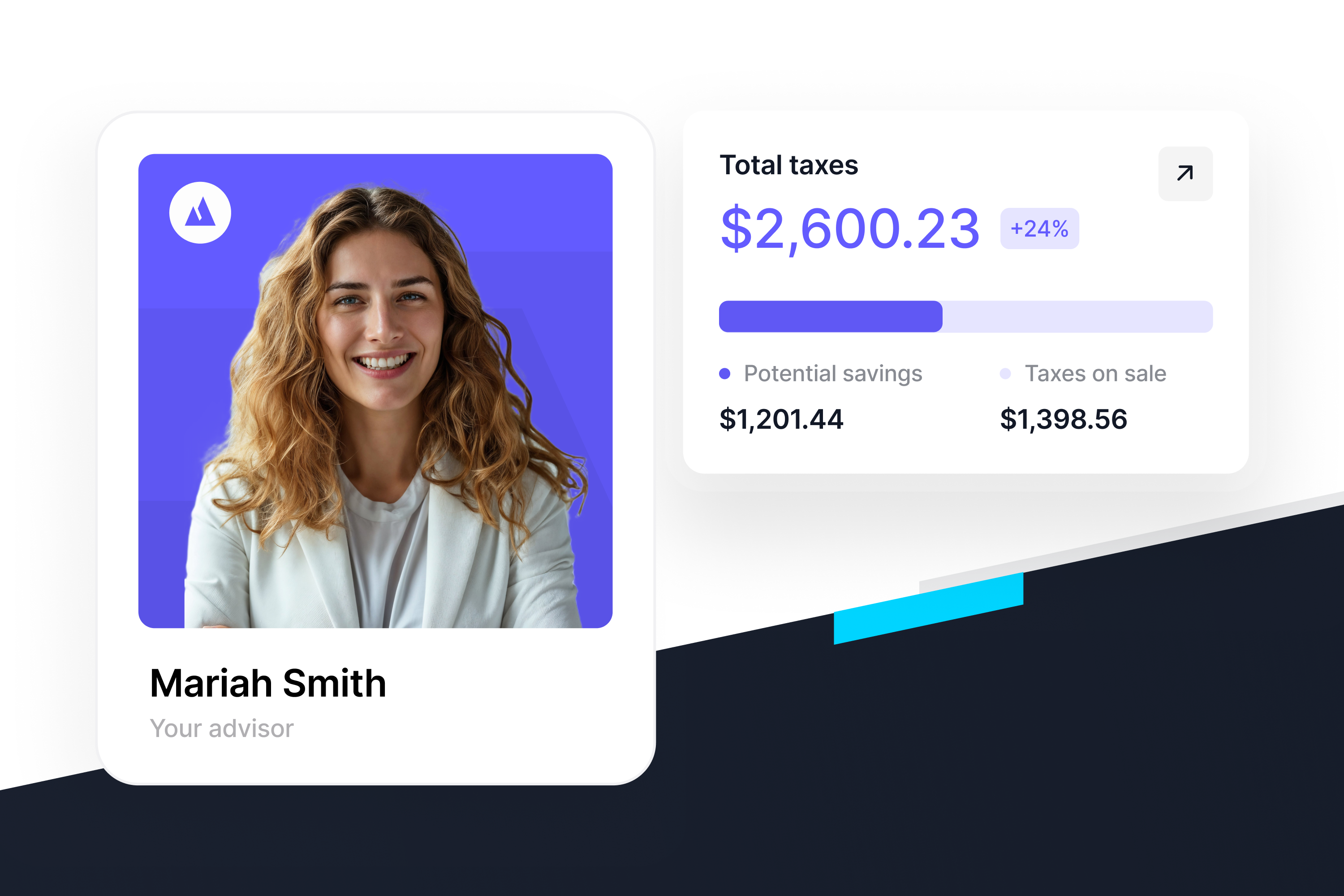

Explore the tax benefits you could have when selling your equity by investing your assets in a CRT. Calculate your potential returns! Or learn more definitions today!

We built a platform to give everyone access to the tax and wealth-building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard-to-access tax-advantaged structures so you can build your wealth more efficiently at less than half the cost of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.