FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

How are your CRTs taxed? Charitable trust accounting is nuanced and different from how an individual manages their taxes. We include accounting as part of our service to make things simple for you. But to understand Charitable Remainder Trust distrution rules and their impact, it’s important to understand how CRTs trust accounting works and how your distributions are taxed.

Accounting within Charitable Remainder Trusts, also known as CRTs or CRUTs, can be a complicated and nuanced. There are three areas impacted by these charitable trust accounting rules are:

You can also learn more details on CRTs in our first Spotify podcast episode!

But before we get into the Charitable Remainder Unitrust distribution rules, there are few key principles that will guide the taxation of your charitable remainder trust distributions:

Understanding the IRS and its general approach to taxing trusts will help you properly grasp the basic aspects of charitable trust accounting.

When distributing income from charitable remainder trusts, the IRS uses an accounting method called the “Four Tiers” of income. At a high level this means, the trust distributes income from the highest federal income tax rate category first and ends with the category subject to the lowest federal income tax rate. So, in simpler terms, Charitable Remainder Trust distribution rules imply the IRS taxes the highest tax rate items first and foremost!

The Four Tiers along with their sub categories, in the order they are distributed, are as follows: (maximum federal tax rates are in brackets)

Sub category: qualified dividends (20%)

Sub category: Sale of collectibles (28%)

Sub category: Sale of real property that is attributable to depreciation recapture (25%)

Sub category: Return of principal (0%)

The Four Tiers really end up looking more like eight tiers with all of the sub categories, so if it’s easier to think about them as individual tiers, they are:

When it comes to funding your trust, the easiest way to remember how you’ll be taxed initially is by the “taxable make-up” of the assets you gift to it. But to show how Charitable Remainder Trust distribution rules actually work, let’s start with an example:

Chalmers sets up a 20 year term standard charitable remainder unitrust and funds it with start-up equity valued at $250,000 with a cost basis of $10,000. Once he decides to sell the stock, he would realize a gain of $240,000 (the value today – cost basis). Since he held his stock for approximately 4 years, his gains qualify as long-term capital gains.

From an accounting perspective, his principal is considered to be $10,000 and his capital gain is considered to be $240,000. (For the sake of distributions, you have to distribute the $240,000 before you’re allowed to distribute principal.)

Now that Chalmers has sold his stock, he reinvests those proceeds into a diversified portfolio of crypto, ETFs and stocks. After the first year, his assets have grown about 8% from $250,000 to $270,000. With the breakdown being:

| Asset | Invested | Growth | Dividends | Total |

|---|---|---|---|---|

| Crypto | $80,000 | $10,000 | $0 | $90,000 |

| ETFs | $50,000 | $0 | $2,000 | $52,000 |

| Individual Stocks | $120,000 | $8,000 | $0 | $128,000 |

| Total Portfolio | $250,000 | $18,000 | $2,000 | $270,000 |

Because he set up a 20 year term CRUT, Chalmers expects a first year payout to be 11% of the trust value or (29,700 which is 11% x $270,000). Now it’s time for Chalmers to take a distribution, how would that work? Well let’s walk through the individual tiers one-by-one:

When it comes to choosing a trust, it’s important to understand the distinctions between the accounting rules, as they can determine how much liquidity you have from your trust at any given time.

Take Selena, she decides that she would like to set up a lifetime NIMCRUT and funds it with crypto tokens valued at $250,000 with a cost basis of $10,000. Once she decides to sell the stock, she would realize a gain of $240,000 (value today – cost basis). She’s only held her tokens for about 6 months, so all of her gains would qualify as short-term capital gains.

From an accounting perspective her principal is considered to be $250,000 and her gain is considered to be $240,000. Now you’re probably wondering, how can that be the case?

The trust still realizes a gain of $240,000, but unlike standard CRUTS, NIMCRUTs are unable to distribute principal. They can only pay out income received from gains. Therefore even though there is the initial gain it’s contributed to principal along with the cost basis.

Now that Selena has sold her crypto, she reinvests those proceeds into a diversified portfolio of crypto, stocks, and collectible cards. Because she’s a crypto enthusiast she decides to lend her crypto in return for a 3.4% interest rate.

After the first year, her assets have grown about 8% and she’s accumulated some nice income from her crypto, with the breakdown being:

| Asset | Invested | Growth | Dividends | Total |

|---|---|---|---|---|

| Crypto | $100,000 | $8,600 | $3,400 | $90,000 |

| Collectible Cards | $30,000 | $0 | $0 | $52,000 |

| Individual Stocks | $120,000 | $8,000 | $0 | $128,000 |

| Total Portfolio | $250,000 | $16,600 | $3,400 | $270,000 |

Because she set up a lifetime NIMCRUT, Selena could expect a payout of $17,820 (based on being 38 her payout rate is ~6.6% x $270,000). It’s important to remember, with NIMCRUTs that the payout is the lesser of Net Income or the standard payout rate, so to receive any distribution (outside of the crypto income that’s forced paid) she would need to sell some assets that have grown.

