FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Investing in real estate generally and investing in short-term rental real estate are two popular strategies for offsetting ordinary income tax. How do you know which one is right for you? This article explains what these strategies are and when they make sense.

This article uses “real estate investment” broadly to mean any investment involving the purchase, sale, management, or leasing of property for profit. Real estate investors can benefit from several tax-saving strategies, but depreciation (specifically accelerated depreciation) is the most important for people looking to reduce their ordinary income taxes. Critically, to offset ordinary income with real estate depreciation, you need to be a real estate professional, which means spending more than 500 or 750 hours in a year on your real estate business. For practical purposes, that means you can’t have another job. But if your spouse doesn’t have a full-time job (and wants to spend 750 hours per year on real estate), or you don’t have a full-time job (and want to spend 750 hours per year on real estate), it can work.

Kevin, a married New Jersey resident who is a real estate developer, is earning $1,000,000 with a $420,000 annual tax bill. In the past, he has only invested in stock indexes. Tired of paying so much tax on his salary, Kevin buys a $500,000 duplex and rents it out. He deducts 60% of this amount as depreciation in the first year, reducing his taxable income by $300,000 that year. If his marginal tax rate is 50%, that will save him $150,000, effectively reducing his taxes in that year from $420,000 to about $270,000 (not including the income tax generated by the rental). Due to leverage, he may have only had to invest $100,000 in the property upfront, with the rest covered by loans. The loan interest will also be deductible, reducing his taxable income by another $20,000 or so. In future years, he’ll be able to deduct additional depreciation as well as interest on the loan. That said, taking on leverage is risky and means that Kevin will have to cover the interest and principal payments as they come due. Kevin or his spouse will also have to qualify as a real estate professional in order to use the depreciation to offset his ordinary income.

Short-term rentals are residential properties that are rented out for a short duration, often through platforms like Airbnb or VRBO. These rentals can generate income while offering substantial tax benefits, including deductions for depreciation, mortgage interest, and other expenses.

Income generated from short-term rentals is considered active income, which allows property owners to deduct ordinary expenses such as property management fees, maintenance costs, utilities, and mortgage interest. Additionally, property owners can depreciate a property over time, further reducing their taxable income. If the property owner actively participates in the rental activities, they may be able to offset other forms of active income with losses from the rental property.

Peter, a married New Yorker earning $1,200,000 per year, has historically invested only in stock indexes. Tired of paying $550,000 of tax on his salary each year, Peter purchases a $500,000 house and lists it on Airbnb. He deducts 60% of this amount as depreciation in the first year, reducing his taxable income by $300,000 that year. If his marginal tax rate is 51%, that will save him close to $153,000, effectively reducing his taxes this year from $550,000 to under $400,000 (not including the income he generates from the rental).

Investing in real estate generally and investing in short-term rentals are variations on the same real estate-based tax and investment strategy. Both provide upfront tax deductions. But investing in short-term rentals is more feasible for people with full-time jobs who aren’t otherwise “real estate professionals.” These two strategies also have different investment return profiles — an important factor that should be weighed alongside the possible tax benefits.

Investing in real estate generally and investing in short-term rentals are both viable tax strategies, but they serve different objectives. Hopefully this article has given you a better idea of what each strategy entails, and whether one or the other might be a better fit.

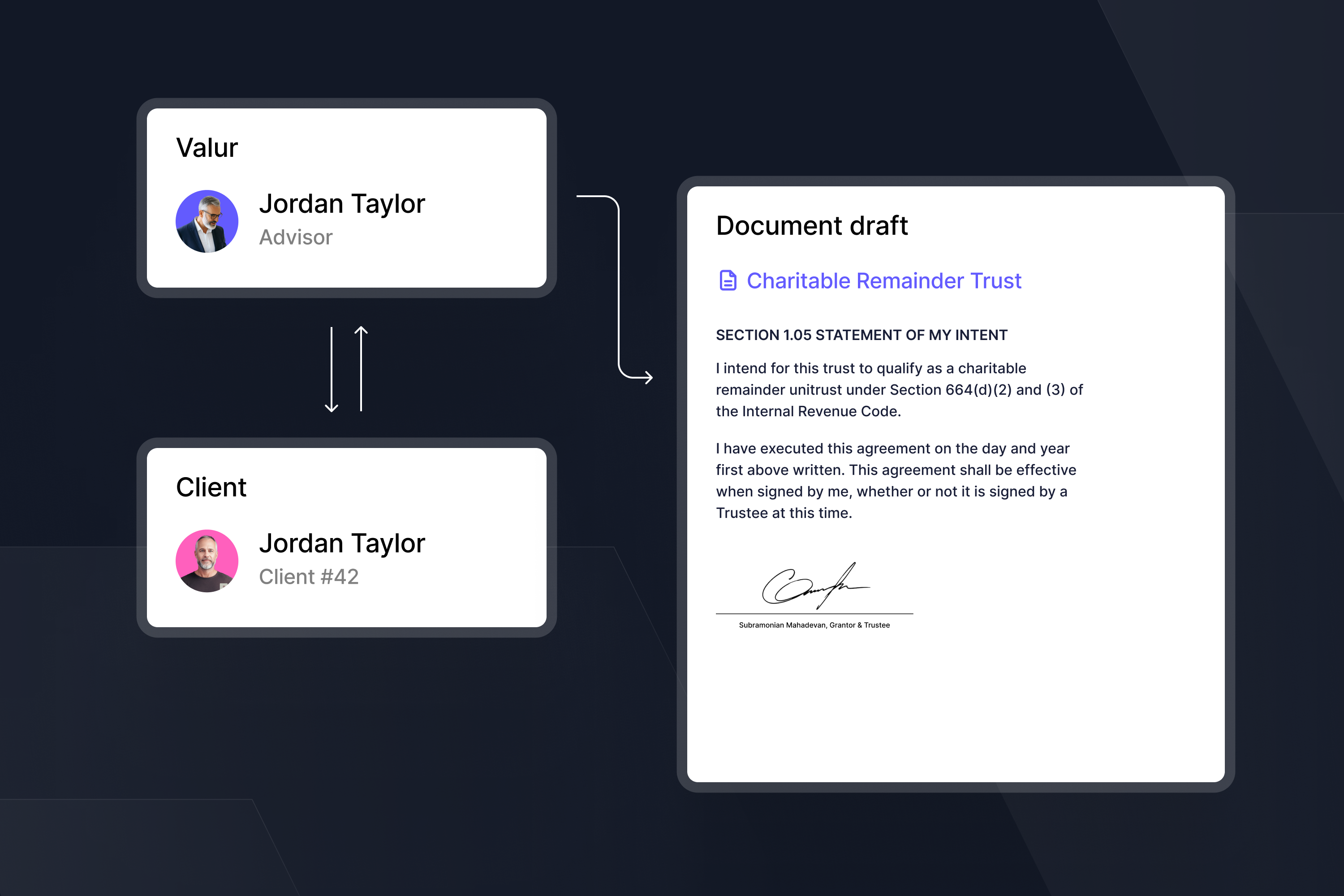

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Ordinary Income