FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

A fiduciary deed is a legal document that creates a fiduciary relationship between two parties. In other words, it establishes trust between the two individuals involved. People who set it can use this type of deed for many purposes, such as transferring assets or ensuring the achievement of someone’s financial wishes after they die. If you need to create a fiduciary relationship with someone, you should consider using a fiduciary deed.

The term “fiduciary” refers to someone entrusted with another person’s property or affairs. This relationship is one of trust, and the fiduciary must act in the best interests of the person they represent. A fiduciary deed can work to establish this type of relationship between two people.

Therefore, when two people want to trust each other, they use this document to make it official. It sets up a relationship where one person has to help the other out and look out for their best interests.

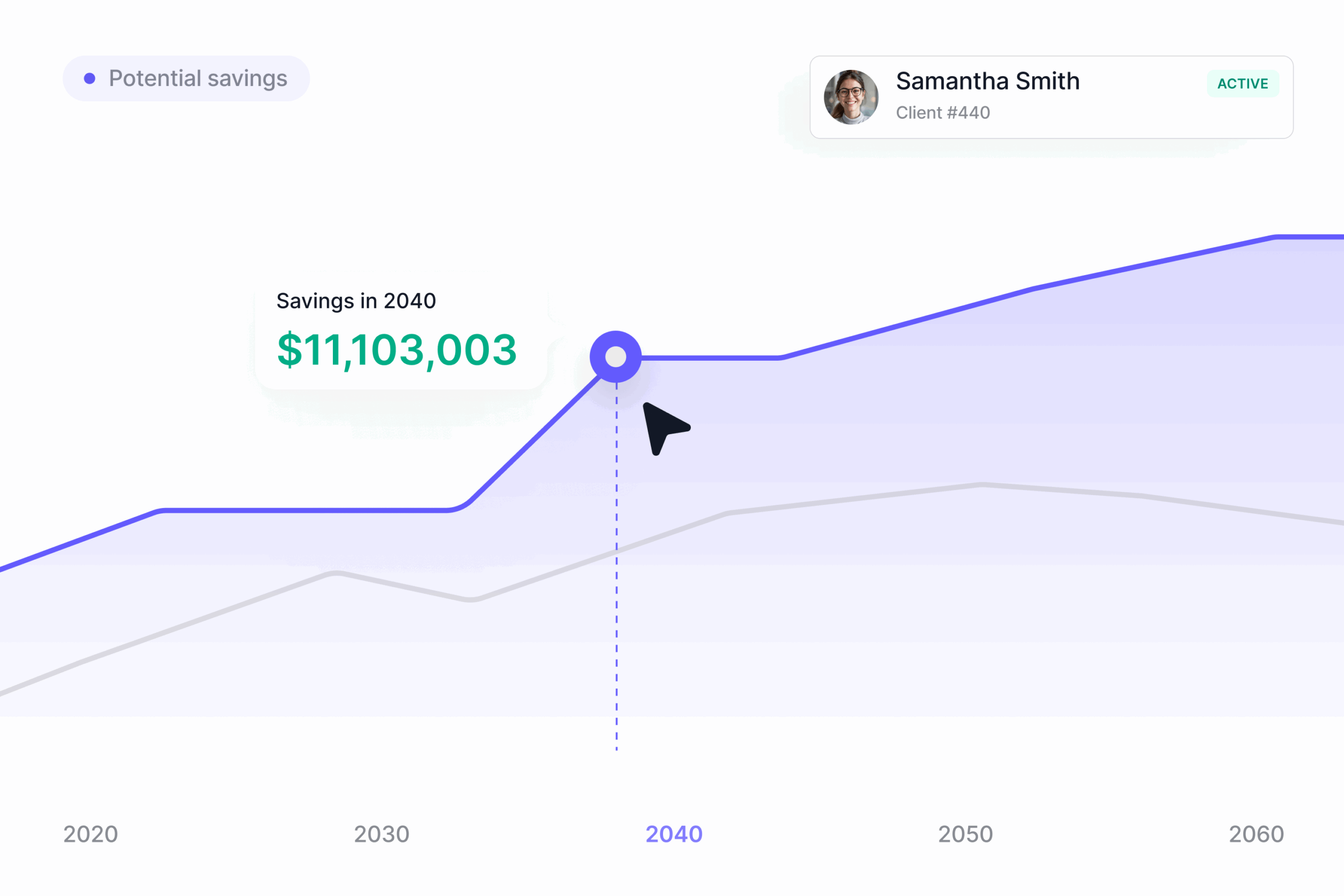

We built a platform to give everyone access to the tax and wealth building tools of the ultra-rich like Mark Zuckerberg and Phil Knight. We make it simple and seamless for our customers to take advantage of these hard to access tax advantaged structures so you can build your wealth more efficiently at less than half the cos of competitors. From picking the best strategy to taking care of all the setup and ongoing overhead, we make it easy and have helped create more than $500m in wealth for our customers.

Founder & CEO

Mani is the founder and CEO of Valur. He brings deep financial and strategic expertise from his prior roles at McKinsey & Company and Goldman Sachs. Mani earned his degree from the University of Michigan and launched Valur in 2020 to transform how individuals and advisors approach tax planning.