Now it’s time for Selena to take a distribution, how would that work in this example? Well let’s walk through the individual tiers one-by-one:

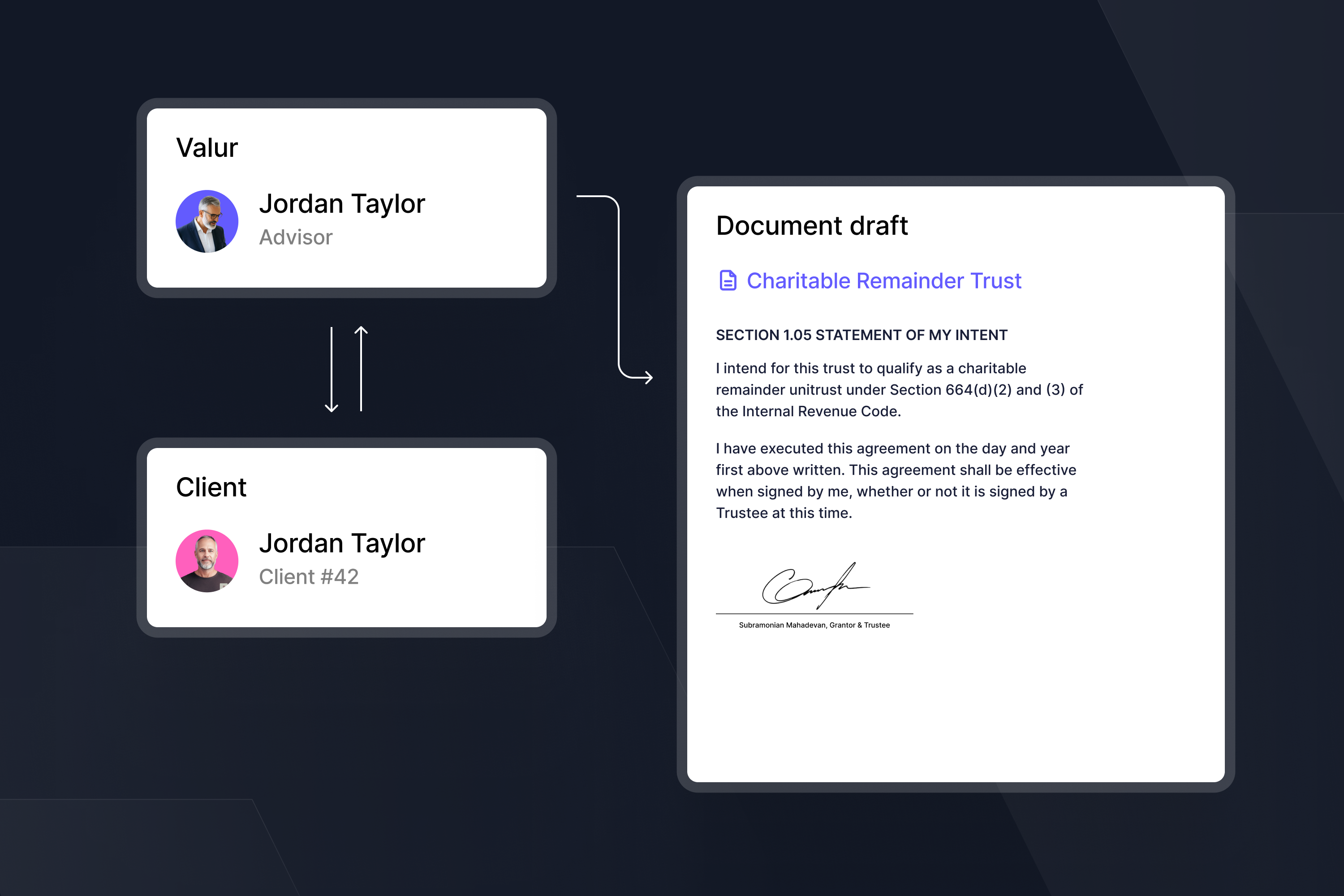

Charitable trust distribution rules can be complicated. At a high level it is important to remember that income from a Charitable Remainder Trust is taxable when you receive distributions and those distributions are taxed according to CRTs four tier accounting rule. Fortunately working with Valur alleviates all of the stress that comes along with the above items.

Our proprietary approach makes the input from you minimal, all you have to do is tell us if you want a CRT distribution and we’ll tell you how much you can take and when. To learn more, check out our post on how does Charitable Remainder Trust tax deduction work. Use our Charitable Trust calculator to evaluate the potential return on investment given your situation. Or contact us for a meeting!

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!