FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Non-Interest Income is money that a company earns that is not from interest payments. This can come from a number of different sources, such as fees, commissions, or dividends. Non-interest income is important for companies because it can help to boost their profits and provide some stability during difficult times.

For banks, non-interest income is an important source of revenue. This is because interest payments are typically lower than other forms of revenue, such as fees and commissions. This income can be generated from a number of different sources, such as lending activities, investments, and fee-based services. By focusing on generating non-interest income, banks can help to offset declines in interest payments and improve their profitability.

Non-interest income is important for companies because it can help to boost their profits and provide some stability during difficult times. For banks, this type of income is an important source of revenue. This is because interest payments are typically lower than other forms of revenue, such as fees and commissions. Non-interest income can be generated from a number of different sources, such as lending activities, investments, and fee-based services. By focusing on generating non-interest revenue, banks can help to offset declines in interest payments and improve their profitability.

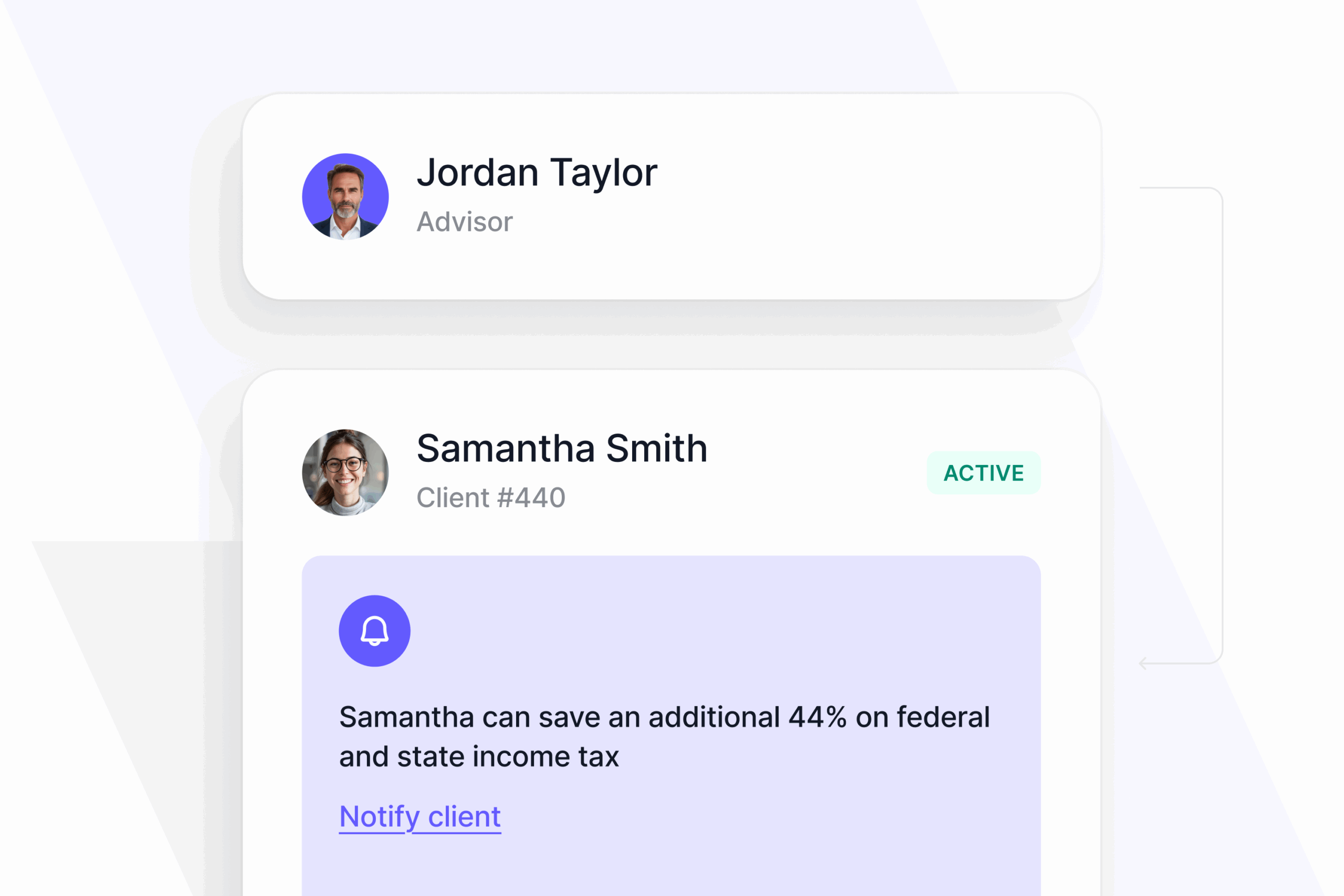

Calculate your income and tax deductions you could achieve from it with our online wealth tools.

We built a platform to give everyone access to the tax and wealth building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard to access tax advantaged structures so you can build your wealth more efficiently at less than half the cos of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.